- Canada

- /

- Metals and Mining

- /

- TSXV:CIO

If You Had Bought Central Iron Ore (CVE:CIO) Stock Five Years Ago, You Could Pocket A 3200% Gain Today

Long term investing can be life changing when you buy and hold the truly great businesses. While not every stock performs well, when investors win, they can win big. To wit, the Central Iron Ore Limited (CVE:CIO) share price has soared 3200% over five years. And this is just one example of the epic gains achieved by some long term investors. In the last week the share price is up 725%.

Anyone who held for that rewarding ride would probably be keen to talk about it.

Check out our latest analysis for Central Iron Ore

Central Iron Ore recorded just AU$110,000 in revenue over the last twelve months, which isn't really enough for us to consider it to have a proven product. So it seems that the investors focused more on what could be, than paying attention to the current revenues (or lack thereof). For example, investors may be hoping that Central Iron Ore finds some valuable resources, before it runs out of money.

Companies that lack both meaningful revenue and profits are usually considered high risk. You should be aware that there is always a chance that this sort of company will need to issue more shares to raise money to continue pursuing its business plan. While some companies like this go on to deliver on their plan, making good money for shareholders, many end in painful losses and eventual de-listing. Central Iron Ore has already given some investors a taste of the sweet gains that high risk investing can generate, if your timing is right.

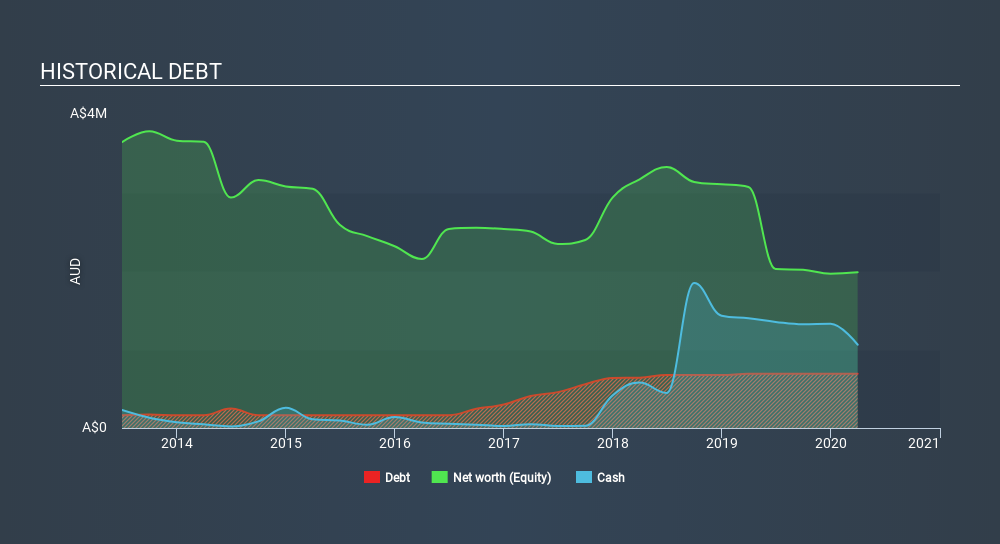

Central Iron Ore had cash in excess of all liabilities of just AU$111k when it last reported (March 2020). So if it hasn't remedied the situation already, it will almost certainly have to raise more capital soon. Given how low on cash it got, investors must really like its potential for the share price to be up 12% per year, over 5 years. You can see in the image below, how Central Iron Ore's cash levels have changed over time (click to see the values).

It can be extremely risky to invest in a company that doesn't even have revenue. There's no way to know its value easily. One thing you can do is check if company insiders are buying shares. It's usually a positive if they have, as it may indicate they see value in the stock. Luckily we are in a position to provide you with this free chart of insider buying (and selling).

A Different Perspective

It's nice to see that Central Iron Ore shareholders have received a total shareholder return of 1000% over the last year. Since the one-year TSR is better than the five-year TSR (the latter coming in at 101% per year), it would seem that the stock's performance has improved in recent times. In the best case scenario, this may hint at some real business momentum, implying that now could be a great time to delve deeper. It's always interesting to track share price performance over the longer term. But to understand Central Iron Ore better, we need to consider many other factors. Take risks, for example - Central Iron Ore has 4 warning signs we think you should be aware of.

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this free list of companies we expect will grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on CA exchanges.

Love or hate this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned. Thank you for reading.

About TSXV:CIO

Central Iron Ore

Focuses on the exploration and development of gold projects in Western Australia.

Medium-low and overvalued.

Market Insights

Community Narratives