- Canada

- /

- Metals and Mining

- /

- TSXV:ASE

A Look at Asante Gold’s (TSXV:ASE) Valuation Following Strong High-Grade Drill Results and Resource Growth Updates

Reviewed by Kshitija Bhandaru

Asante Gold (TSXV:ASE) just shared a detailed exploration update, highlighting new high-grade gold intercepts at its Bibiani and Chirano mines. Drilling has boosted confidence in expanding resources and extending the mine life for both assets.

See our latest analysis for Asante Gold.

Shares of Asante Gold have been on a tear, with a year-to-date share price return of 133.65% and a 57.79% jump over the past month as investors react to exploration progress and upbeat resource updates. The company’s three-year total shareholder return of 102.5% and five-year total return of 2,457.9% make its long-term track record especially noteworthy. This suggests there is strong momentum building around future growth prospects.

If you're looking for more opportunities in dynamic resource sectors, now might be the perfect time to broaden your search and check out fast growing stocks with high insider ownership.

With shares soaring and high-grade results in hand, the big question remains: is Asante Gold still undervalued, or have investors already priced in these exploration gains and strong growth prospects?

Price-to-Sales of 2.6x: Is it justified?

Asante Gold’s shares last closed at CA$2.43 and currently trade at a price-to-sales (P/S) ratio of 2.6x. This multiple sits notably below direct peers, suggesting the market may be overlooking the company’s revenue outlook.

The price-to-sales ratio reflects how much investors are willing to pay for each dollar of revenue generated. For metals and mining companies like Asante Gold, strong production, resource growth, or bullish commodity cycles can quickly shift this multiple.

At 2.6x, Asante Gold stands out as a strong value play compared to the wider industry’s average of 5.8x. This steep discount indicates investors could be underestimating project upside, or perhaps factoring in downside risks or recent unprofitability more heavily. If market perceptions shift, there is clear room for this valuation to rerate towards the peer level.

See what the numbers say about this price — find out in our valuation breakdown.

Result: Price-to-Sales of 2.6x (UNDERVALUED)

However, persistent net losses and uncertain revenue growth trends remain risks. These factors could weigh on sentiment if operational improvements do not materialize soon.

Find out about the key risks to this Asante Gold narrative.

Another View: Discounted Cash Flow Tells a Different Story

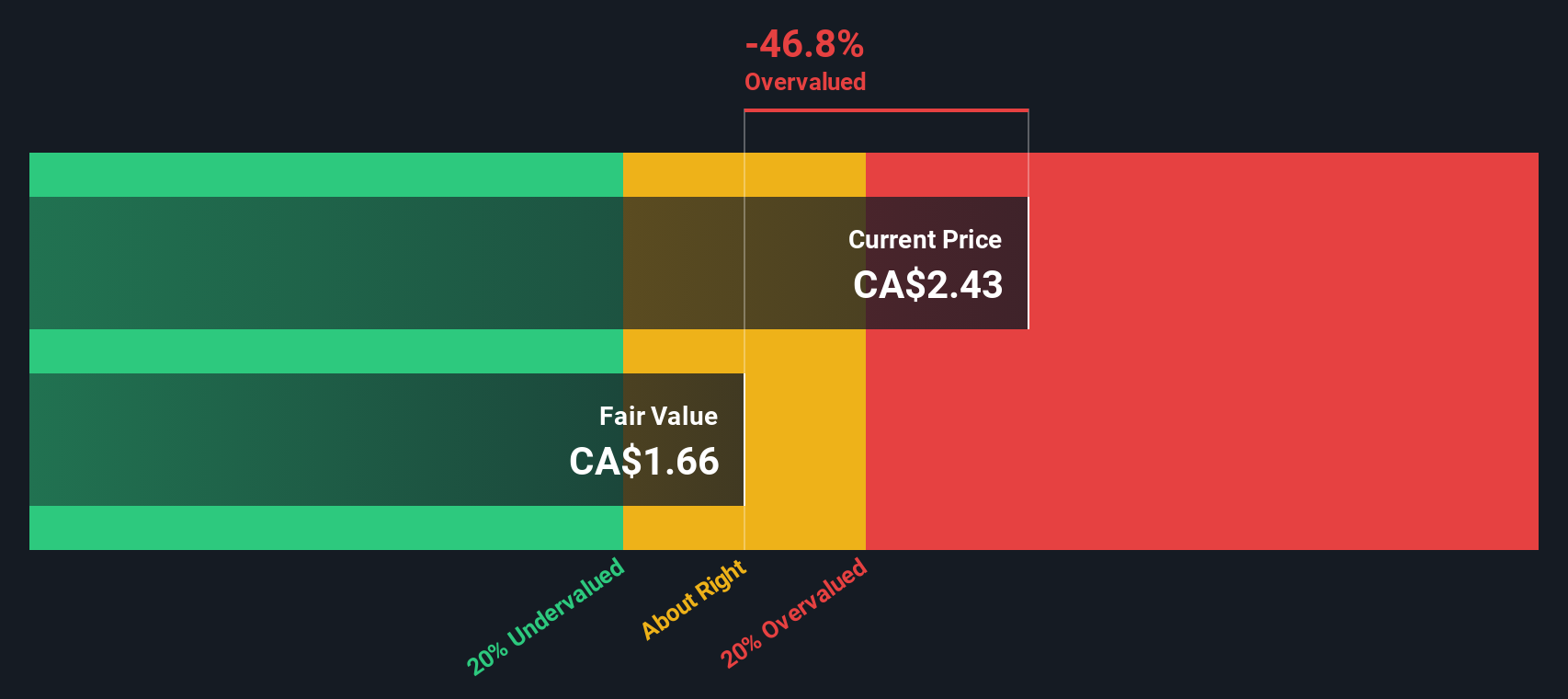

While the price-to-sales ratio suggests Asante Gold is undervalued compared to peers, the SWS DCF model offers a more cautious outlook. According to our DCF analysis, the shares trade above their estimated fair value. Could the market have already priced in future optimism, or is something getting overlooked?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Asante Gold for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Asante Gold Narrative

If you see things differently or want to dive deeper into the numbers yourself, you can quickly develop your own perspective using our tools. Do it your way.

A great starting point for your Asante Gold research is our analysis highlighting 3 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Smart investors always widen their search. Don’t let great opportunities slip by when there are other high-potential stocks just waiting to be found using our tailored screeners.

- Tap into fast-moving trends by scanning companies positioned for strong upside with these 893 undervalued stocks based on cash flows and uncover overlooked bargains with robust fundamentals.

- Maximize your income with picks offering yields above 3% using these 18 dividend stocks with yields > 3% to reveal consistent dividend performers with healthy balance sheets.

- Ride the next wave of financial innovation by checking out these 79 cryptocurrency and blockchain stocks featuring companies driving change in cryptocurrency infrastructure and blockchain solutions.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSXV:ASE

Asante Gold

A mineral exploration and gold production company, primarily involved in the assessment, acquisition, development, and operation of mines in the Republic of Ghana.

Low risk and slightly overvalued.

Market Insights

Community Narratives