- Canada

- /

- Metals and Mining

- /

- CNSX:ADDY

Top TSX Penny Stocks To Watch In January 2025

Reviewed by Simply Wall St

As 2025 begins, the Canadian market is navigating through a period of uncertainty due to new U.S. policies on tariffs and energy, yet the TSX index has seen positive movement since Inauguration Day. Amid these shifting conditions, investors might find opportunities in penny stocks, which often represent smaller or newer companies with potential for growth despite their historical connotations. While the term "penny stocks" may seem outdated, these investments can still offer significant value when backed by strong financials and clear growth paths.

Top 10 Penny Stocks In Canada

| Name | Share Price | Market Cap | Financial Health Rating |

| Alvopetro Energy (TSXV:ALV) | CA$4.99 | CA$189.37M | ★★★★★★ |

| Silvercorp Metals (TSX:SVM) | CA$4.34 | CA$933.34M | ★★★★★★ |

| Mandalay Resources (TSX:MND) | CA$4.50 | CA$406.63M | ★★★★★★ |

| Foraco International (TSX:FAR) | CA$2.24 | CA$222.46M | ★★★★★☆ |

| PetroTal (TSX:TAL) | CA$0.68 | CA$619.93M | ★★★★★★ |

| Pulse Seismic (TSX:PSD) | CA$2.46 | CA$123.03M | ★★★★★★ |

| Findev (TSXV:FDI) | CA$0.495 | CA$14.18M | ★★★★★★ |

| NamSys (TSXV:CTZ) | CA$1.00 | CA$26.86M | ★★★★★★ |

| East West Petroleum (TSXV:EW) | CA$0.04 | CA$3.62M | ★★★★★★ |

| Tornado Infrastructure Equipment (TSXV:TGH) | CA$1.03 | CA$140.31M | ★★★★★☆ |

Click here to see the full list of 937 stocks from our TSX Penny Stocks screener.

Underneath we present a selection of stocks filtered out by our screen.

Spearmint Resources (CNSX:SPMT)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Spearmint Resources Inc. is an exploration stage company focused on the identification, acquisition, and exploration of mineral properties with a market cap of CA$4.32 million.

Operations: Currently, there are no reported revenue segments for this exploration stage company.

Market Cap: CA$4.32M

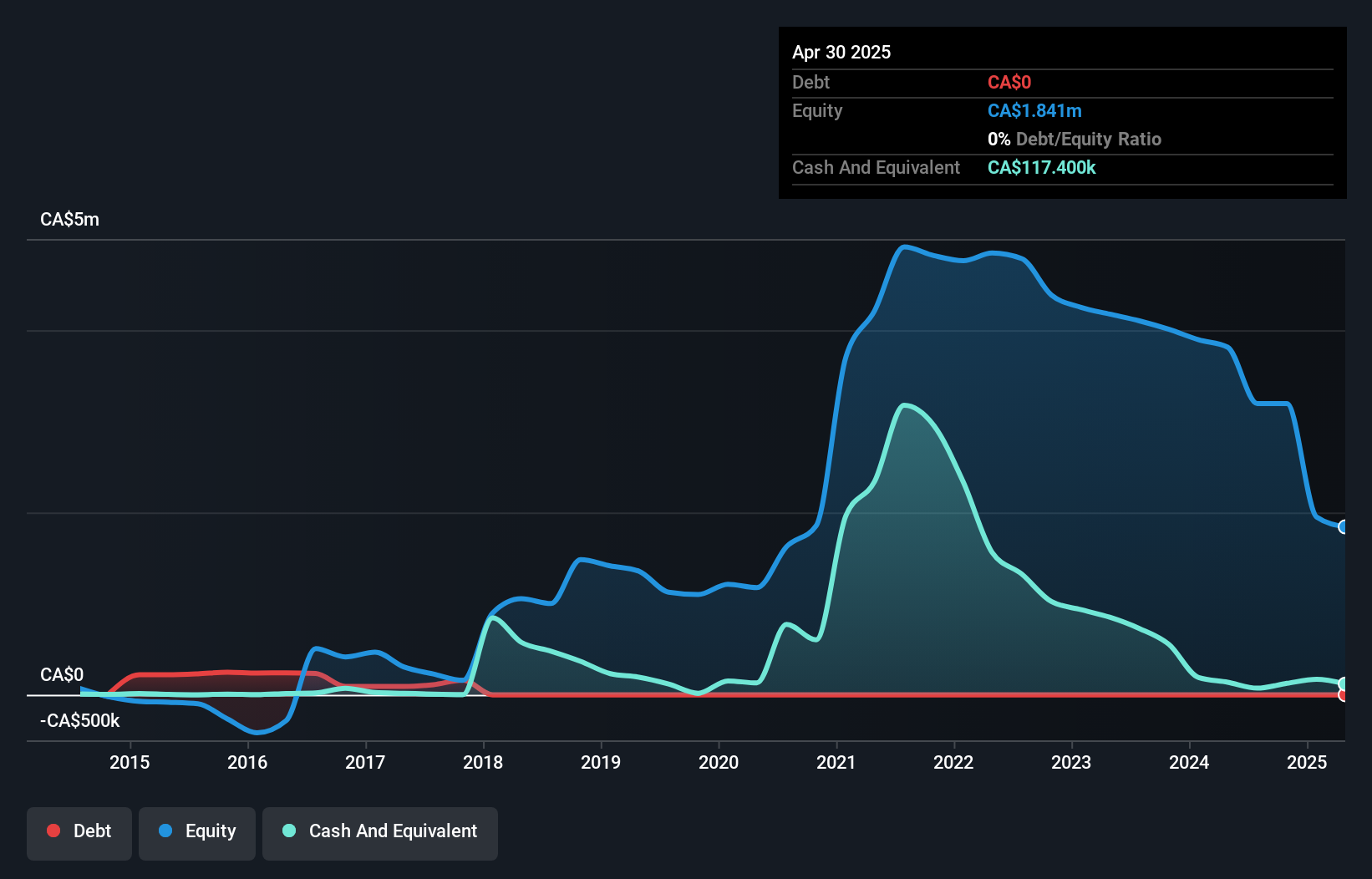

Spearmint Resources Inc., with a market cap of CA$4.32 million, remains a pre-revenue exploration company focused on mineral properties. Recent acquisition of the George Lake South Antimony Project in New Brunswick highlights its strategic expansion into antimony, a critical material for electronics and battery technology. Despite being debt-free, Spearmint faces challenges with increased losses over five years and short-term liabilities exceeding assets. The company's volatile share price and limited cash runway are concerns; however, additional capital raised recently may provide some financial cushioning as it continues its exploration activities.

- Jump into the full analysis health report here for a deeper understanding of Spearmint Resources.

- Gain insights into Spearmint Resources' historical outcomes by reviewing our past performance report.

Canadian North Resources (TSXV:CNRI)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Canadian North Resources Inc. is involved in the exploration and development of mineral properties in Canada, with a market cap of CA$115.56 million.

Operations: Canadian North Resources Inc. has not reported any revenue segments.

Market Cap: CA$115.56M

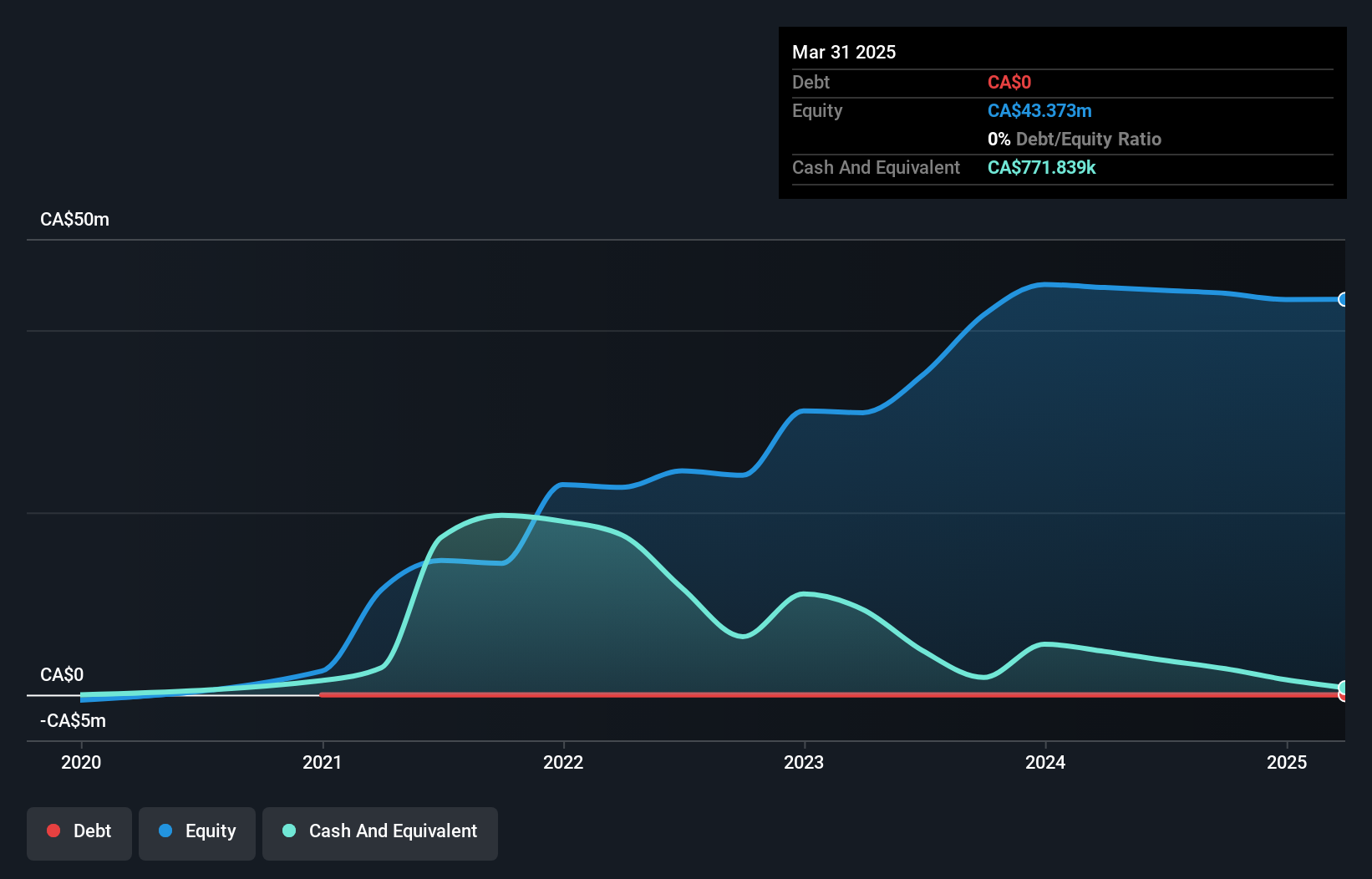

Canadian North Resources Inc., with a market cap of CA$115.56 million, is a pre-revenue entity focused on mineral exploration, facing challenges typical of early-stage mining ventures. The company reported reduced net losses for the third quarter and nine months ending September 2024 compared to the previous year, indicating some improvement in financial management. Despite being debt-free and having short-term assets exceeding liabilities, CNRI has less than a year of cash runway and experiences high share price volatility. Recent board changes include appointing Henderson Tse, bringing extensive financial expertise to its leadership team.

- Dive into the specifics of Canadian North Resources here with our thorough balance sheet health report.

- Review our historical performance report to gain insights into Canadian North Resources' track record.

Sailfish Royalty (TSXV:FISH)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Sailfish Royalty Corp. focuses on acquiring precious metals royalty and streaming agreements, with a market cap of CA$97.89 million.

Operations: The company generates revenue of $2.83 million from its royalties and stream interests segment.

Market Cap: CA$97.89M

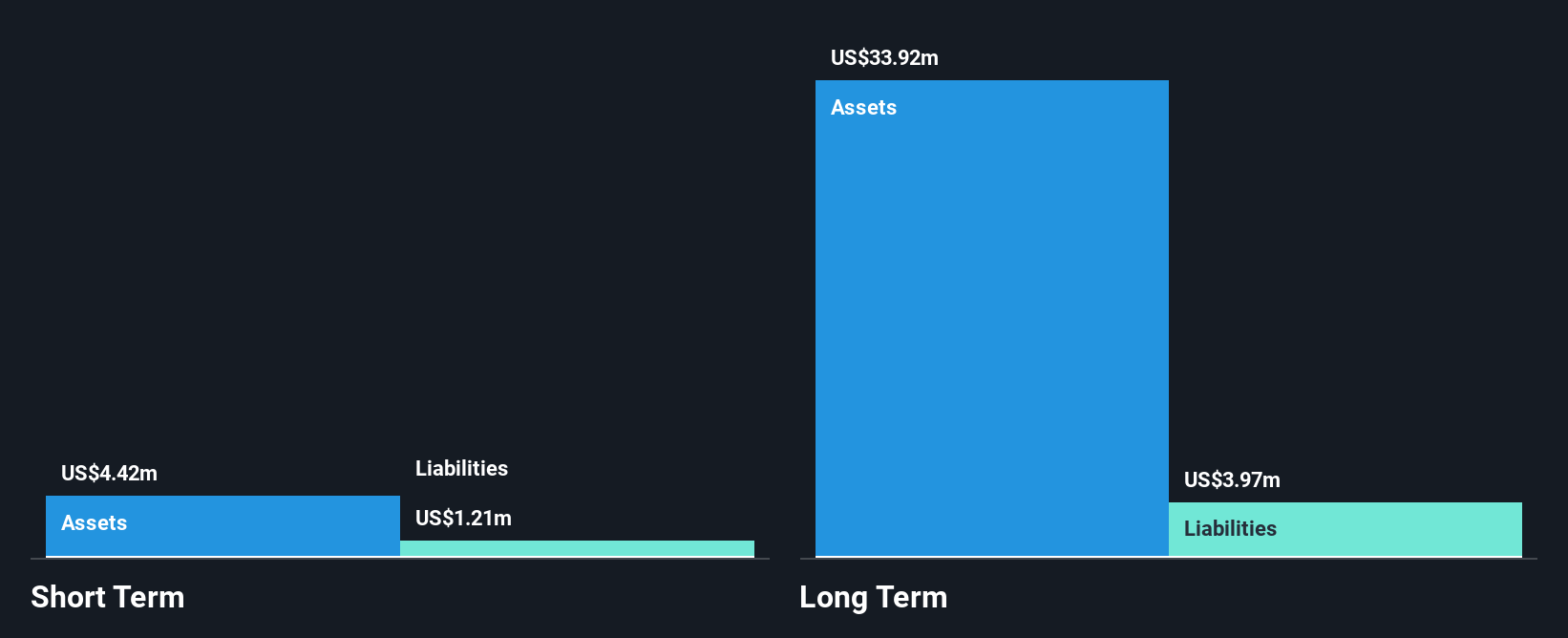

Sailfish Royalty Corp., with a market cap of CA$97.89 million, has transitioned to profitability this year, reporting net income of US$1.15 million for the first nine months of 2024 compared to a loss in the previous year. Despite limited revenue generation at US$2.11 million, the company maintains a stable financial position with short-term assets exceeding liabilities and reduced debt levels over five years. However, its dividend yield is not well covered by earnings or cash flows, and future earnings are forecasted to decline annually by 17.8%. The experienced management team supports strategic direction amidst these challenges.

- Click here and access our complete financial health analysis report to understand the dynamics of Sailfish Royalty.

- Explore Sailfish Royalty's analyst forecasts in our growth report.

Seize The Opportunity

- Jump into our full catalog of 937 TSX Penny Stocks here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About CNSX:ADDY

Adelayde Exploration

An exploration stage company, engages in the identification, acquisition, and exploration of mineral properties in Canada and the United States.

Excellent balance sheet with moderate risk.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

A tech powerhouse quietly powering the world’s AI infrastructure.

Keppel DC REIT (SGX: AJBU) is a resilient gem in the data center space.

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)