- Canada

- /

- Metals and Mining

- /

- TSXV:CKG

Promising TSX Penny Stocks To Consider In December 2024

Reviewed by Simply Wall St

As the Canadian market benefits from easing monetary policies and robust economic indicators, investors are finding renewed opportunities across various sectors. Amid this backdrop, penny stocks—often representing smaller or newer companies—continue to offer intriguing prospects for those looking beyond traditional investments. While the term may seem outdated, these stocks remain relevant by providing potential growth at lower price points, especially when backed by strong financials and solid fundamentals.

Top 10 Penny Stocks In Canada

| Name | Share Price | Market Cap | Financial Health Rating |

| Alvopetro Energy (TSXV:ALV) | CA$4.36 | CA$159.29M | ★★★★★★ |

| Amerigo Resources (TSX:ARG) | CA$1.71 | CA$283.52M | ★★★★★☆ |

| Findev (TSXV:FDI) | CA$0.47 | CA$13.46M | ★★★★★★ |

| Pulse Seismic (TSX:PSD) | CA$2.33 | CA$118.56M | ★★★★★★ |

| PetroTal (TSX:TAL) | CA$0.63 | CA$574.88M | ★★★★★★ |

| Mandalay Resources (TSX:MND) | CA$3.61 | CA$339.15M | ★★★★★★ |

| Foraco International (TSX:FAR) | CA$2.13 | CA$210.78M | ★★★★★☆ |

| Silvercorp Metals (TSX:SVM) | CA$4.60 | CA$1B | ★★★★★★ |

| Winshear Gold (TSXV:WINS) | CA$0.165 | CA$5.18M | ★★★★★★ |

| Hemisphere Energy (TSXV:HME) | CA$1.88 | CA$183.36M | ★★★★★☆ |

Click here to see the full list of 915 stocks from our TSX Penny Stocks screener.

Let's explore several standout options from the results in the screener.

GoldMining (TSX:GOLD)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: GoldMining Inc. is a mineral exploration company that focuses on acquiring, exploring, and developing gold assets in the Americas, with a market cap of CA$239.46 million.

Operations: GoldMining Inc. does not have any reported revenue segments.

Market Cap: CA$239.46M

GoldMining Inc., with a market cap of CA$239.46 million, remains pre-revenue and unprofitable but debt-free, reflecting its early-stage exploration status. Recent drilling at the São Jorge Project in Brazil has revealed promising gold mineralization, with auger drilling identifying high-grade targets for further exploration. Despite shareholder dilution and insider selling, the company's experienced management team continues to pursue strategic growth through targeted exploration activities. The addition to the S&P Global BMI Index may enhance visibility among investors as GoldMining seeks to capitalize on its potential resource base in a historically rich gold district.

- Click here and access our complete financial health analysis report to understand the dynamics of GoldMining.

- Understand GoldMining's earnings outlook by examining our growth report.

Colonial Coal International (TSXV:CAD)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Colonial Coal International Corp. focuses on acquiring, exploring, and developing coal properties in Canada with a market cap of CA$390.67 million.

Operations: There are no reported revenue segments for the company.

Market Cap: CA$390.67M

Colonial Coal International Corp., with a market cap of CA$390.67 million, is pre-revenue and currently unprofitable, reporting a net loss of CA$5.5 million for the first quarter ended October 31, 2024. The company remains debt-free and has not significantly diluted shareholders recently. Its short-term assets of CA$6.4 million exceed both its short-term and long-term liabilities, indicating financial stability despite ongoing losses that have increased at a rate of 32.1% annually over the past five years. The seasoned management team offers stability as the company navigates its early-stage development in coal exploration without immediate revenue streams.

- Dive into the specifics of Colonial Coal International here with our thorough balance sheet health report.

- Assess Colonial Coal International's previous results with our detailed historical performance reports.

Chesapeake Gold (TSXV:CKG)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Chesapeake Gold Corp. is a mineral exploration and evaluation company that focuses on the acquisition, evaluation, and development of precious metal deposits in North and Central America, with a market cap of CA$74.55 million.

Operations: Chesapeake Gold Corp. does not report any specific revenue segments as it is primarily engaged in the exploration and evaluation of precious metal deposits in North and Central America.

Market Cap: CA$74.55M

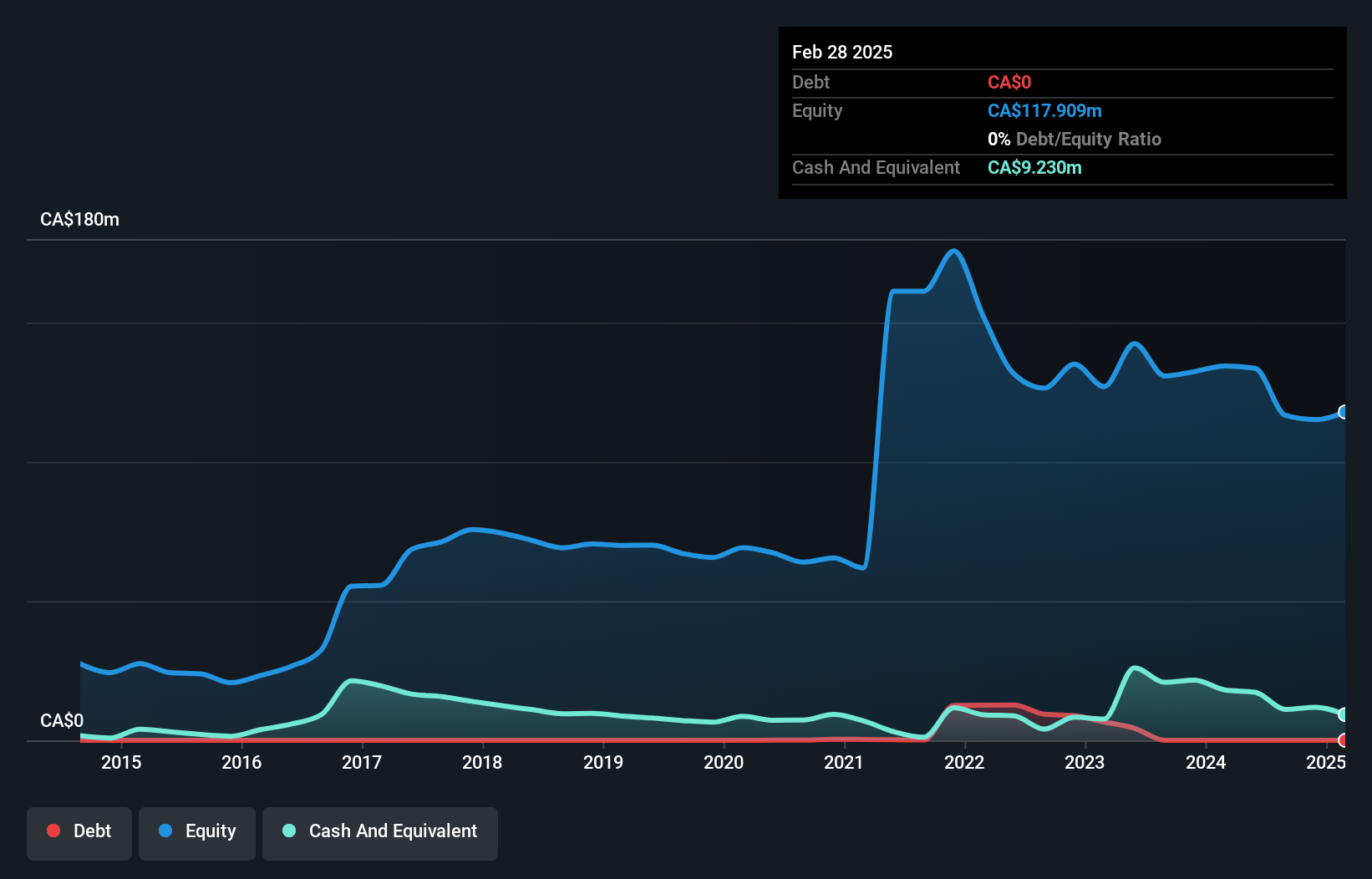

Chesapeake Gold Corp., with a market cap of CA$74.55 million, is pre-revenue and unprofitable, reporting a net loss of CA$0.695 million for the third quarter of 2024. The company remains debt-free and has not significantly diluted shareholders recently. Its short-term assets (CA$14.3M) cover both short-term (CA$1.8M) and long-term liabilities (CA$11.1M), indicating financial stability despite ongoing losses increasing by 25.5% annually over five years. Recent metallurgical updates at its Metates project show promising gold recovery rates exceeding 70%, supporting future development plans and potentially unlocking significant economic value in refractory ores globally.

- Take a closer look at Chesapeake Gold's potential here in our financial health report.

- Learn about Chesapeake Gold's historical performance here.

Next Steps

- Click this link to deep-dive into the 915 companies within our TSX Penny Stocks screener.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSXV:CKG

Chesapeake Gold

A mineral exploration and evaluation company, focuses on acquisition, evaluation, and development of precious metal deposits in North and Central America.

Flawless balance sheet low.