- Canada

- /

- Metals and Mining

- /

- TSXV:AZM

3 Promising TSX Penny Stocks With Market Caps Under CA$400M

Reviewed by Simply Wall St

The Canadian market is demonstrating strong momentum as it heads into 2025, supported by a resilient consumer base and rising corporate profits. Amidst this optimistic backdrop, investors are cautioned to consider potential curveballs that could impact their portfolios. While the term "penny stocks" might seem outdated, these investments in smaller or newer companies can still offer significant growth opportunities when backed by solid financial health.

Top 10 Penny Stocks In Canada

| Name | Share Price | Market Cap | Financial Health Rating |

| Alvopetro Energy (TSXV:ALV) | CA$4.54 | CA$169.52M | ★★★★★★ |

| Amerigo Resources (TSX:ARG) | CA$1.74 | CA$286.83M | ★★★★★☆ |

| Pulse Seismic (TSX:PSD) | CA$2.34 | CA$117.03M | ★★★★★★ |

| Winshear Gold (TSXV:WINS) | CA$0.16 | CA$5.03M | ★★★★★★ |

| Mandalay Resources (TSX:MND) | CA$3.52 | CA$317.65M | ★★★★★★ |

| PetroTal (TSX:TAL) | CA$0.63 | CA$574.88M | ★★★★★★ |

| Findev (TSXV:FDI) | CA$0.455 | CA$12.89M | ★★★★★☆ |

| Foraco International (TSX:FAR) | CA$2.18 | CA$207.81M | ★★★★★☆ |

| Silvercorp Metals (TSX:SVM) | CA$4.79 | CA$1.08B | ★★★★★★ |

| NamSys (TSXV:CTZ) | CA$1.07 | CA$29.28M | ★★★★★★ |

Click here to see the full list of 965 stocks from our TSX Penny Stocks screener.

Below we spotlight a couple of our favorites from our exclusive screener.

Hamilton Thorne (TSX:HTL)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Hamilton Thorne Ltd. develops, manufactures, and sells precision instruments, laboratory equipment, consumables, software, and services for the assisted reproductive technologies (ART), research, and cell biology markets with a market cap of CA$346.28 million.

Operations: No specific revenue segments are reported for Hamilton Thorne Ltd.

Market Cap: CA$346.28M

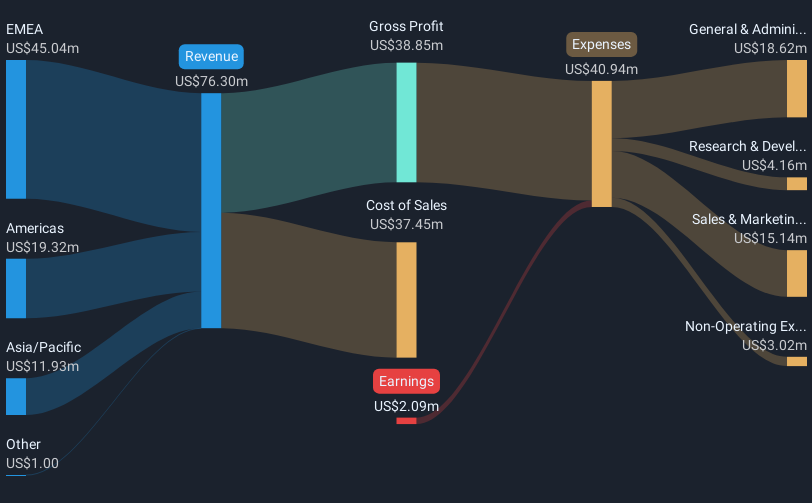

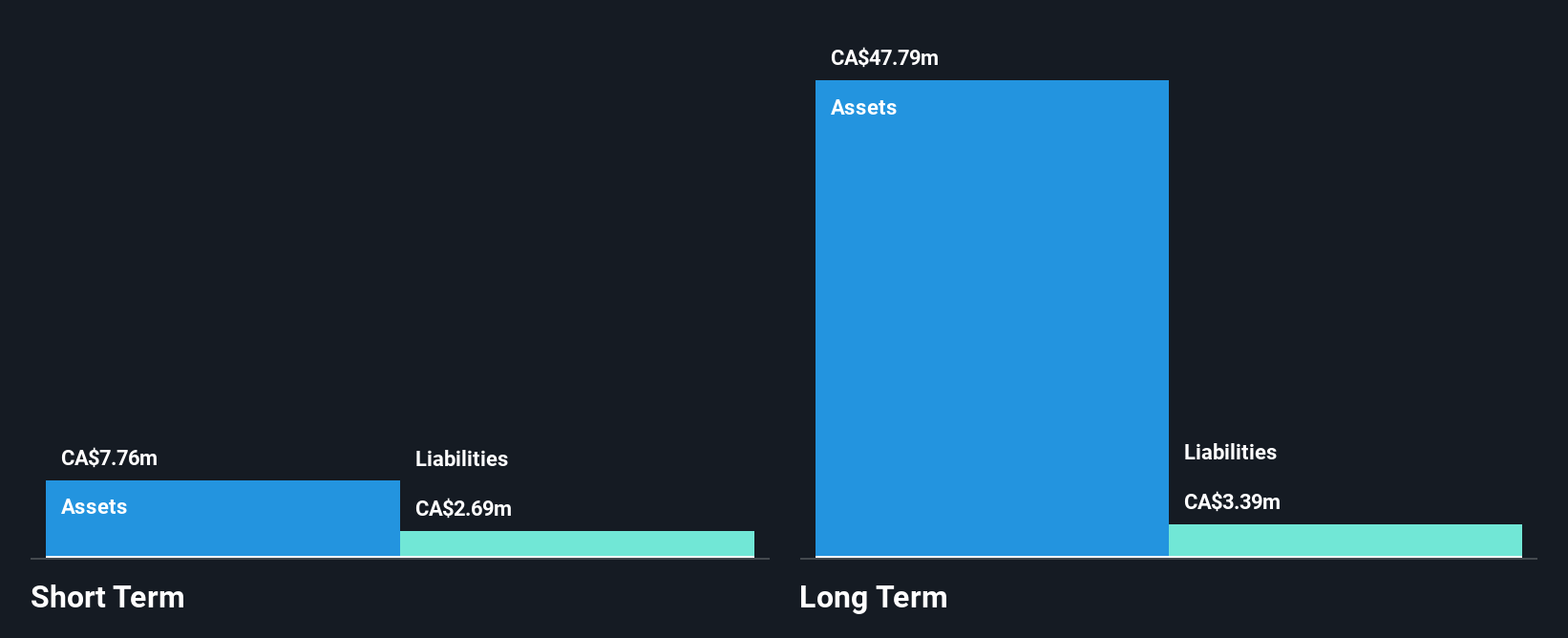

Hamilton Thorne Ltd. reported third-quarter sales of US$19.38 million, up from US$15.66 million the previous year, but remains unprofitable with a net loss of US$1.18 million. The company's debt is well covered by operating cash flow and its short-term assets exceed both short and long-term liabilities, indicating solid liquidity management despite increasing losses over five years at a significant rate. Trading significantly below estimated fair value may attract interest; however, the lack of profitability and limited management experience could pose challenges in achieving projected earnings growth of 161.56% annually amidst industry competition.

- Dive into the specifics of Hamilton Thorne here with our thorough balance sheet health report.

- Gain insights into Hamilton Thorne's outlook and expected performance with our report on the company's earnings estimates.

Azimut Exploration (TSXV:AZM)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Azimut Exploration Inc. focuses on the acquisition, exploration, and evaluation of mineral properties in Canada and has a market cap of CA$54.78 million.

Operations: The company generates CA$0.32 million in revenue from its activities related to acquiring, exploring, and evaluating exploration properties.

Market Cap: CA$54.78M

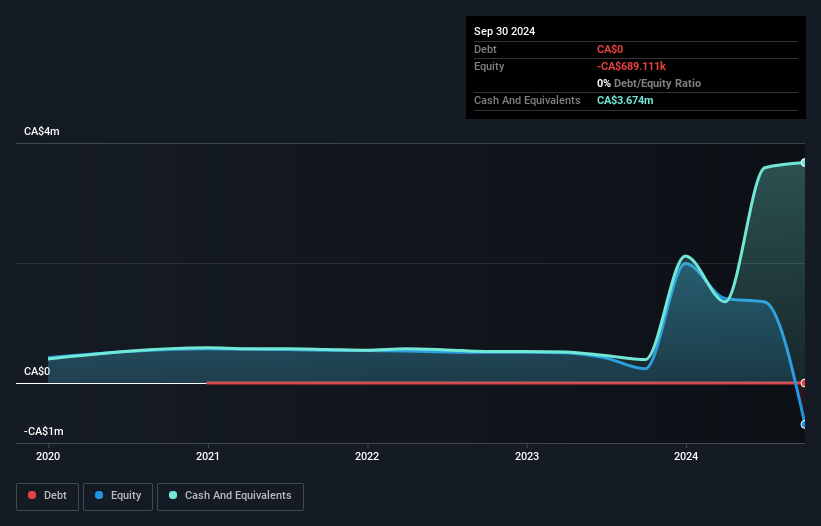

Azimut Exploration Inc., with a market cap of CA$54.78 million, is pre-revenue and has recently become profitable, though its return on equity remains low at 1.9%. The company is debt-free, with short-term assets of CA$14.3 million exceeding liabilities, indicating strong financial positioning for ongoing exploration activities. Recent discoveries include a high-grade antimony corridor in Quebec and promising nickel zones at the Kukamas Property, both requiring further drilling to assess potential. Azimut's strategic focus on critical minerals like lithium and antimony aligns with supply concerns, potentially enhancing its exploration prospects in Canada's mineral-rich regions.

- Click here to discover the nuances of Azimut Exploration with our detailed analytical financial health report.

- Examine Azimut Exploration's past performance report to understand how it has performed in prior years.

Moon River Moly (TSXV:MOO)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Moon River Moly Ltd. is a resource company engaged in the acquisition, exploration, and development of mineral projects, with a market cap of CA$15.16 million.

Operations: Moon River Moly Ltd. has not reported any revenue segments.

Market Cap: CA$15.16M

Moon River Moly Ltd., with a market cap of CA$15.16 million, is a pre-revenue resource company focused on mineral exploration, particularly molybdenum. Recent chemical and mineralogical analysis at its Davidson Project in British Columbia aims to assess the economic viability of recovering molybdenum and other by-products like tungsten and copper. Despite being debt-free, Moon River faces financial challenges with short-term assets of CA$28.1 million not covering long-term liabilities of CA$35.7 million, alongside increasing losses over five years and high share price volatility. The management team is relatively new, indicating potential changes in strategic direction.

- Get an in-depth perspective on Moon River Moly's performance by reading our balance sheet health report here.

- Review our historical performance report to gain insights into Moon River Moly's track record.

Next Steps

- Get an in-depth perspective on all 965 TSX Penny Stocks by using our screener here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSXV:AZM

Azimut Exploration

Engages in the acquisition, exploration, and evaluation of mineral properties in Canada.

Flawless balance sheet low.

Similar Companies

Market Insights

Community Narratives