- Canada

- /

- Metals and Mining

- /

- TSXV:BCM

Bear Creek Mining (CVE:BCM) delivers shareholders strong 125% return over 1 year, surging 14% in the last week alone

Unless you borrow money to invest, the potential losses are limited. But if you pick the right stock, you can make a lot more than 100%. Take, for example Bear Creek Mining Corporation (CVE:BCM). Its share price is already up an impressive 125% in the last twelve months. And in the last week the share price has popped 14%. Zooming out, the stock is actually down 65% in the last three years.

On the back of a solid 7-day performance, let's check what role the company's fundamentals have played in driving long term shareholder returns.

Check out our latest analysis for Bear Creek Mining

Bear Creek Mining wasn't profitable in the last twelve months, it is unlikely we'll see a strong correlation between its share price and its earnings per share (EPS). Arguably revenue is our next best option. Generally speaking, companies without profits are expected to grow revenue every year, and at a good clip. That's because fast revenue growth can be easily extrapolated to forecast profits, often of considerable size.

In the last year Bear Creek Mining saw its revenue grow by 21%. That's a fairly respectable growth rate. While that revenue growth is pretty good the share price performance outshone it, with a lift of 125% as mentioned above. If the profitability is on the horizon then now could be a very exciting time to be a shareholder. Of course, we are always cautious about succumbing to 'fear of missing out' when a stock has shot up strongly.

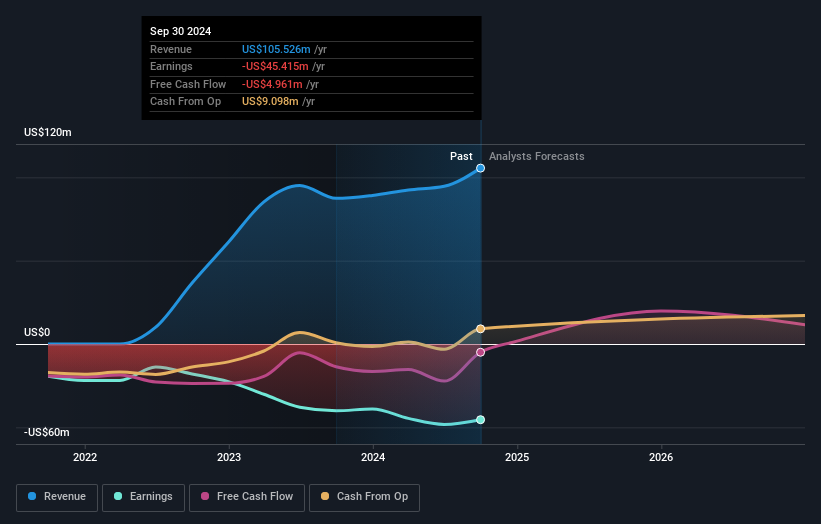

The graphic below depicts how earnings and revenue have changed over time (unveil the exact values by clicking on the image).

Take a more thorough look at Bear Creek Mining's financial health with this free report on its balance sheet.

A Different Perspective

It's good to see that Bear Creek Mining has rewarded shareholders with a total shareholder return of 125% in the last twelve months. That certainly beats the loss of about 13% per year over the last half decade. We generally put more weight on the long term performance over the short term, but the recent improvement could hint at a (positive) inflection point within the business. It's always interesting to track share price performance over the longer term. But to understand Bear Creek Mining better, we need to consider many other factors. Case in point: We've spotted 4 warning signs for Bear Creek Mining you should be aware of, and 1 of them is a bit unpleasant.

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this free list of companies we expect will grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Canadian exchanges.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Bear Creek Mining might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSXV:BCM

Bear Creek Mining

Engages in the acquisition, exploration, and development of precious and base metal properties in Peru and Mexico.

Moderate risk and slightly overvalued.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Sunrun Stock: When the Energy Transition Collides With the Cost of Capital

Salesforce Stock: AI-Fueled Growth Is Real — But Can Margins Stay This Strong?

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)