Legendary fund manager Li Lu (who Charlie Munger backed) once said, 'The biggest investment risk is not the volatility of prices, but whether you will suffer a permanent loss of capital.' It's only natural to consider a company's balance sheet when you examine how risky it is, since debt is often involved when a business collapses. We can see that Corsa Coal Corp. (CVE:CSO) does use debt in its business. But the more important question is: how much risk is that debt creating?

Why Does Debt Bring Risk?

Debt assists a business until the business has trouble paying it off, either with new capital or with free cash flow. If things get really bad, the lenders can take control of the business. However, a more usual (but still expensive) situation is where a company must dilute shareholders at a cheap share price simply to get debt under control. Of course, plenty of companies use debt to fund growth, without any negative consequences. The first step when considering a company's debt levels is to consider its cash and debt together.

See our latest analysis for Corsa Coal

What Is Corsa Coal's Net Debt?

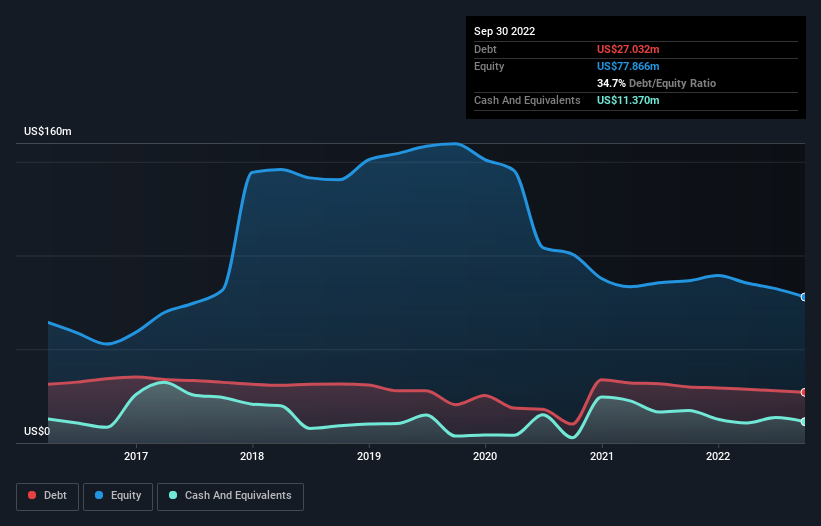

The image below, which you can click on for greater detail, shows that Corsa Coal had debt of US$27.0m at the end of September 2022, a reduction from US$29.9m over a year. However, because it has a cash reserve of US$11.4m, its net debt is less, at about US$15.7m.

How Healthy Is Corsa Coal's Balance Sheet?

We can see from the most recent balance sheet that Corsa Coal had liabilities of US$33.1m falling due within a year, and liabilities of US$87.5m due beyond that. Offsetting this, it had US$11.4m in cash and US$15.9m in receivables that were due within 12 months. So its liabilities total US$93.3m more than the combination of its cash and short-term receivables.

This deficit casts a shadow over the US$20.0m company, like a colossus towering over mere mortals. So we'd watch its balance sheet closely, without a doubt. At the end of the day, Corsa Coal would probably need a major re-capitalization if its creditors were to demand repayment. When analysing debt levels, the balance sheet is the obvious place to start. But you can't view debt in total isolation; since Corsa Coal will need earnings to service that debt. So when considering debt, it's definitely worth looking at the earnings trend. Click here for an interactive snapshot.

Over 12 months, Corsa Coal reported revenue of US$167m, which is a gain of 54%, although it did not report any earnings before interest and tax. Shareholders probably have their fingers crossed that it can grow its way to profits.

Caveat Emptor

Despite the top line growth, Corsa Coal still had an earnings before interest and tax (EBIT) loss over the last year. To be specific the EBIT loss came in at US$1.1m. If you consider the significant liabilities mentioned above, we are extremely wary of this investment. That said, it is possible that the company will turn its fortunes around. Nevertheless, we would not bet on it given that it vaporized US$440k in cash over the last twelve months, and it doesn't have much by way of liquid assets. So we think this stock is risky, like walking through a dirty dog park with a mask on. When analysing debt levels, the balance sheet is the obvious place to start. However, not all investment risk resides within the balance sheet - far from it. For example, we've discovered 3 warning signs for Corsa Coal (1 is concerning!) that you should be aware of before investing here.

If, after all that, you're more interested in a fast growing company with a rock-solid balance sheet, then check out our list of net cash growth stocks without delay.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSXV:CSO.H

Corsa Coal

Corsa Coal Corp. mines, processes, and sells metallurgical coal in the Asia, North America, South America, and Europe.

Good value with mediocre balance sheet.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

ADNOC Gas future shines with a 21.4% revenue surge

Watch Pulse Seismic Outperform with 13.6% Revenue Growth in the Coming Years

Significantly undervalued gold explorer in Timmins, finally getting traction

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026