- Canada

- /

- Metals and Mining

- /

- TSXV:ARTG

Artemis Gold (TSXV:ARTG) Is Up 6.9% After Securing US$700M Credit Facility for Blackwater Expansion

Reviewed by Sasha Jovanovic

- Artemis Gold Inc. recently closed a US$700 million Revolving Credit Facility, using about US$450 million to repay its project loan and significantly increasing its balance sheet liquidity.

- This financial move was endorsed by leading lenders and positions Artemis Gold to pursue its 33% expansion at the Blackwater Mine.

- Next, we'll examine how this expanded access to capital shapes the company's growth prospects and overall investment narrative.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

What Is Artemis Gold's Investment Narrative?

Anyone considering Artemis Gold right now is essentially betting on the company’s ability to translate increased liquidity and financial flexibility into successful growth, particularly at the Blackwater Mine. The closing of the US$700 million revolving credit facility is a major shift, retiring the previous project loan and clearing the path for the 33% capacity expansion. This new capital access sharpens Artemis’ position to act on near-term production catalysts and pursue its stated growth guidance, all while reinforcing confidence from leading lenders. Risks haven’t disappeared, though. With a relatively high debt load and a lofty price-to-earnings ratio compared to industry peers, execution of the expansion project and actual cash flow delivery remain key watch items for the coming quarters. Positive price moves since the news suggest optimism, but high expectations put pressure on management to deliver.

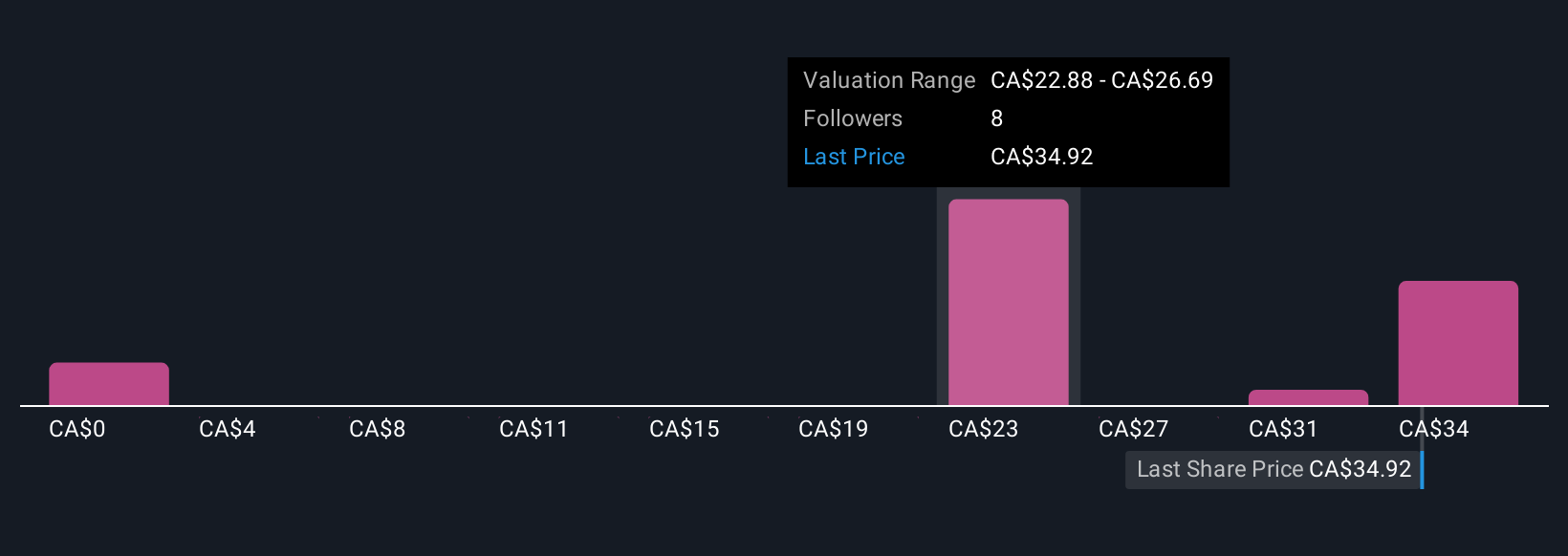

But with such rapid growth, execution risk looms larger than ever for Artemis Gold. Artemis Gold's shares are on the way up, but they could be overextended by 21%. Uncover the fair value now.Exploring Other Perspectives

Explore 6 other fair value estimates on Artemis Gold - why the stock might be worth as much as CA$37.21!

Build Your Own Artemis Gold Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Artemis Gold research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

- Our free Artemis Gold research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Artemis Gold's overall financial health at a glance.

Curious About Other Options?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 32 best rare earth metal stocks of the very few that mine this essential strategic resource.

- Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSXV:ARTG

Artemis Gold

Focuses on the identification, acquisition, and development of gold properties.

Exceptional growth potential with low risk.

Market Insights

Community Narratives