- Canada

- /

- Metals and Mining

- /

- TSXV:ASE

Asante Gold (TSXV:ASE) Q3 Loss Deepening Reinforces Bearish Profitability Narratives

Reviewed by Simply Wall St

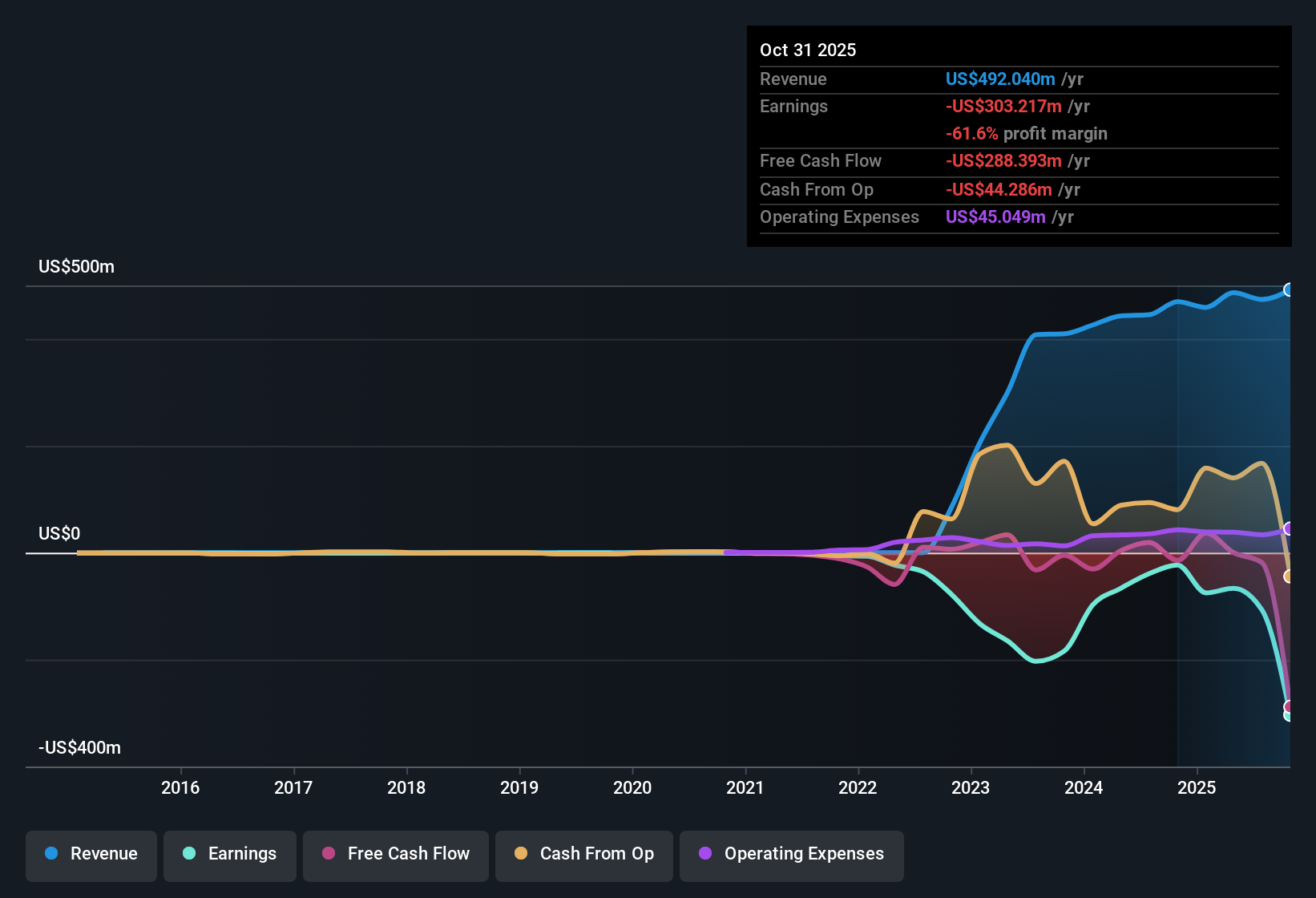

Asante Gold (TSXV:ASE) has just posted another tough quarter, with Q3 2026 revenue of about $129 million and basic EPS at a loss of $0.30, while trailing twelve month revenue sits near $492 million alongside a basic EPS loss of $0.55. Over the past few quarters the company has seen revenue move between roughly $101 million and $142 million per quarter, but EPS has remained in the red throughout. This points to a business still working to get margins under control even as the top line holds around the half billion dollar mark on a twelve month view.

See our full analysis for Asante Gold.With the headline numbers on the table, the next step is to compare these results with the dominant narratives around Asante Gold to see which stories the data supports and which ones start to crack.

Curious how numbers become stories that shape markets? Explore Community Narratives

$303 million loss over last year puts revenue in context

- Over the last twelve months Asante has generated about $492 million in revenue but booked a net loss of roughly $303 million, meaning the business has been losing well over half of every sales dollar after expenses.

- What stands out for a bearish view is how quickly losses have deepened, with earnings declining at about 40.1 percent per year over five years, and Q3 alone showing a net loss of $213 million on $129 million of revenue. This heavily reinforces concerns about the company’s ability to turn strong sales into sustainable profits.

- On a per share basis, trailing twelve month EPS is a loss of about $0.55, compared with a single quarter loss of $0.30 in Q3, so shareholders have absorbed both a weak recent period and a tough year overall.

- Across 2026 so far, net losses have widened from about $11 million in Q1 to $62 million in Q2 and then $213 million in Q3. This aligns closely with the bearish focus on worsening profitability rather than one off setbacks.

Low 2x P/S multiple despite rising revenue base

- Even with trailing twelve month revenue rising from about $445 million in Q2 2025 to roughly $492 million by Q3 2026, the stock trades at a price to sales ratio of just 2 times, well below the Canadian metals and mining industry average of 6.5 times and a 12.4 times peer average.

- Supporters of a more bullish narrative might point to that 2 times sales valuation as a potential bargain given the near half billion dollar revenue base. Yet the numbers also explain why the discount persists because sizeable and persistent losses sit alongside that top line.

- On a rolling basis, net losses have grown from about $39 million on $445 million of revenue to $303 million on $492 million of revenue, so while the sales base has expanded, profitability has moved sharply in the wrong direction.

- With the share price around $2.03 and no profit to anchor traditional valuation ratios like price to earnings, investors are effectively being asked to weigh a low sales multiple against a loss making earnings profile that has not yet shown improvement.

Less than one year cash runway and recent dilution

- The risk data indicates Asante has less than one year of cash runway and has already diluted shareholders materially over the past year, which means recent heavy losses are being funded by a capital structure that is under pressure.

- Critics who lean bearish see these financing signals as just as important as the income statement, since funding ongoing losses of $303 million over the last twelve months with limited cash and fresh equity issues can weigh on future per share value.

- Because net income has been negative in every quarter listed from Q2 2025 through Q3 2026, with no offsetting profitability period, the company has not been replenishing its cash position through operations during this stretch.

- Substantial dilution in the past year means that even if revenue holds near the current $492 million level, each share now represents a smaller claim on that revenue and any eventual return to profit, which is central to many bearish arguments.

Next Steps

Don't just look at this quarter; the real story is in the long-term trend. We've done an in-depth analysis on Asante Gold's growth and its valuation to see if today's price is a bargain. Add the company to your watchlist or portfolio now so you don't miss the next big move.

Explore Alternatives

Asante Gold’s widening losses, limited cash runway, and ongoing dilution highlight a fragile financial position that could increasingly work against long term shareholders.

If you want businesses with stronger cushions and less funding risk, use our solid balance sheet and fundamentals stocks screener (1942 results) today to quickly focus on companies built on healthier balance sheets.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSXV:ASE

Asante Gold

A mineral exploration and gold production company, primarily involved in the assessment, acquisition, development, and operation of mines in the Republic of Ghana.

Low risk and slightly overvalued.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

A tech powerhouse quietly powering the world’s AI infrastructure.

Keppel DC REIT (SGX: AJBU) is a resilient gem in the data center space.

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)