- Canada

- /

- Metals and Mining

- /

- TSXV:OCI

3 Promising TSX Penny Stocks With Market Caps Below CA$20M

Reviewed by Simply Wall St

Recent shifts in Federal Reserve expectations and strong U.S. economic data have influenced global markets, including Canada, prompting investors to reassess interest rate paths and economic growth projections. Amid these evolving conditions, penny stocks—often representing smaller or newer companies—continue to capture attention for their affordability and potential growth opportunities. Despite being an older term, penny stocks remain relevant for those seeking investments with a mix of financial strength and potential upside in the Canadian market.

Top 10 Penny Stocks In Canada

| Name | Share Price | Market Cap | Financial Health Rating |

| PetroTal (TSX:TAL) | CA$0.65 | CA$602.45M | ★★★★★★ |

| Alvopetro Energy (TSXV:ALV) | CA$4.85 | CA$182.69M | ★★★★★★ |

| Pulse Seismic (TSX:PSD) | CA$2.39 | CA$119.63M | ★★★★★★ |

| Findev (TSXV:FDI) | CA$0.40 | CA$11.46M | ★★★★★☆ |

| Winshear Gold (TSXV:WINS) | CA$0.18 | CA$5.66M | ★★★★★★ |

| Mandalay Resources (TSX:MND) | CA$3.40 | CA$327.12M | ★★★★★★ |

| Amerigo Resources (TSX:ARG) | CA$1.71 | CA$291.81M | ★★★★★☆ |

| NamSys (TSXV:CTZ) | CA$1.07 | CA$28.74M | ★★★★★★ |

| East West Petroleum (TSXV:EW) | CA$0.045 | CA$4.07M | ★★★★★★ |

| Enterprise Group (TSX:E) | CA$2.10 | CA$129.82M | ★★★★☆☆ |

Click here to see the full list of 954 stocks from our TSX Penny Stocks screener.

Underneath we present a selection of stocks filtered out by our screen.

Spearmint Resources (CNSX:SPMT)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Spearmint Resources Inc. is an exploration stage company focused on identifying, acquiring, and exploring mineral properties in Canada and the United States, with a market cap of CA$5.42 million.

Operations: There are no reported revenue segments for this exploration stage company.

Market Cap: CA$5.42M

Spearmint Resources Inc., with a market cap of CA$5.42 million, is a pre-revenue exploration stage company that recently announced a private placement to raise CA$250,000. This move aims to extend its cash runway beyond the current one-month estimate based on free cash flow. Despite being debt-free, Spearmint faces financial challenges with short-term assets of CA$75.2K not covering liabilities of CA$88.5K and experiencing shareholder dilution over the past year. The management team is experienced with an average tenure of seven years, but the stock remains highly volatile compared to most Canadian stocks.

- Dive into the specifics of Spearmint Resources here with our thorough balance sheet health report.

- Assess Spearmint Resources' previous results with our detailed historical performance reports.

Astra Exploration (TSXV:ASTR)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Astra Exploration Inc. is a company focused on acquiring, exploring, and developing epithermal gold-silver properties in Chile, with a market cap of CA$6.34 million.

Operations: Currently, there are no reported revenue segments for this company.

Market Cap: CA$6.34M

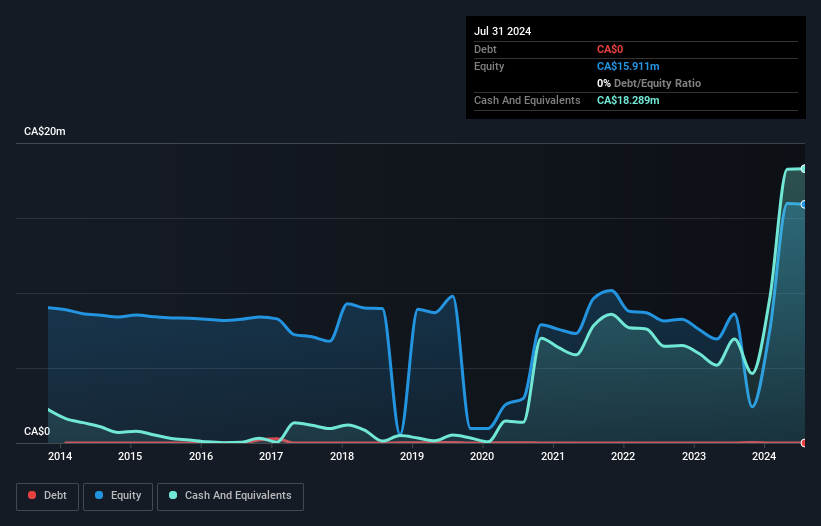

Astra Exploration Inc., with a market cap of CA$6.34 million, is a pre-revenue company focused on gold-silver properties in Chile. Recently, it announced a private placement to raise up to CA$2 million, which could extend its cash runway beyond the current one-month estimate. The company is debt-free and has reduced losses by 15.4% annually over five years, though shareholder dilution occurred last year with shares outstanding increasing by 6.5%. Astra's management team is considered experienced despite an inexperienced board, and its stock price remains highly volatile compared to other Canadian stocks.

- Jump into the full analysis health report here for a deeper understanding of Astra Exploration.

- Learn about Astra Exploration's historical performance here.

Orecap Invest (TSXV:OCI)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Orecap Invest Corp. is a company that invests in the natural resource sector and has a market cap of CA$13.62 million.

Operations: No revenue segments are reported for this company.

Market Cap: CA$13.62M

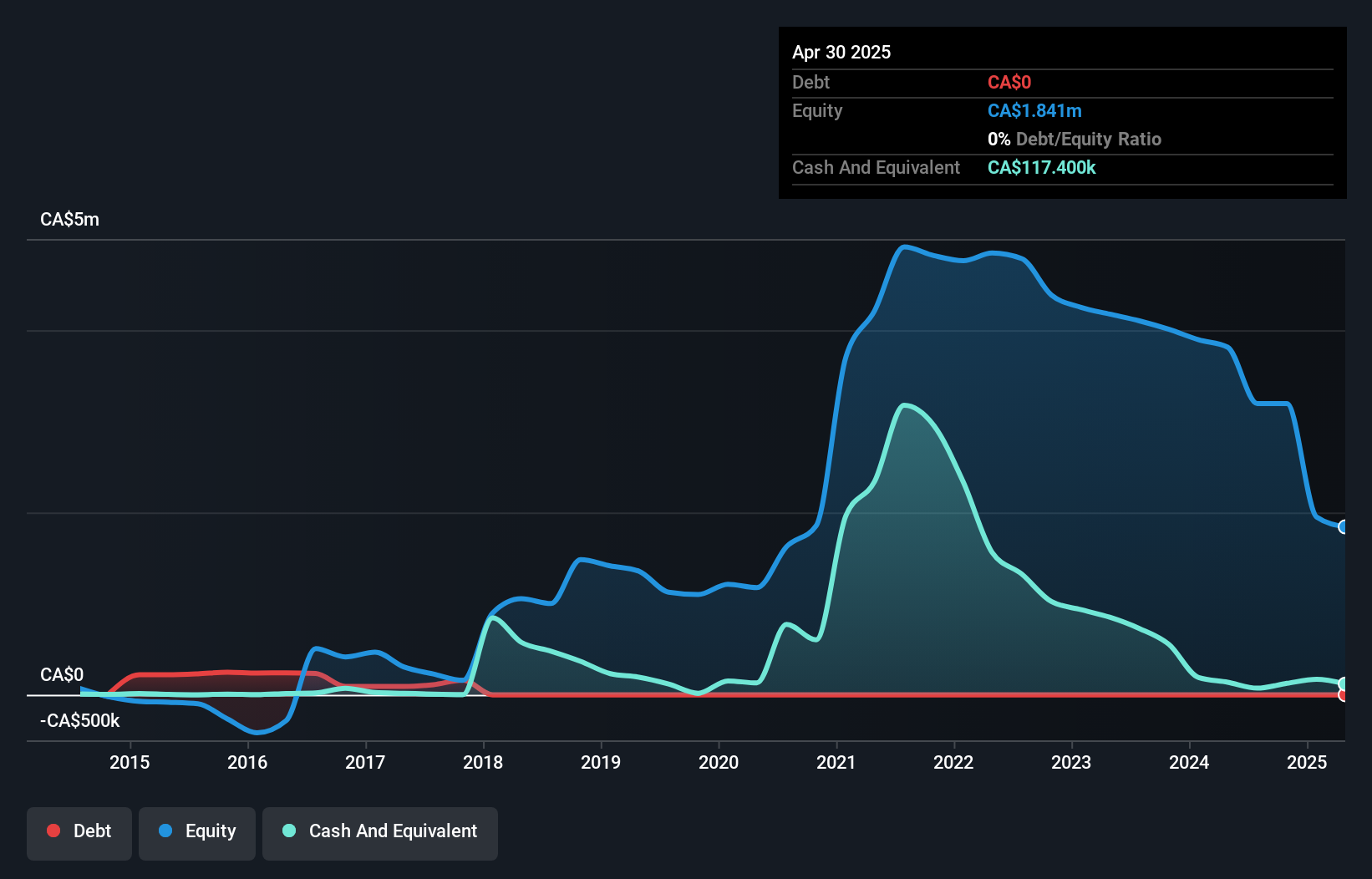

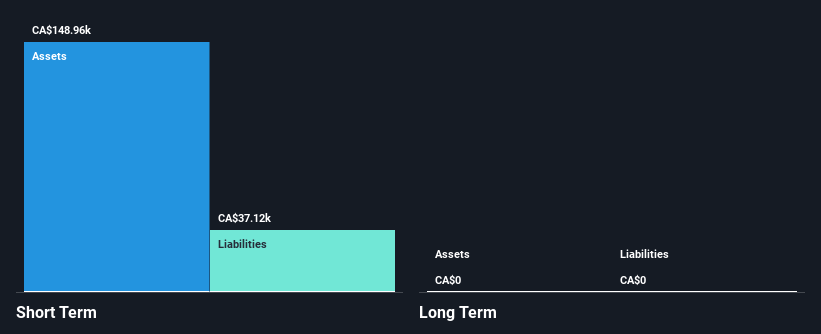

Orecap Invest Corp., with a market cap of CA$13.62 million, operates as a pre-revenue entity in the natural resource sector. The company is debt-free and has shown significant earnings growth, driven largely by a one-off gain of CA$11.6 million over the past year, although its share price remains volatile. Orecap's short-term assets significantly exceed liabilities, providing financial stability. Recent portfolio updates include promising drill results from Awale Resources and American Eagle Gold projects, potentially enhancing asset value through high-grade gold and copper equivalent intercepts that suggest further exploration potential in these areas.

- Click here and access our complete financial health analysis report to understand the dynamics of Orecap Invest.

- Understand Orecap Invest's track record by examining our performance history report.

Make It Happen

- Jump into our full catalog of 954 TSX Penny Stocks here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSXV:OCI

Flawless balance sheet with proven track record.

Market Insights

Community Narratives