- Canada

- /

- Metals and Mining

- /

- TSXV:GRDM

February 2025's Top TSX Penny Stocks To Watch

Reviewed by Simply Wall St

As we move through February 2025, the Canadian market is navigating a complex landscape marked by persistent inflation and solid corporate earnings. Amid these crosscurrents, investors are exploring diverse opportunities to balance their portfolios. Penny stocks, though an older term, remain a relevant investment area for those seeking growth potential in smaller or newer companies. These stocks can offer unique value when supported by strong financials, making them intriguing prospects for investors looking beyond the mainstream markets.

Top 10 Penny Stocks In Canada

| Name | Share Price | Market Cap | Financial Health Rating |

| Alvopetro Energy (TSXV:ALV) | CA$5.00 | CA$182.79M | ★★★★★★ |

| Findev (TSXV:FDI) | CA$0.52 | CA$14.9M | ★★★★★★ |

| Mandalay Resources (TSX:MND) | CA$4.67 | CA$438.56M | ★★★★★★ |

| Foraco International (TSX:FAR) | CA$2.24 | CA$220.49M | ★★★★★☆ |

| PetroTal (TSX:TAL) | CA$0.71 | CA$647.19M | ★★★★★★ |

| NamSys (TSXV:CTZ) | CA$1.16 | CA$31.16M | ★★★★★★ |

| East West Petroleum (TSXV:EW) | CA$0.04 | CA$3.62M | ★★★★★★ |

| Orezone Gold (TSX:ORE) | CA$0.86 | CA$397.63M | ★★★★★☆ |

| Hemisphere Energy (TSXV:HME) | CA$1.86 | CA$180.58M | ★★★★★☆ |

| DIRTT Environmental Solutions (TSX:DRT) | CA$1.19 | CA$230.15M | ★★★★☆☆ |

Click here to see the full list of 940 stocks from our TSX Penny Stocks screener.

Let's uncover some gems from our specialized screener.

Boat Rocker Media (TSX:BRMI)

Simply Wall St Financial Health Rating: ★★★★★☆

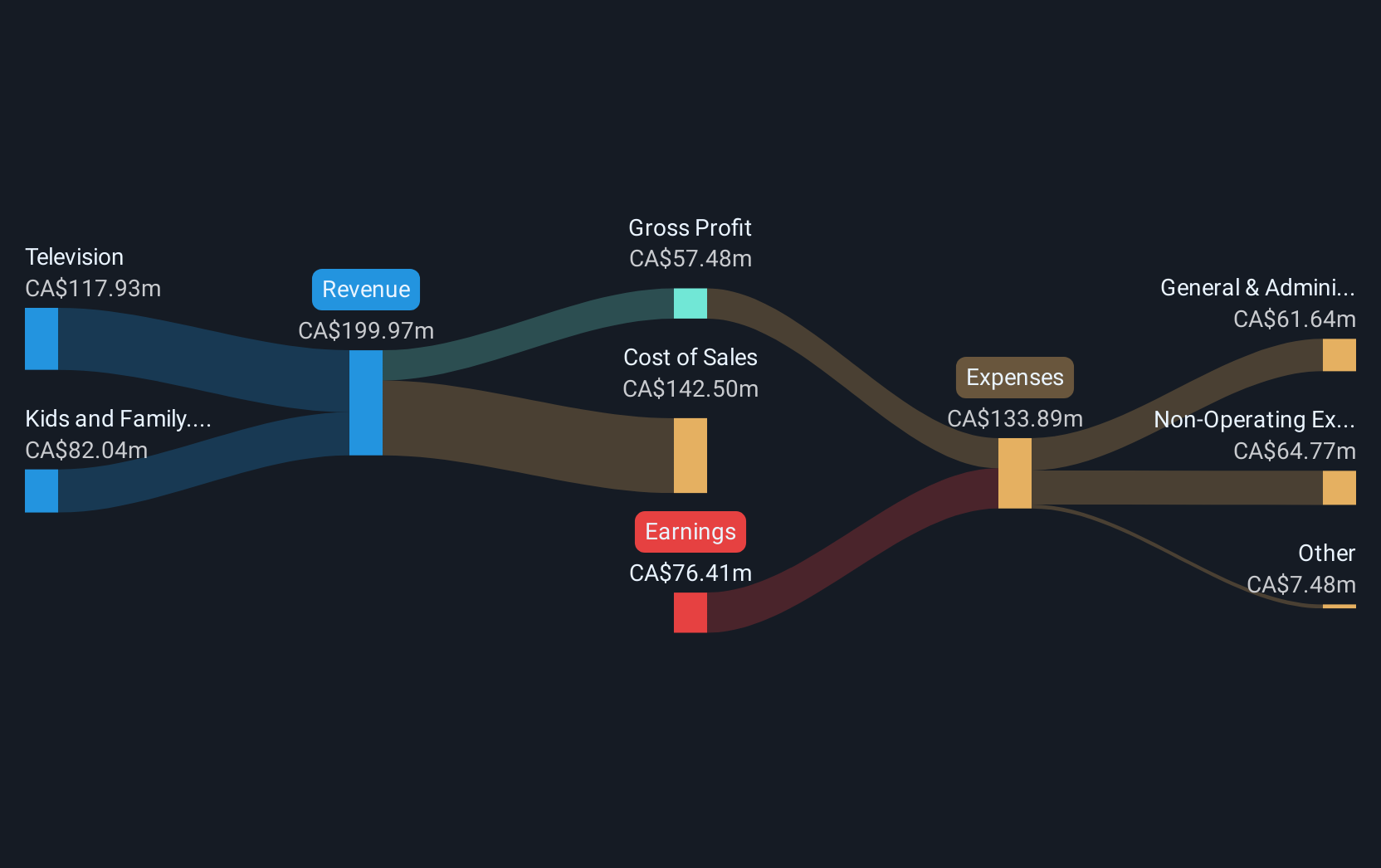

Overview: Boat Rocker Media Inc. is an entertainment company that creates, produces, and distributes television and film content across Canada, the United States, and internationally with a market cap of CA$40.27 million.

Operations: The company's revenue is primarily derived from its Television segment, which generated CA$134.89 million, and its Kids and Family segment, contributing CA$50.67 million.

Market Cap: CA$40.27M

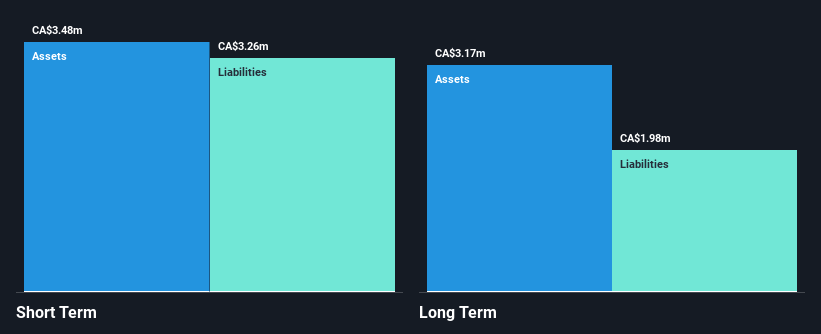

Boat Rocker Media Inc., with a market cap of CA$40.27 million, is currently unprofitable but has shown resilience by reducing its debt to equity ratio significantly over the past five years. The company generates substantial revenue from its Television segment (CA$134.89 million) and Kids and Family segment (CA$50.67 million), indicating strong operational foundations despite profitability challenges. While the management team is relatively inexperienced, the board of directors brings experience to strategic decisions. The company maintains a satisfactory net debt to equity ratio of 14.9% and has not diluted shareholders meaningfully in the past year, providing stability for potential investors in this penny stock space.

- Click to explore a detailed breakdown of our findings in Boat Rocker Media's financial health report.

- Gain insights into Boat Rocker Media's outlook and expected performance with our report on the company's earnings estimates.

Colibri Resource (TSXV:CBI)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Colibri Resource Corporation is a mineral exploration company focused on acquiring, exploring, and developing mineral properties in Mexico with a market cap of CA$4.16 million.

Operations: Colibri Resource Corporation has not reported any revenue segments.

Market Cap: CA$4.16M

Colibri Resource Corporation, with a market cap of CA$4.16 million, is pre-revenue and engaged in mineral exploration in Mexico. Recent drilling at its El Pilar Gold & Silver Project has shown promising results, with 1,122 meters drilled across 10 diamond holes revealing key structures and favorable rock characteristics. Despite the company's high volatility and short-term liabilities exceeding assets, it has managed to reduce its debt-to-equity ratio significantly over five years. Colibri recently raised additional capital through a private placement to support ongoing exploration efforts and potential development activities at its projects.

- Take a closer look at Colibri Resource's potential here in our financial health report.

- Assess Colibri Resource's previous results with our detailed historical performance reports.

Grid Metals (TSXV:GRDM)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Grid Metals Corp. is involved in the exploration and development of base and precious metal mineral properties in Canada, with a market cap of CA$7.15 million.

Operations: Grid Metals Corp. does not have any reported revenue segments.

Market Cap: CA$7.15M

Grid Metals Corp., with a market cap of CA$7.15 million, is pre-revenue and focuses on mineral exploration in Canada. The company recently entered a joint venture with Teck Resources to develop the Makwa nickel project, aiming for significant discovery potential. Positive drill results from its Eagle gabbro project indicate promising copper-nickel mineralization, enhancing prospects of high-value deposits. Despite being unprofitable with increasing losses over five years, Grid maintains a stable cash runway exceeding three years and remains debt-free. However, its stock exhibits high volatility and an inexperienced board may pose challenges in strategic execution.

- Get an in-depth perspective on Grid Metals' performance by reading our balance sheet health report here.

- Learn about Grid Metals' historical performance here.

Where To Now?

- Gain an insight into the universe of 940 TSX Penny Stocks by clicking here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSXV:GRDM

Grid Metals

Explores for and develops base and precious metal mineral properties in Canada.

Excellent balance sheet with slight risk.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Jackson Financial Stock: When Insurance Math Meets a Shifting Claims Landscape

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion