- Canada

- /

- Metals and Mining

- /

- TSXV:EMX

Subdued Growth No Barrier To EMX Royalty Corporation (CVE:EMX) With Shares Advancing 26%

EMX Royalty Corporation (CVE:EMX) shares have continued their recent momentum with a 26% gain in the last month alone. The last 30 days bring the annual gain to a very sharp 65%.

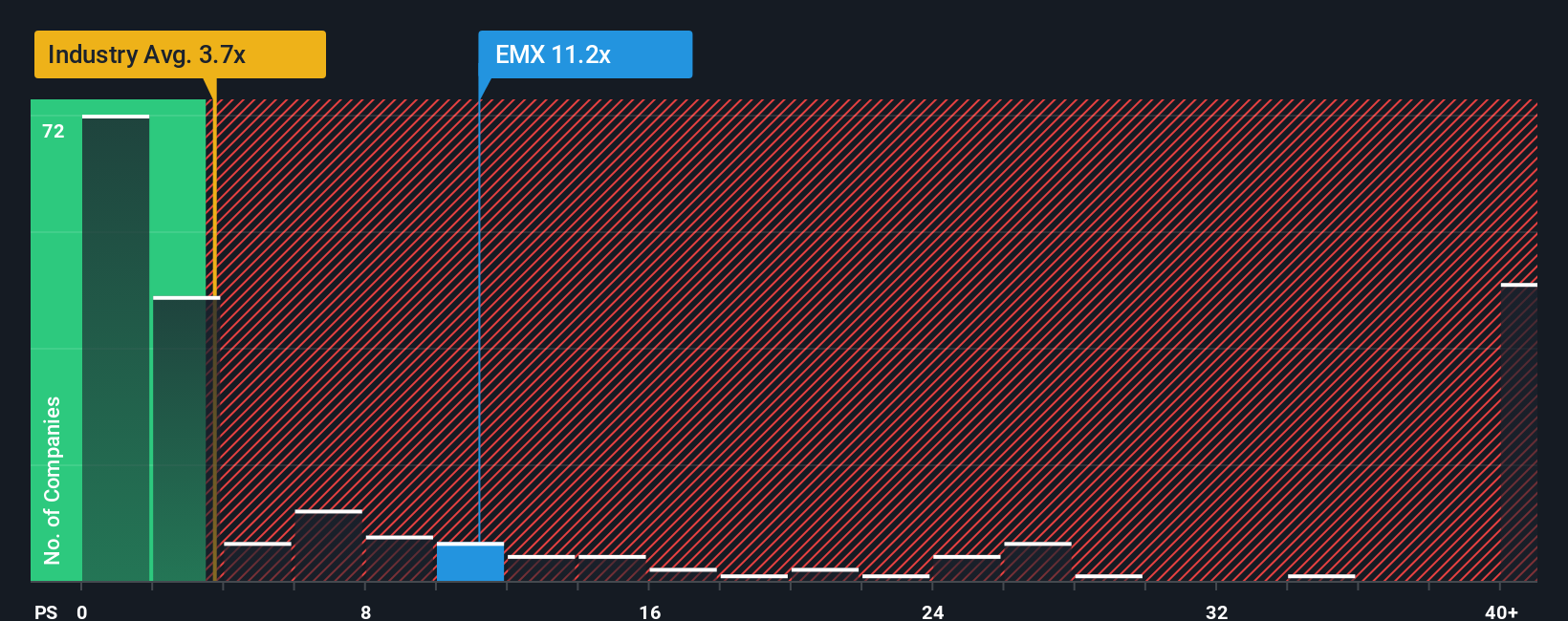

After such a large jump in price, when almost half of the companies in Canada's Metals and Mining industry have price-to-sales ratios (or "P/S") below 3.7x, you may consider EMX Royalty as a stock not worth researching with its 11.2x P/S ratio. However, the P/S might be quite high for a reason and it requires further investigation to determine if it's justified.

View our latest analysis for EMX Royalty

How EMX Royalty Has Been Performing

While the industry has experienced revenue growth lately, EMX Royalty's revenue has gone into reverse gear, which is not great. It might be that many expect the dour revenue performance to recover substantially, which has kept the P/S from collapsing. If not, then existing shareholders may be extremely nervous about the viability of the share price.

Keen to find out how analysts think EMX Royalty's future stacks up against the industry? In that case, our free report is a great place to start.What Are Revenue Growth Metrics Telling Us About The High P/S?

In order to justify its P/S ratio, EMX Royalty would need to produce outstanding growth that's well in excess of the industry.

In reviewing the last year of financials, we were disheartened to see the company's revenues fell to the tune of 1.6%. However, a few very strong years before that means that it was still able to grow revenue by an impressive 260% in total over the last three years. Although it's been a bumpy ride, it's still fair to say the revenue growth recently has been more than adequate for the company.

Turning to the outlook, the next year should generate growth of 17% as estimated by the dual analysts watching the company. Meanwhile, the rest of the industry is forecast to expand by 69%, which is noticeably more attractive.

With this in consideration, we believe it doesn't make sense that EMX Royalty's P/S is outpacing its industry peers. It seems most investors are hoping for a turnaround in the company's business prospects, but the analyst cohort is not so confident this will happen. Only the boldest would assume these prices are sustainable as this level of revenue growth is likely to weigh heavily on the share price eventually.

The Bottom Line On EMX Royalty's P/S

EMX Royalty's P/S has grown nicely over the last month thanks to a handy boost in the share price. Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

Despite analysts forecasting some poorer-than-industry revenue growth figures for EMX Royalty, this doesn't appear to be impacting the P/S in the slightest. The weakness in the company's revenue estimate doesn't bode well for the elevated P/S, which could take a fall if the revenue sentiment doesn't improve. At these price levels, investors should remain cautious, particularly if things don't improve.

A lot of potential risks can sit within a company's balance sheet. Our free balance sheet analysis for EMX Royalty with six simple checks will allow you to discover any risks that could be an issue.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

Valuation is complex, but we're here to simplify it.

Discover if EMX Royalty might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSXV:EMX

EMX Royalty

Explores for and generates royalties from metals and minerals properties.

Adequate balance sheet with limited growth.

Market Insights

Community Narratives