- Canada

- /

- Metals and Mining

- /

- CNSX:GGC

Promising TSX Penny Stocks For December 2024

Reviewed by Simply Wall St

As the Canadian market navigates a landscape influenced by diverse economic trends, investors are increasingly exploring opportunities beyond traditional large-cap stocks. Penny stocks, despite their somewhat outdated moniker, remain an intriguing investment area due to their potential for growth and value, especially when backed by strong financials. This article highlights three such penny stocks on the TSX that exhibit financial resilience and offer promising prospects for those seeking under-the-radar opportunities.

Top 10 Penny Stocks In Canada

| Name | Share Price | Market Cap | Financial Health Rating |

| Findev (TSXV:FDI) | CA$0.465 | CA$13.61M | ★★★★★★ |

| Pulse Seismic (TSX:PSD) | CA$2.26 | CA$115M | ★★★★★★ |

| PetroTal (TSX:TAL) | CA$0.59 | CA$528.97M | ★★★★★★ |

| Foraco International (TSX:FAR) | CA$2.30 | CA$221.48M | ★★★★★☆ |

| East West Petroleum (TSXV:EW) | CA$0.04 | CA$3.62M | ★★★★★★ |

| Silvercorp Metals (TSX:SVM) | CA$4.475 | CA$948.57M | ★★★★★★ |

| NamSys (TSXV:CTZ) | CA$1.23 | CA$33.04M | ★★★★★★ |

| New Gold (TSX:NGD) | CA$4.08 | CA$3.11B | ★★★★★☆ |

| Hemisphere Energy (TSXV:HME) | CA$1.84 | CA$179.46M | ★★★★★☆ |

| Enterprise Group (TSX:E) | CA$1.79 | CA$108.95M | ★★★★☆☆ |

Click here to see the full list of 935 stocks from our TSX Penny Stocks screener.

We'll examine a selection from our screener results.

Generic Gold (CNSX:GGC)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Generic Gold Corp. is an exploration stage company focused on acquiring and exploring gold properties in Canada, with a market capitalization of CA$3.94 million.

Operations: No revenue segments are reported for this exploration stage company focused on acquiring and exploring gold properties in Canada.

Market Cap: CA$3.94M

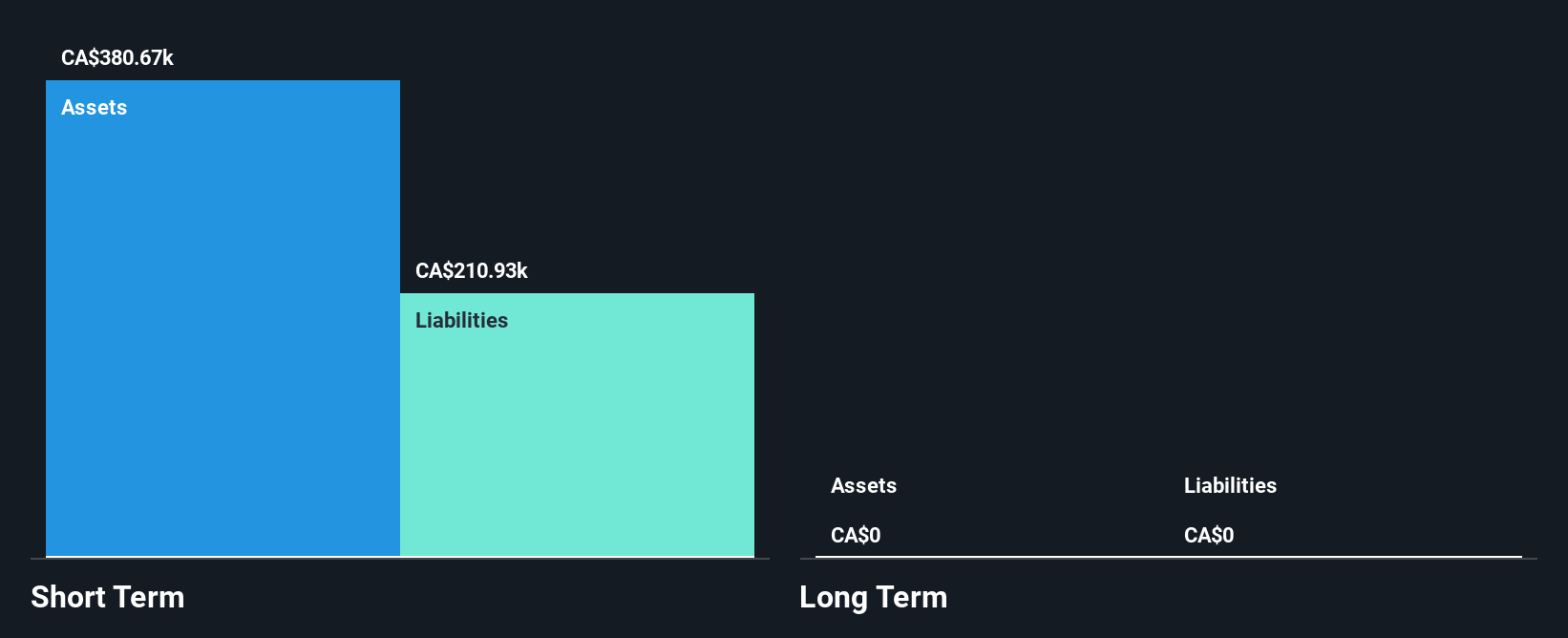

Generic Gold Corp., with a market cap of CA$3.94 million, is a pre-revenue exploration company focused on gold properties in Canada. Despite being unprofitable, it has consistently reduced its losses over the past five years by 14.4% annually and remains debt-free with no long-term liabilities. The company has sufficient cash runway for more than a year based on current free cash flow but faces high share price volatility and increased weekly volatility from 46% to 70% over the past year. Its experienced management and board bolster its operational foundation amidst financial challenges typical of early-stage exploration firms.

- Jump into the full analysis health report here for a deeper understanding of Generic Gold.

- Gain insights into Generic Gold's past trends and performance with our report on the company's historical track record.

Almadex Minerals (TSXV:DEX)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Almadex Minerals Ltd. is involved in the acquisition and exploration of mineral resource properties across Canada, the United States, and Mexico, with a market cap of CA$10.98 million.

Operations: The company's revenue segment is primarily from the acquisition and exploration of mineral resource properties, generating CA$0.04 million.

Market Cap: CA$10.98M

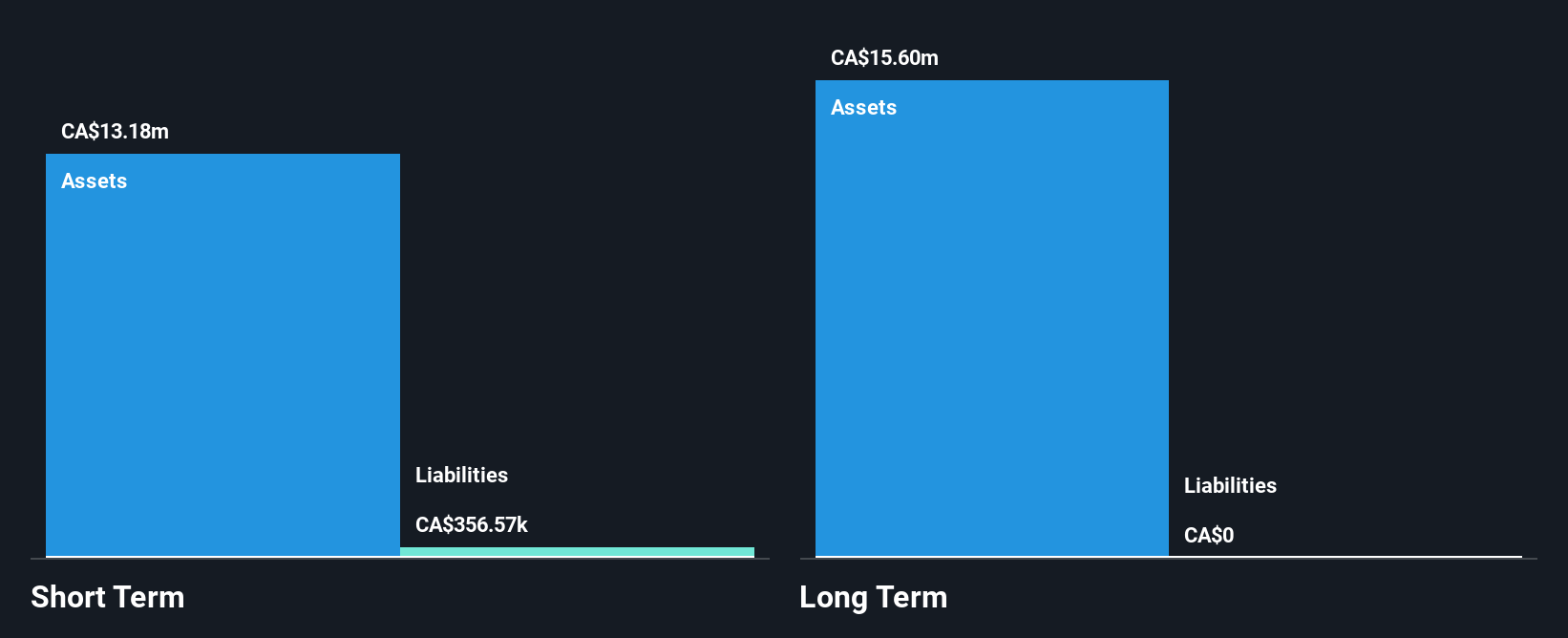

Almadex Minerals Ltd., with a market cap of CA$10.98 million, is a pre-revenue mineral exploration company focusing on projects in Canada, the U.S., and Mexico. Despite being unprofitable, it has reduced losses by 12.5% annually over the past five years and remains debt-free with no long-term liabilities. The company has sufficient cash runway for over three years based on current free cash flow levels. Recent exploration updates highlight promising activities at its Paradise-Davis Project in Nevada, including mapping and drilling efforts targeting gold-silver epithermal systems, which could potentially enhance future resource delineation efforts.

- Dive into the specifics of Almadex Minerals here with our thorough balance sheet health report.

- Evaluate Almadex Minerals' historical performance by accessing our past performance report.

Intouch Insight (TSXV:INX)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Intouch Insight Ltd. offers customer experience management products and software solutions across Canada, the United States, and internationally, with a market cap of CA$15.06 million.

Operations: The company generates revenue from its data processing segment, amounting to CA$30.88 million.

Market Cap: CA$15.06M

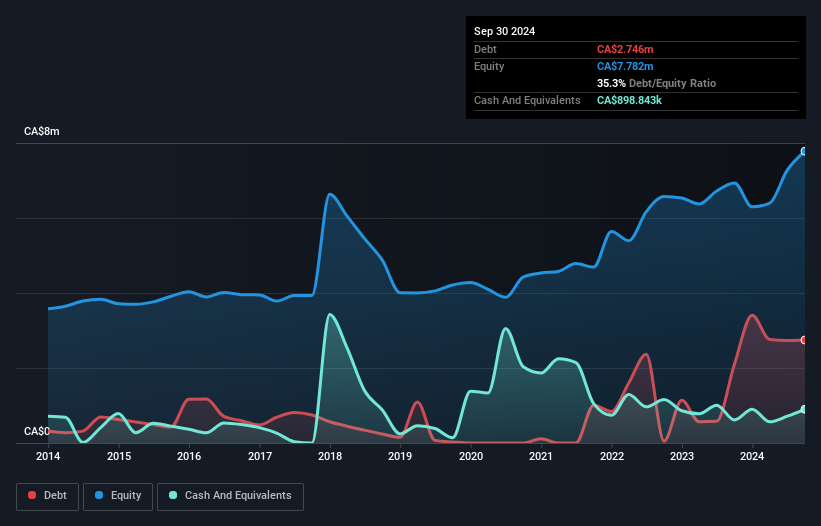

Intouch Insight Ltd., with a market cap of CA$15.06 million, has shown significant earnings growth, reporting a 213.7% increase over the past year, surpassing industry averages. The company's revenue for the third quarter was CA$6.66 million, up from CA$5.63 million the previous year, reflecting robust sales performance. Despite this growth and stable short-term financial coverage with assets exceeding liabilities, Intouch faces challenges including high volatility and interest payments not well covered by EBIT (2.3x). The debt to equity ratio has risen to 35.3%, though operating cash flow adequately covers debt obligations at 122%.

- Get an in-depth perspective on Intouch Insight's performance by reading our balance sheet health report here.

- Review our historical performance report to gain insights into Intouch Insight's track record.

Next Steps

- Explore the 935 names from our TSX Penny Stocks screener here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About CNSX:GGC

Generic Gold

An exploration stage company, engages in acquisition and exploration of gold properties in Canada.

Excellent balance sheet slight.