- Canada

- /

- Metals and Mining

- /

- TSXV:ASE

A Look at Asante Gold’s (TSXV:ASE) Valuation Following Bibiani Mine Sulphide Plant Launch

Reviewed by Kshitija Bhandaru

Asante Gold (TSXV:ASE) just shared a comprehensive update on its Bibiani Mine sulphide plant in Ghana. Construction and commissioning are complete, and the facility has officially started processing ore. A ramp-up is now underway.

See our latest analysis for Asante Gold.

After a long stretch of steady action, Asante Gold’s latest update on the Bibiani Mine sulphide plant has renewed attention on the stock. Shares have gained momentum with a 1.2% year-to-date share price return, while the five-year total shareholder return of nearly 25% reflects the greater upside seen by long-term investors.

If this kind of operational progress has you keeping an eye out for market standouts, now could be the perfect moment to discover fast growing stocks with high insider ownership

But with shares up only modestly year-to-date and a major operational milestone now in the rearview, is Asante Gold still undervalued or is the market already factoring in the company’s anticipated growth? Could this be a buying opportunity or is future potential already priced in?

Price-to-Sales of 2.5x: Is it justified?

At the most recent close of CA$2.32, Asante Gold is trading at a price-to-sales ratio of 2.5x. This signals the market is assigning a lower valuation to its revenues compared to both the industry and peer averages.

The price-to-sales (P/S) ratio measures how much investors are willing to pay for each dollar of revenue generated by the company. In the metals and mining sector, this metric is often used when companies are unprofitable or experiencing earnings volatility, as it better reflects underlying business activity.

With Asante Gold’s P/S ratio of 2.5x sitting well below the Canadian metals and mining industry average of 5.6x and the peer average of 6x, the market seems to be discounting the company’s top-line performance. This suggests investors are cautious despite the company’s production progress, possibly reflecting ongoing losses or financial headwinds. Should sentiment improve or profitability materialize, there could be a re-rating toward higher sector multiples.

See what the numbers say about this price — find out in our valuation breakdown.

Result: Price-to-Sales of 2.5x (UNDERVALUED)

However, persistent net losses and ongoing revenue uncertainty could stall the market’s enthusiasm if operational progress does not soon translate into stronger financial results.

Find out about the key risks to this Asante Gold narrative.

Another View: Discounted Cash Flow Perspective

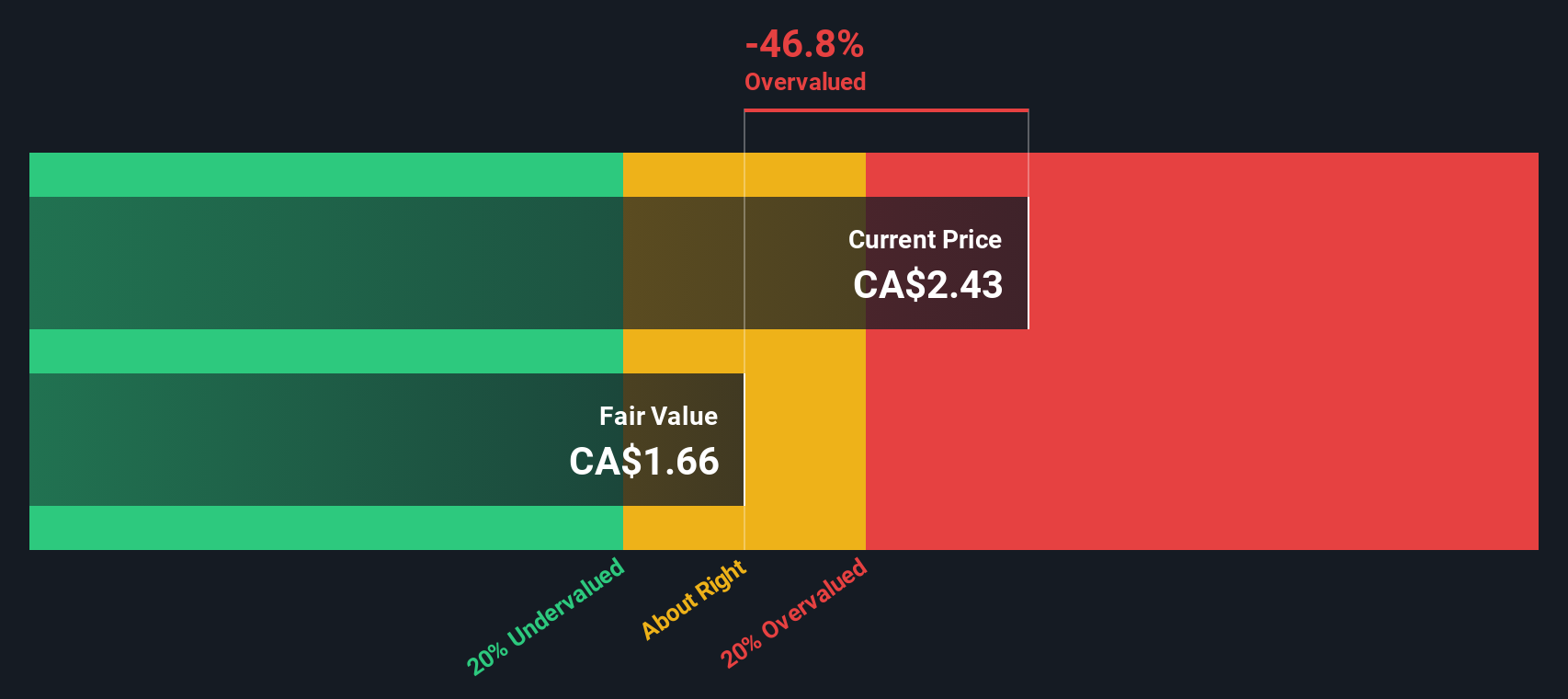

While the price-to-sales ratio hints at a bargain, our DCF model presents a different picture. According to the SWS DCF model, Asante Gold’s current share price of CA$2.32 sits above its estimated fair value of CA$1.67. This suggests the stock might be overvalued when future cash flow projections are considered. Should investors trust the apparent valuation gap, or is caution the wiser move?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Asante Gold for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Asante Gold Narrative

If you’d rather dive into the numbers yourself or think there’s another angle to the story, you can easily build a personalized outlook in just a few minutes as well. Do it your way

A great starting point for your Asante Gold research is our analysis highlighting 3 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Why limit your options? Supercharge your watchlist by hunting for undervalued gems, capturing AI breakthroughs, or lining up steady dividends using the SWS screener tools.

- Unlock unique value by targeting these 896 undervalued stocks based on cash flows, which could be trading below their intrinsic worth and could be ready for growth.

- Spot the pioneers by catching these 24 AI penny stocks, set to shape tomorrow’s technology with bold innovation and smarter automation.

- Boost your potential passive income by selecting these 19 dividend stocks with yields > 3%, offering robust yields and a track record of shareholder rewards.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSXV:ASE

Asante Gold

A mineral exploration and gold production company, primarily involved in the assessment, acquisition, development, and operation of mines in the Republic of Ghana.

Low risk and slightly overvalued.

Market Insights

Community Narratives