- Canada

- /

- Metals and Mining

- /

- TSXV:ASE

Is Asante Gold’s Exploration Success and Increased Drilling Spend Reframing the Investment Case for TSXV:ASE?

Reviewed by Sasha Jovanovic

- Asante Gold Corporation recently announced an exploration update for its Bibiani and Chirano Gold Mines, reporting significant high-grade gold intercepts and progress across key targets including Obra, Suraw, and Sariehu in 2025.

- The allocation of more than $9 million in exploration financing for each mine highlights the company's accelerated efforts to expand its resource base and extend mine life through ongoing drilling programs.

- We’ll explore how strong drilling results and targeted exploration at Bibiani and Chirano could reshape Asante Gold’s investment narrative.

AI is about to change healthcare. These 33 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

What Is Asante Gold's Investment Narrative?

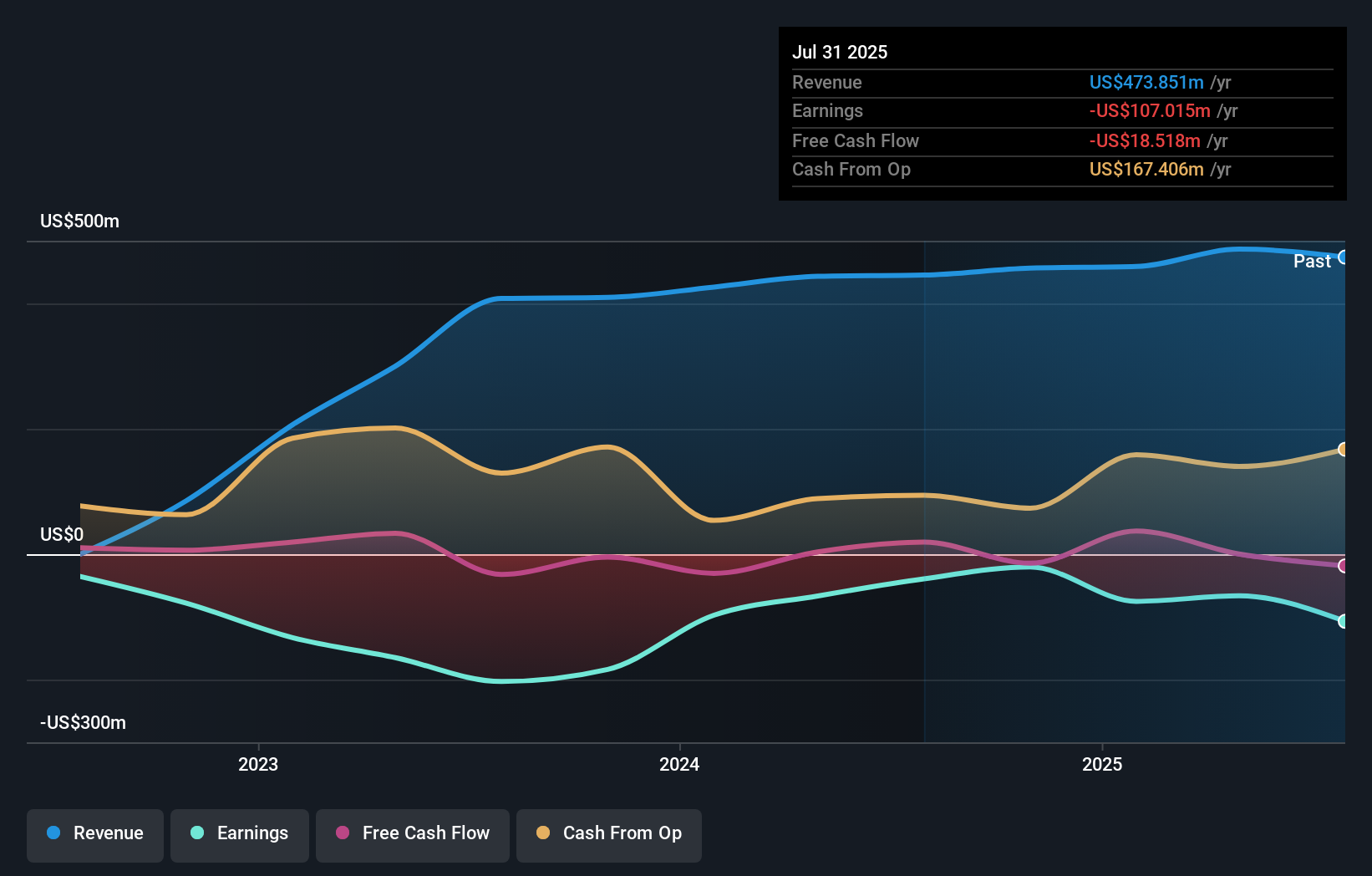

Asante Gold’s story hinges on investors believing in its ability to unlock more ounces from Bibiani and Chirano, driving future production and, ultimately, financial recovery. This recent exploration update showcasing high-grade gold intercepts and rapid drill progress is directly tied to the company’s biggest near-term catalyst: converting new discoveries into mineable resources that extend mine life and support ambitious output targets. With more than $9 million allocated to each site, management is positioning exploration front and center, but recurring operating losses and a significant drop in recent gold production still cast a shadow. If these strong exploration results translate quickly into expanded reserves and stable output, particularly after boosting recovery rates with the newly operational Bibiani sulphide plant, they could help ease concerns about earnings declines. Still, execution and cost discipline remain major variables. But strong drill results alone don’t eliminate concerns about ongoing financial losses and dilution.

Asante Gold's shares are on the way up, but could they be overextended? Uncover how much higher they are than fair value.Exploring Other Perspectives

Explore 2 other fair value estimates on Asante Gold - why the stock might be worth 34% less than the current price!

Build Your Own Asante Gold Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Asante Gold research is our analysis highlighting 3 important warning signs that could impact your investment decision.

- Our free Asante Gold research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Asante Gold's overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Find companies with promising cash flow potential yet trading below their fair value.

- Outshine the giants: these 24 early-stage AI stocks could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSXV:ASE

Asante Gold

A mineral exploration and gold production company, primarily involved in the assessment, acquisition, development, and operation of mines in the Republic of Ghana.

Low risk and slightly overvalued.

Market Insights

Community Narratives