- Canada

- /

- Commercial Services

- /

- TSXV:SECU

TSX Penny Stocks Under CA$50M Market Cap: 3 Hidden Opportunities

Reviewed by Simply Wall St

As the Canadian market navigates shifts in Federal Reserve expectations and potential productivity gains from technological advancements, investors are keenly observing how these factors influence broader economic conditions. Amidst these developments, penny stocks—though an older term—remain relevant as they highlight smaller or less-established companies that can offer significant value. By focusing on those with robust financials and growth potential, investors may uncover promising opportunities within this often-overlooked segment of the market.

Top 10 Penny Stocks In Canada

| Name | Share Price | Market Cap | Financial Health Rating |

| PetroTal (TSX:TAL) | CA$0.67 | CA$602.45M | ★★★★★★ |

| Alvopetro Energy (TSXV:ALV) | CA$4.93 | CA$182.69M | ★★★★★★ |

| Pulse Seismic (TSX:PSD) | CA$2.36 | CA$119.63M | ★★★★★★ |

| Findev (TSXV:FDI) | CA$0.40 | CA$11.46M | ★★★★★☆ |

| Winshear Gold (TSXV:WINS) | CA$0.185 | CA$5.66M | ★★★★★★ |

| Mandalay Resources (TSX:MND) | CA$3.45 | CA$327.12M | ★★★★★★ |

| Amerigo Resources (TSX:ARG) | CA$1.72 | CA$291.81M | ★★★★★☆ |

| NamSys (TSXV:CTZ) | CA$1.08 | CA$28.74M | ★★★★★★ |

| East West Petroleum (TSXV:EW) | CA$0.045 | CA$4.07M | ★★★★★★ |

| Enterprise Group (TSX:E) | CA$2.13 | CA$129.82M | ★★★★☆☆ |

Click here to see the full list of 954 stocks from our TSX Penny Stocks screener.

Underneath we present a selection of stocks filtered out by our screen.

BCM Resources (TSXV:B)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: BCM Resources Corporation focuses on acquiring, exploring, and developing mineral properties in Canada with a market cap of CA$7.62 million.

Operations: There are no reported revenue segments for the company.

Market Cap: CA$7.62M

BCM Resources Corporation, with a market cap of CA$7.62 million, is a pre-revenue company focused on mineral exploration. Despite its unprofitability, it has a cash runway exceeding three years, thanks to positive free cash flow. However, the company faces challenges such as high share price volatility and shareholder dilution over the past year. Short-term liabilities significantly exceed short-term assets (CA$1.8 million vs CA$16.3K), posing liquidity concerns despite being debt-free with no long-term obligations. Recent earnings reports show reduced losses compared to the previous year but highlight ongoing financial instability in its operations.

- Click to explore a detailed breakdown of our findings in BCM Resources' financial health report.

- Examine BCM Resources' past performance report to understand how it has performed in prior years.

Fortune Bay (TSXV:FOR)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Fortune Bay Corp. is involved in the acquisition, exploration, and development of mineral properties with a market cap of CA$14.12 million.

Operations: Fortune Bay Corp. has not reported any revenue segments.

Market Cap: CA$14.12M

Fortune Bay Corp., with a market cap of CA$14.12 million, is a pre-revenue company engaged in mineral exploration. Recent high-grade uranium assay results from its Murmac Uranium Project indicate potential resource value, but the company remains unprofitable with short-term liabilities exceeding short-term assets (CA$2.2M vs CA$1.6M). Shareholders have faced dilution over the past year, and although recent capital raising has extended its cash runway beyond three months, liquidity concerns persist due to limited cash flow generation. Despite these challenges, Fortune Bay's experienced management and board may offer stability as it navigates financial hurdles.

- Click here and access our complete financial health analysis report to understand the dynamics of Fortune Bay.

- Understand Fortune Bay's track record by examining our performance history report.

SSC Security Services (TSXV:SECU)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: SSC Security Services Corp. offers physical and cyber security services to corporate and public sector clients in Canada, with a market cap of CA$48.63 million.

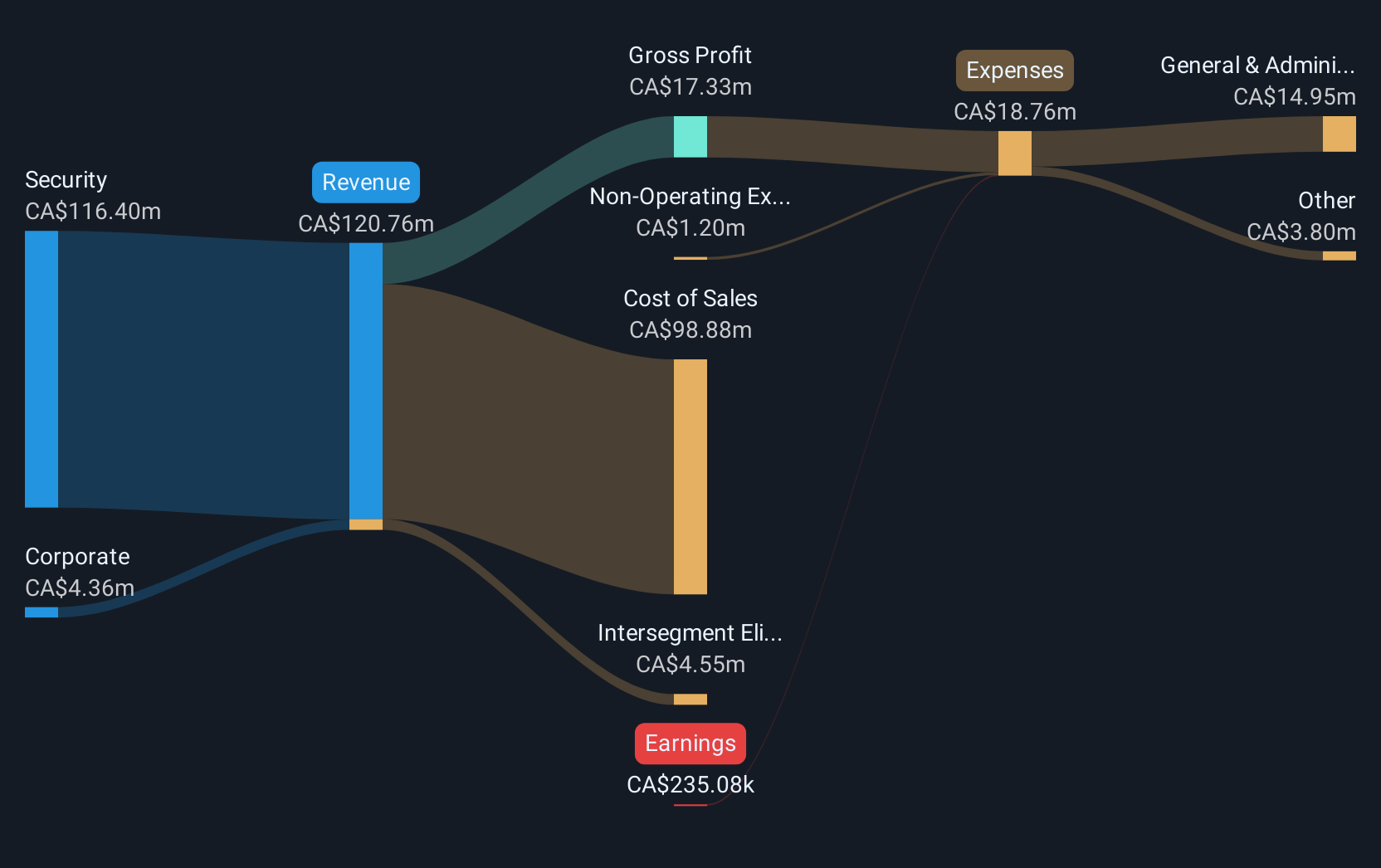

Operations: The company's revenue is primarily derived from its Security segment, which accounts for CA$120.48 million, complemented by CA$4.18 million from its Corporate segment.

Market Cap: CA$48.63M

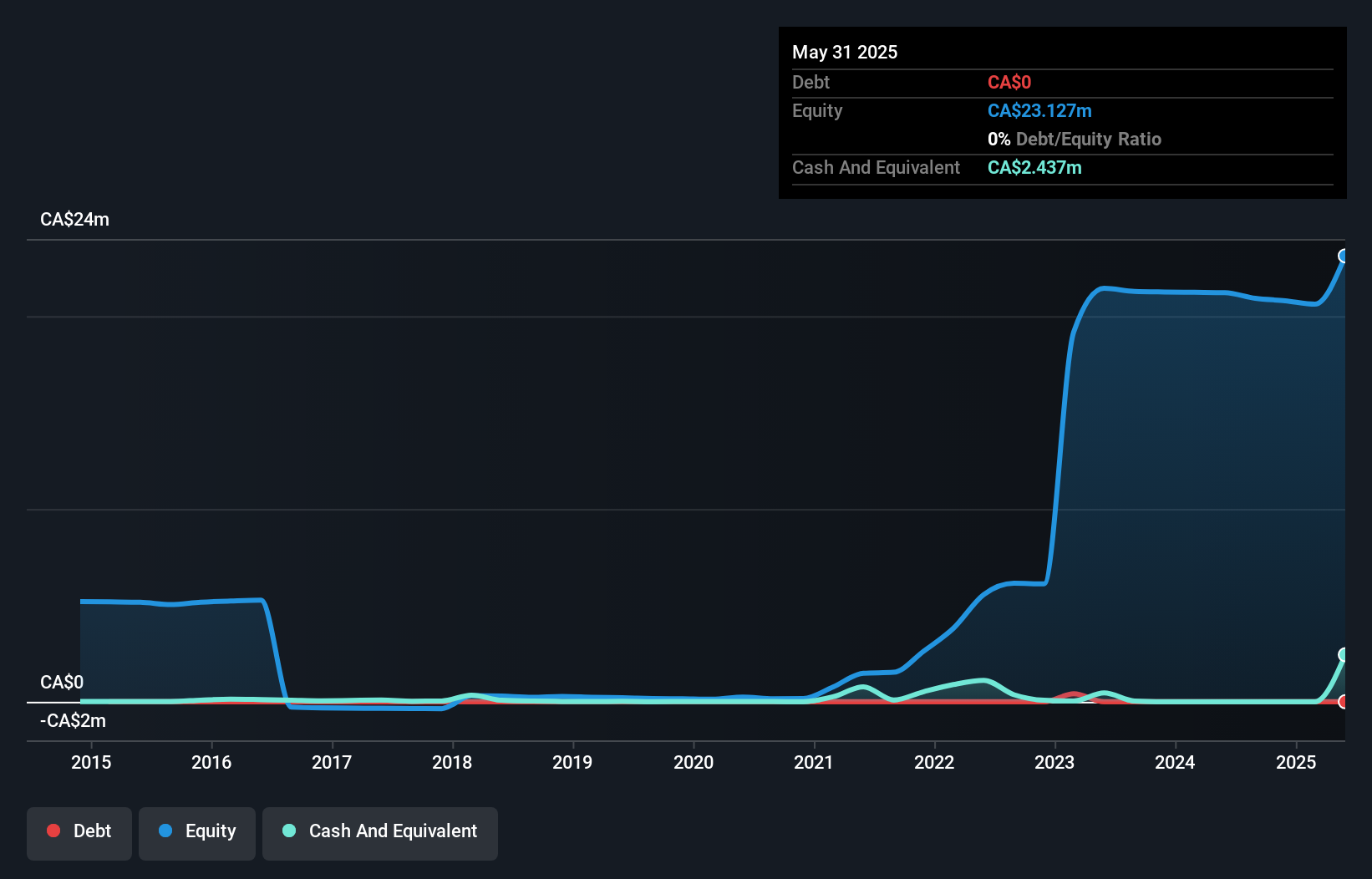

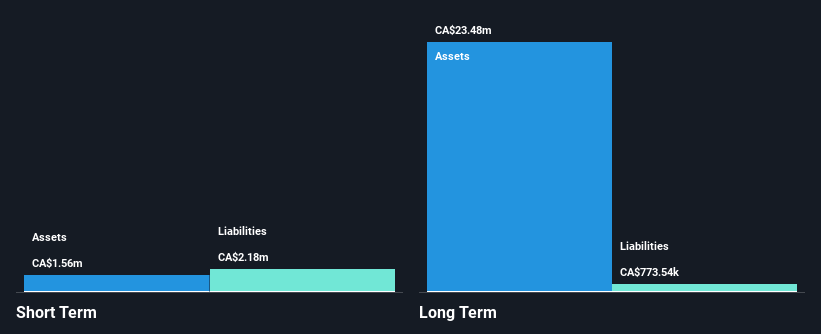

SSC Security Services Corp., with a market cap of CA$48.63 million, has shown financial stability by becoming profitable this year, reporting CA$91.01 million in sales for the first nine months of 2024. The company has no debt, reducing financial risk and eliminating interest payment concerns. Its short-term assets significantly exceed both long-term and short-term liabilities, indicating solid liquidity management. Despite trading below its estimated fair value, the company's dividend yield is not well covered by earnings or free cash flows, raising sustainability questions. The experienced board offers governance stability as SSC continues to navigate market dynamics.

- Take a closer look at SSC Security Services' potential here in our financial health report.

- Learn about SSC Security Services' historical performance here.

Turning Ideas Into Actions

- Gain an insight into the universe of 954 TSX Penny Stocks by clicking here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSXV:SECU

SSC Security Services

Provides cyber, physical, and electronic security services to commercial, industrial, and public sector clients in Canada.

Flawless balance sheet with acceptable track record.

Market Insights

Community Narratives