- Canada

- /

- Capital Markets

- /

- TSXV:ZC

Consolidated Lithium Metals And 2 Other Exciting Penny Stocks On The TSX

Reviewed by Simply Wall St

The Canadian market is navigating a complex landscape, with investors keeping a close eye on interest rates and economic indicators. Amid these broader market dynamics, there remains an intriguing space for those looking beyond the large-cap stocks: penny stocks. While the term may seem outdated, these smaller or newer companies can offer surprising value and potential returns when supported by solid financials.

Top 10 Penny Stocks In Canada

| Name | Share Price | Market Cap | Rewards & Risks |

| Westbridge Renewable Energy (TSXV:WEB) | CA$2.55 | CA$67.75M | ✅ 3 ⚠️ 4 View Analysis > |

| Canso Select Opportunities (TSXV:CSOC.A) | CA$4.50 | CA$22.73M | ✅ 2 ⚠️ 2 View Analysis > |

| Montero Mining and Exploration (TSXV:MON) | CA$0.36 | CA$3.22M | ✅ 2 ⚠️ 4 View Analysis > |

| CEMATRIX (TSX:CEMX) | CA$0.365 | CA$54.07M | ✅ 2 ⚠️ 1 View Analysis > |

| Thor Explorations (TSXV:THX) | CA$1.40 | CA$918.11M | ✅ 3 ⚠️ 2 View Analysis > |

| Automotive Finco (TSXV:AFCC.H) | CA$1.00 | CA$21.4M | ✅ 2 ⚠️ 3 View Analysis > |

| Amerigo Resources (TSX:ARG) | CA$2.87 | CA$463.48M | ✅ 3 ⚠️ 2 View Analysis > |

| Pulse Seismic (TSX:PSD) | CA$3.42 | CA$171.04M | ✅ 2 ⚠️ 1 View Analysis > |

| Hemisphere Energy (TSXV:HME) | CA$2.16 | CA$200.3M | ✅ 3 ⚠️ 1 View Analysis > |

| Matachewan Consolidated Mines (TSXV:MCM.A) | CA$0.80 | CA$9.21M | ✅ 2 ⚠️ 4 View Analysis > |

Click here to see the full list of 405 stocks from our TSX Penny Stocks screener.

We'll examine a selection from our screener results.

Consolidated Lithium Metals (TSXV:CLM)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Consolidated Lithium Metals Inc. is a junior mining exploration company focused on acquiring, exploring, producing, and developing mining properties in Canada with a market cap of CA$19.47 million.

Operations: Consolidated Lithium Metals Inc. does not currently report any revenue segments.

Market Cap: CA$19.47M

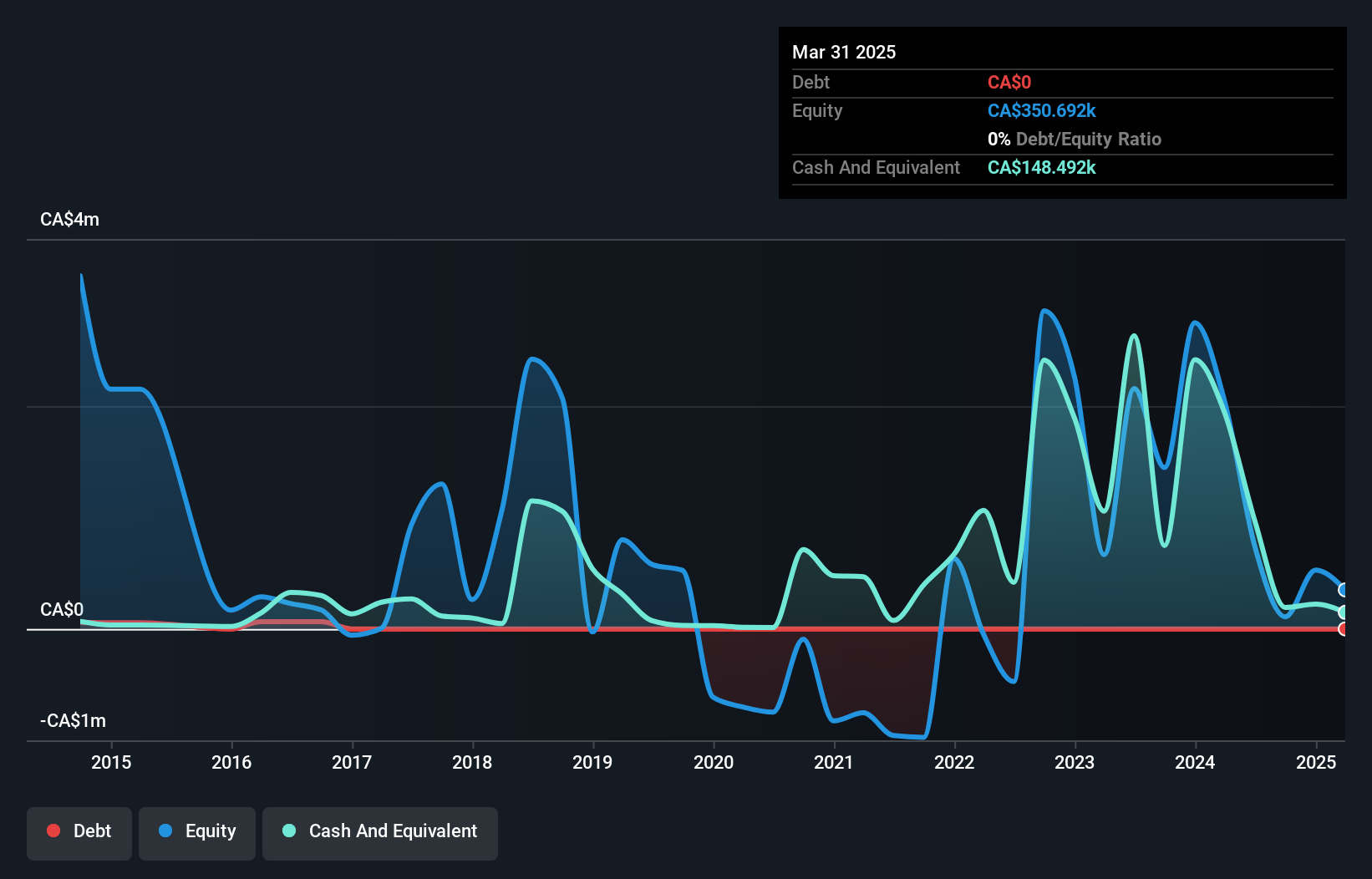

Consolidated Lithium Metals Inc., with a market cap of CA$19.47 million, is a pre-revenue junior mining exploration company. It has no debt and its short-term assets exceed liabilities, but it faces high volatility in share price and negative return on equity due to unprofitability. Recently, the company announced an LOI with SOQUEM Inc., aiming to acquire up to 80% interest in the Kwyjibo Rare Earth Project in Quebec. This potential acquisition could enhance its strategic positioning by leveraging existing infrastructure and access to Quebec's hydroelectric power grid, though financing remains a challenge for this expansion.

- Jump into the full analysis health report here for a deeper understanding of Consolidated Lithium Metals.

- Learn about Consolidated Lithium Metals' historical performance here.

Silver One Resources (TSXV:SVE)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Silver One Resources Inc. focuses on the acquisition, exploration, and development of mineral properties in the United States with a market cap of CA$111.89 million.

Operations: Silver One Resources Inc. does not report any revenue segments as it is primarily engaged in the acquisition, exploration, and development of mineral properties in the United States.

Market Cap: CA$111.89M

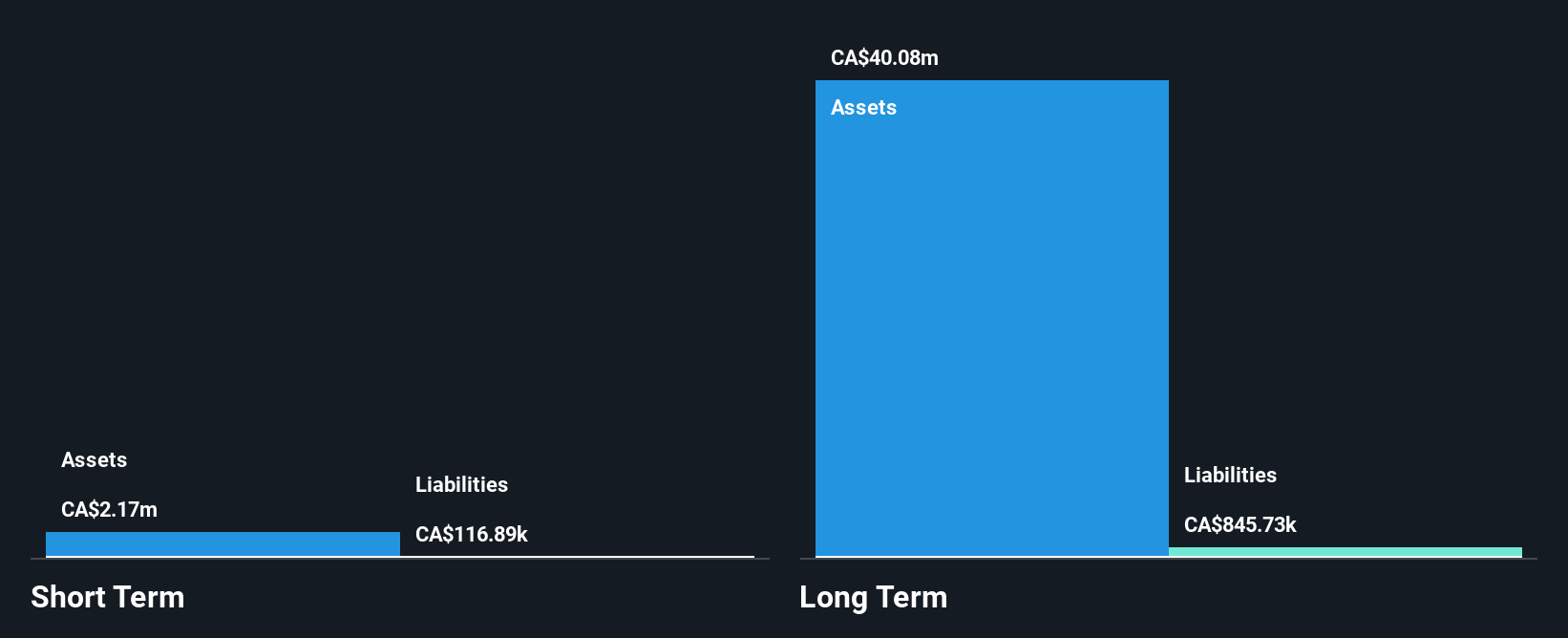

Silver One Resources Inc., with a market cap of CA$111.89 million, is a pre-revenue company focused on mineral exploration in the U.S. It remains debt-free and has not diluted shareholders over the past year, maintaining stable weekly volatility at 12%. The seasoned management team and board have an average tenure of over nine years. Despite being unprofitable with negative return on equity, Silver One has reduced losses by 1.3% annually over five years. Recent capital raises through private placements have bolstered its cash runway beyond four months, ensuring short-term liabilities are covered by assets totaling CA$1.7 million.

- Take a closer look at Silver One Resources' potential here in our financial health report.

- Examine Silver One Resources' past performance report to understand how it has performed in prior years.

Zimtu Capital (TSXV:ZC)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Zimtu Capital Corp. is a private equity and venture capital firm focusing on seed and early-stage investments in micro and small-cap resource companies, with a market cap of CA$9.51 million.

Operations: The company's revenue is primarily derived from management services, totaling CA$2.81 million.

Market Cap: CA$9.51M

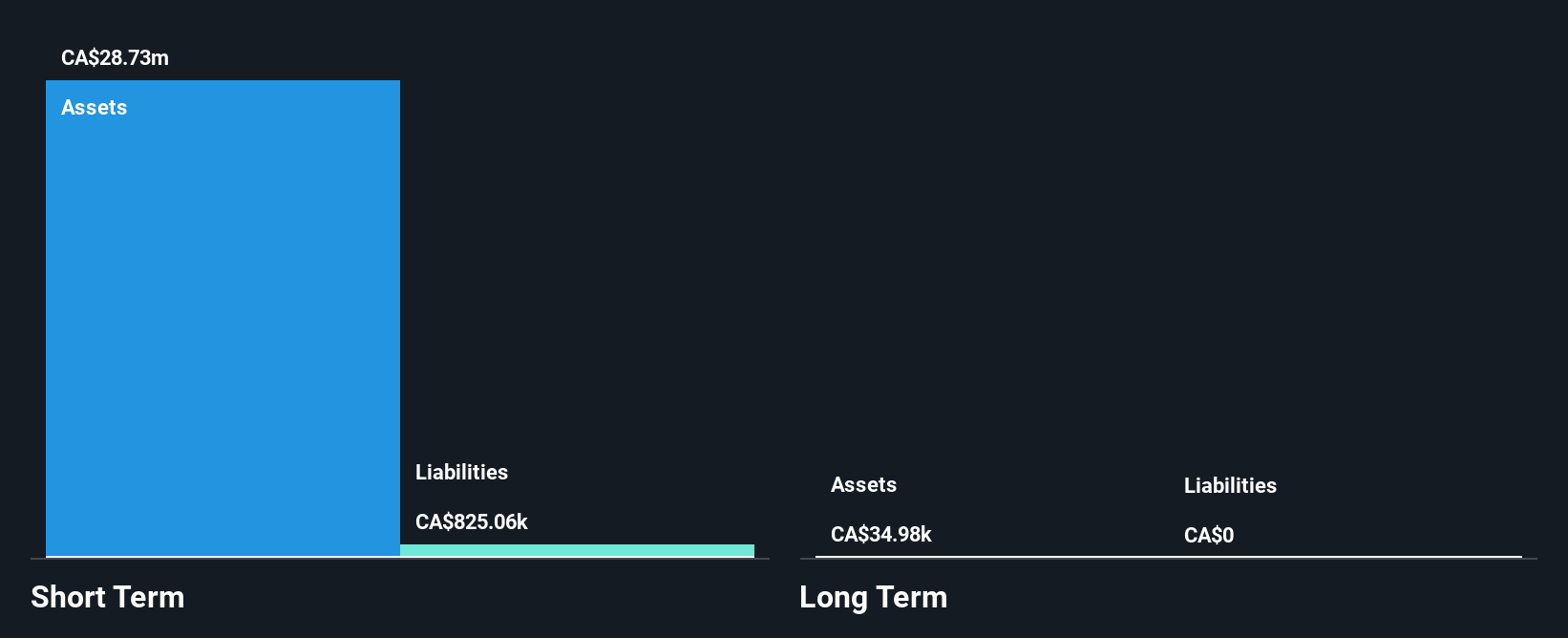

Zimtu Capital Corp., with a market cap of CA$9.51 million, has transitioned to profitability this year despite its high volatility, which increased from 22% to 28%. The firm remains debt-free and boasts a strong balance sheet with short-term assets of CA$19 million surpassing both short-term and long-term liabilities. While revenue is not significant at CA$2.81 million, the company has enhanced earnings quality through non-cash components. Recent initiatives include a private placement aiming to raise CA$1.5 million and an agreement for marketing services under ZimtuADVANTAGE, potentially boosting investor engagement and visibility in the resource sector.

- Unlock comprehensive insights into our analysis of Zimtu Capital stock in this financial health report.

- Explore historical data to track Zimtu Capital's performance over time in our past results report.

Key Takeaways

- Navigate through the entire inventory of 405 TSX Penny Stocks here.

- Searching for a Fresh Perspective? Trump's oil boom is here — pipelines are primed to profit. Discover the 22 US stocks riding the wave.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Zimtu Capital might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSXV:ZC

Zimtu Capital

A private equity and venture capital firm specializing in seed stage, early stage, acquisition, pre-IPO investments in private micro and small-cap resource companies.

Flawless balance sheet with medium-low risk.

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

A case for USD $14.81 per share based on book value. Be warned, this is a micro-cap dependent on a single mine.

Occidental Petroleum to Become Fairly Priced at $68.29 According to Future Projections

Agfa-Gevaert is a digital and materials turnaround opportunity, with growth potential in ZIRFON, but carrying legacy risks.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)