- Canada

- /

- Metals and Mining

- /

- TSX:IMG

TSX Stocks Estimated Below Fair Value For October 2025

Reviewed by Simply Wall St

As the Canadian market navigates uncertainties surrounding trade, a U.S. government shutdown, and emerging credit concerns, it remains resilient with no signs of a deep bear market on the horizon. Investors are encouraged to use any market volatility as an opportunity to rebalance, diversify, or add quality investments at better prices. In this context, identifying undervalued stocks can be particularly beneficial for those looking to capitalize on potential corrections while aligning with strategic allocations.

Top 10 Undervalued Stocks Based On Cash Flows In Canada

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Vitalhub (TSX:VHI) | CA$10.24 | CA$18.85 | 45.7% |

| SSR Mining (TSX:SSRM) | CA$33.26 | CA$56.32 | 40.9% |

| Savaria (TSX:SIS) | CA$21.39 | CA$40.97 | 47.8% |

| Magellan Aerospace (TSX:MAL) | CA$16.08 | CA$28.02 | 42.6% |

| IAMGOLD (TSX:IMG) | CA$18.76 | CA$34.70 | 45.9% |

| GURU Organic Energy (TSX:GURU) | CA$5.08 | CA$8.97 | 43.3% |

| Boyd Group Services (TSX:BYD) | CA$209.51 | CA$359.05 | 41.6% |

| Bird Construction (TSX:BDT) | CA$29.25 | CA$56.71 | 48.4% |

| Artemis Gold (TSXV:ARTG) | CA$37.55 | CA$64.28 | 41.6% |

| Aritzia (TSX:ATZ) | CA$89.76 | CA$159.87 | 43.9% |

Let's uncover some gems from our specialized screener.

Aritzia (TSX:ATZ)

Overview: Aritzia Inc., along with its subsidiaries, designs, develops, and sells apparel and accessories for women in the United States and Canada, with a market cap of approximately CA$10.35 billion.

Operations: The company generates revenue primarily from its apparel segment, amounting to CA$3.10 billion.

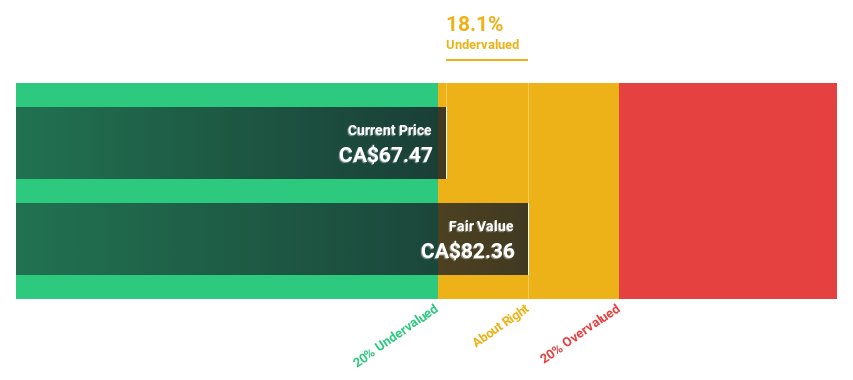

Estimated Discount To Fair Value: 43.9%

Aritzia's recent earnings report highlights robust financial performance, with net income surging to CA$66.3 million in Q2 2025 from CA$18.25 million a year ago, and revenue growing significantly. The company has raised its 2026 revenue forecast to CA$3.3 billion to CA$3.35 billion due to strong momentum in North America. Despite insider selling, Aritzia is trading at a substantial discount of over 40% below its estimated fair value based on discounted cash flow analysis, indicating potential undervaluation.

- Our comprehensive growth report raises the possibility that Aritzia is poised for substantial financial growth.

- Click here and access our complete balance sheet health report to understand the dynamics of Aritzia.

IAMGOLD (TSX:IMG)

Overview: IAMGOLD Corporation is a gold producer and developer operating in Canada and Burkina Faso, with a market cap of CA$10.79 billion.

Operations: The company's revenue segments include $632.70 million from the Côté Gold Project, $345.90 million from Canadian gold mines, and $1.09 billion from Burkina Faso gold mines.

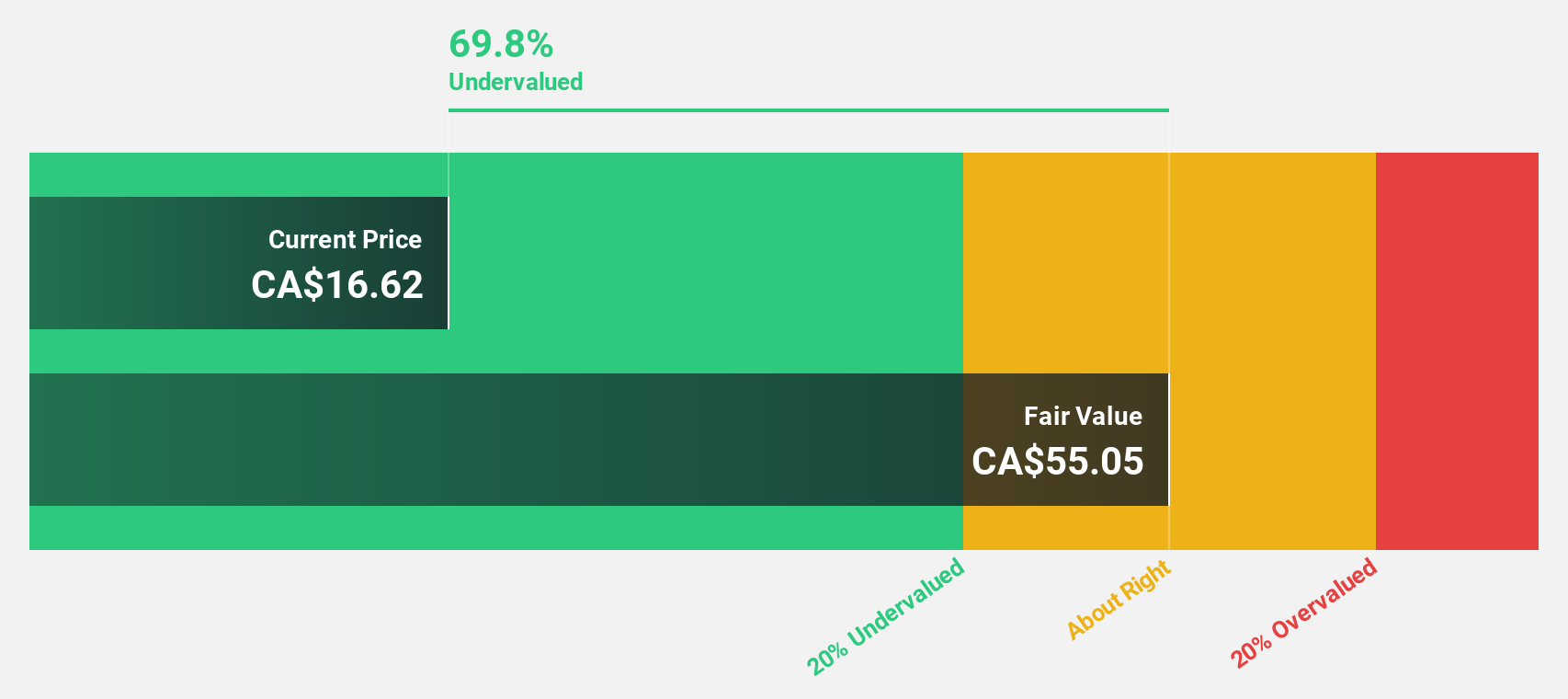

Estimated Discount To Fair Value: 45.9%

IAMGOLD is trading at CA$18.76, significantly below its estimated fair value of CA$34.7, highlighting potential undervaluation based on cash flows. With earnings projected to grow substantially over the next three years and revenue expected to outpace the Canadian market significantly, IAMGOLD shows strong growth prospects. Recent drilling results at Nelligan and Monster Lake confirm mineralized zone extensions, potentially enhancing future resource estimates and supporting long-term value creation in its exploration projects.

- Our growth report here indicates IAMGOLD may be poised for an improving outlook.

- Click here to discover the nuances of IAMGOLD with our detailed financial health report.

Artemis Gold (TSXV:ARTG)

Overview: Artemis Gold Inc. is engaged in the identification, acquisition, and development of gold properties, with a market cap of CA$8.67 billion.

Operations: Artemis Gold Inc. does not currently report any revenue segments in its financial disclosures.

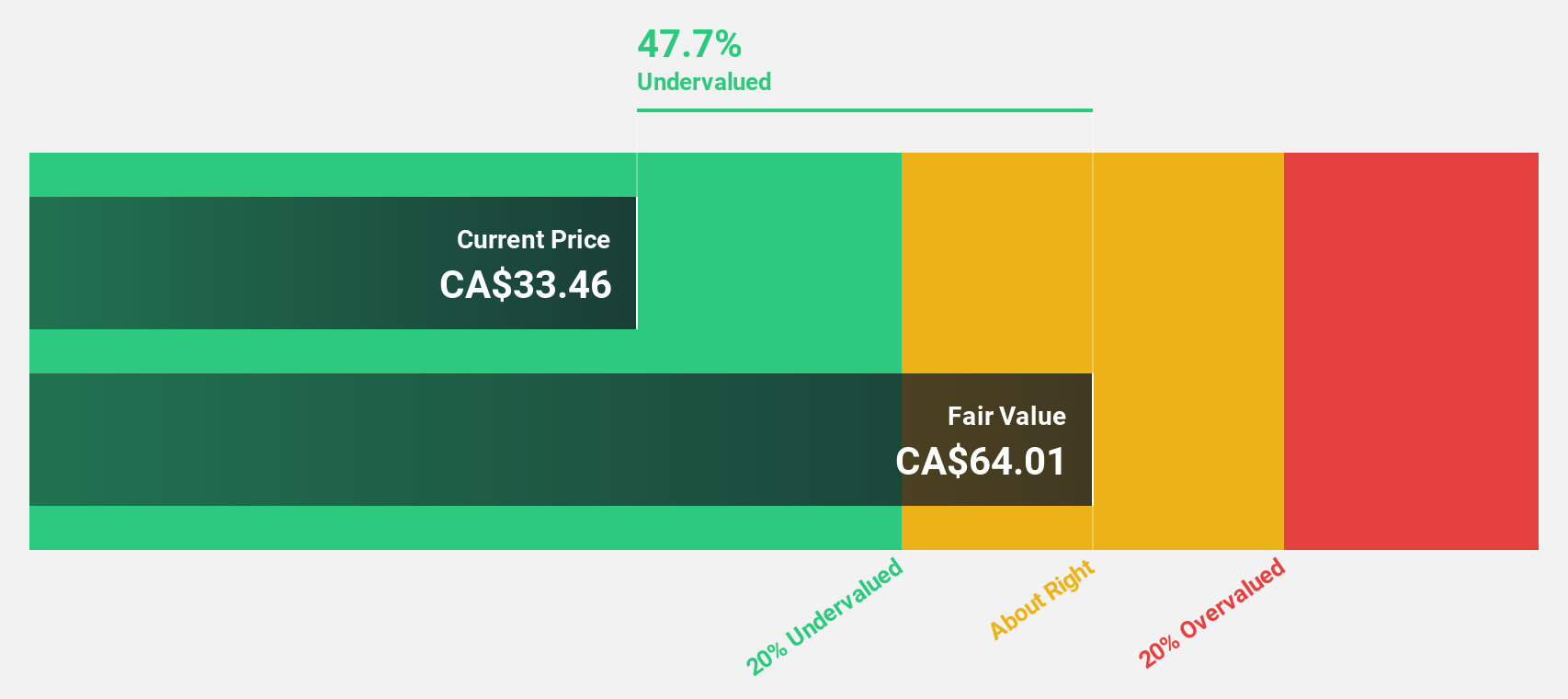

Estimated Discount To Fair Value: 41.6%

Artemis Gold, trading at CA$37.55, is significantly undervalued compared to its fair value of CA$64.28 based on cash flows. Despite high debt levels and substantial insider selling recently, earnings are forecasted to grow substantially over the next three years, with revenue growth expected to outpace the Canadian market significantly. Recent executive appointments and production results from Blackwater Mine underscore strategic improvements and operational efficiency that could support future growth potential.

- Insights from our recent growth report point to a promising forecast for Artemis Gold's business outlook.

- Navigate through the intricacies of Artemis Gold with our comprehensive financial health report here.

Key Takeaways

- Click this link to deep-dive into the 25 companies within our Undervalued TSX Stocks Based On Cash Flows screener.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:IMG

IAMGOLD

Through its subsidiaries, operates as a gold producer and developer in Canada and Burkina Faso.

Good value with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Engineered for Stability. Positioned for Growth.

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026