- Canada

- /

- Capital Markets

- /

- TSX:SII

Undiscovered Gems in Canada to Explore This March 2025

Reviewed by Simply Wall St

As the Canadian market navigates a period of sideways consolidation, with no immediate signs of an economic downturn or central bank rate hikes, investors are increasingly focusing on diversification to mitigate potential volatility. In this evolving landscape, identifying promising small-cap stocks can be key to fortifying portfolios against uncertainty; such stocks often offer unique growth opportunities that align well with the current shift toward cyclical and value-style investments.

Top 10 Undiscovered Gems With Strong Fundamentals In Canada

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| TWC Enterprises | 6.24% | 12.63% | 23.89% | ★★★★★★ |

| Minsud Resources | NA | nan | -29.01% | ★★★★★★ |

| Maxim Power | 25.01% | 12.79% | 17.14% | ★★★★★☆ |

| Mako Mining | 10.21% | 38.44% | 58.78% | ★★★★★☆ |

| Grown Rogue International | 24.92% | 19.37% | 188.55% | ★★★★★☆ |

| Corby Spirit and Wine | 59.18% | 8.79% | -5.67% | ★★★★☆☆ |

| Petrus Resources | 19.44% | 17.20% | 46.03% | ★★★★☆☆ |

| Queen's Road Capital Investment | 8.87% | 13.76% | 16.18% | ★★★★☆☆ |

| Genesis Land Development | 47.40% | 28.61% | 52.30% | ★★★★☆☆ |

| Dundee | 3.76% | -37.57% | 44.64% | ★★★★☆☆ |

Let's explore several standout options from the results in the screener.

Headwater Exploration (TSX:HWX)

Simply Wall St Value Rating: ★★★★★★

Overview: Headwater Exploration Inc. is a Canadian company focused on the exploration, development, and production of petroleum and natural gas with a market capitalization of CA$1.42 billion.

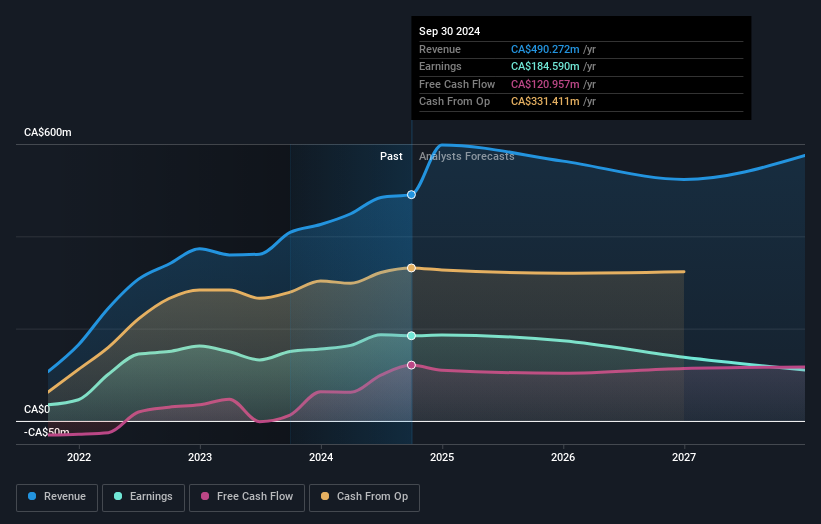

Operations: Headwater generates revenue primarily from the exploration, development, and production of petroleum and natural gas, amounting to CA$490.27 million. The company's financial performance can be assessed through its profit margins over time.

Headwater Exploration, a nimble player in the oil and gas sector, stands out with its debt-free status over the past five years and impressive earnings growth of 22.7% last year, surpassing the industry's -25.6%. Trading at 45.4% below fair value estimates, it offers potential upside for investors seeking undervalued opportunities. Recent expansions include a partnership with Bigstone Cree Nation to drill four commitment wells, enhancing its land holdings in promising areas like Greater Pelican and Peavine. With fourth-quarter production hitting 21,500 BOE/d and plans to spend C$25 million on exploration this year, Headwater is actively pursuing growth avenues while increasing dividends by 10%.

- Take a closer look at Headwater Exploration's potential here in our health report.

Explore historical data to track Headwater Exploration's performance over time in our Past section.

Sprott (TSX:SII)

Simply Wall St Value Rating: ★★★★★★

Overview: Sprott Inc. is a publicly owned asset management holding company with a market cap of CA$1.54 billion.

Operations: Sprott generates revenue primarily from Managed Equities, Private Strategies, and Exchange Listed Products, with the latter contributing $112.50 million. The company does not report revenue from its Corporate segment.

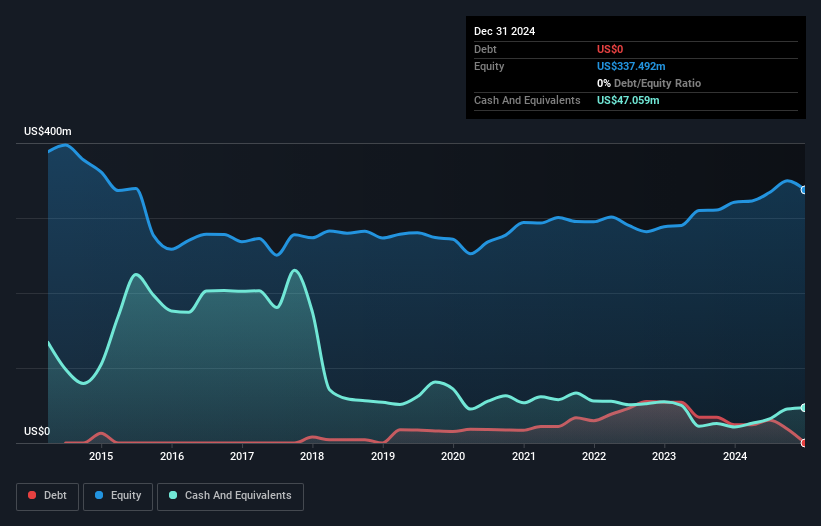

Sprott, a nimble player in the financial sector, has demonstrated robust earnings growth of 17.9% over the past year, outpacing its industry peers. With no debt on its books now compared to a debt-to-equity ratio of 5.6% five years ago, Sprott's financial health appears solid. Recent earnings reports highlight an increase in net income to US$49.29 million for 2024 from US$41.8 million the previous year, alongside basic earnings per share rising to US$1.94 from US$1.66. The launch of their first actively managed ETF focused on gold and silver miners underscores their strategic expansion into precious metals investments.

- Navigate through the intricacies of Sprott with our comprehensive health report here.

Gain insights into Sprott's past trends and performance with our Past report.

Alphamin Resources (TSXV:AFM)

Simply Wall St Value Rating: ★★★★★★

Overview: Alphamin Resources Corp., along with its subsidiaries, focuses on the production and sale of tin concentrates, with a market cap of CA$895.10 million.

Operations: Alphamin generates revenue primarily from the production and sale of tin concentrates, reporting $436.73 million in revenue from its Bisie Tin Mine. The company's net profit margin is 25%, reflecting its profitability in the tin market.

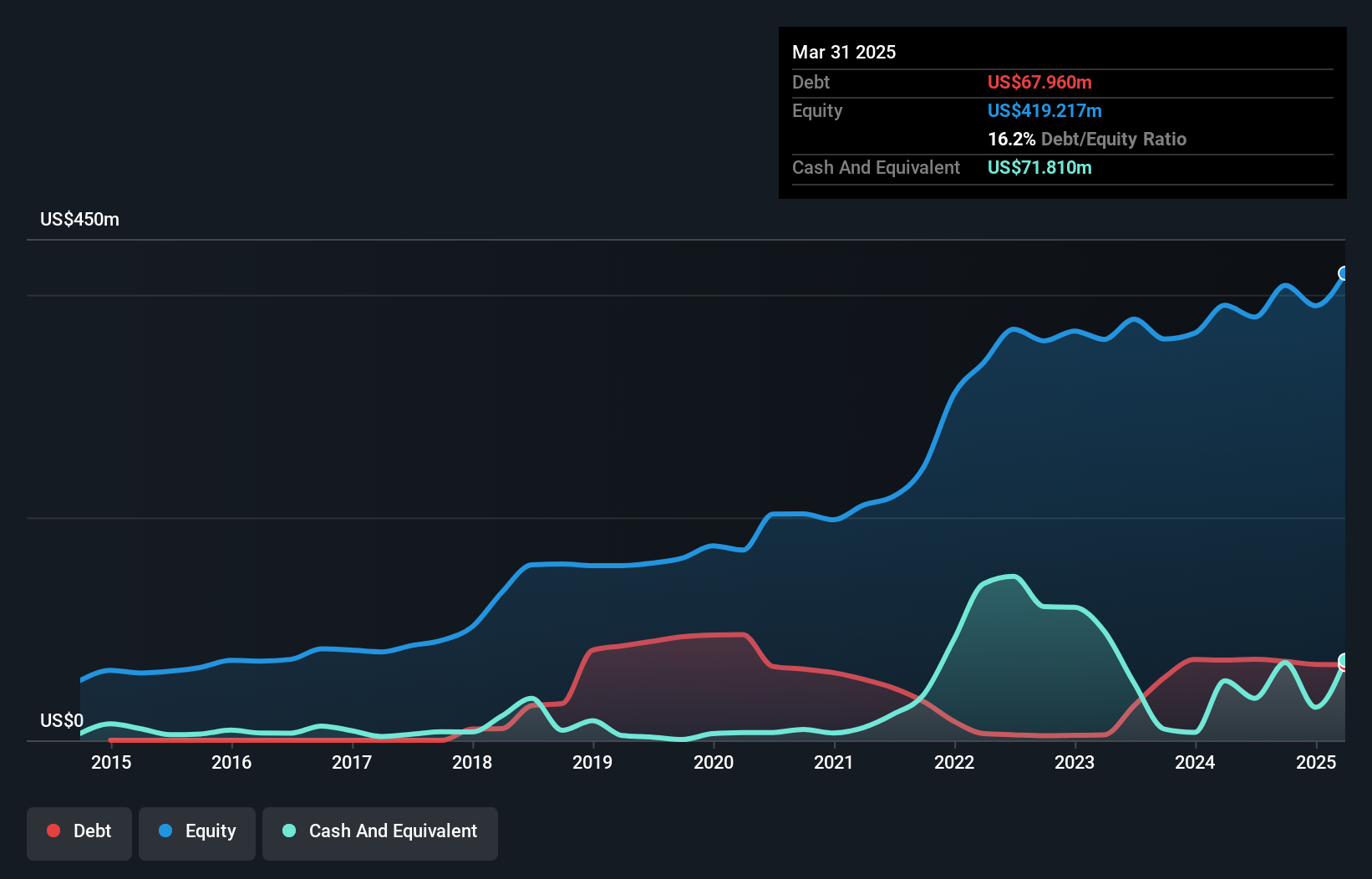

Alphamin Resources, a notable player in the mining sector, has seen its debt to equity ratio improve significantly from 56.8% to 17.3% over five years, reflecting prudent financial management. Earnings have surged by 39% annually during this period, showcasing robust growth potential. The company offers good value with a price-to-earnings ratio of 8.5x compared to the Canadian market's average of 14.7x. Recent production results highlight an increase in ore processed to 738,067 tonnes and contained tin produced reaching 17,324 tonnes for the year ending December 2024, up from previous figures of 400,691 tonnes and 12,568 tonnes respectively.

- Delve into the full analysis health report here for a deeper understanding of Alphamin Resources.

Examine Alphamin Resources' past performance report to understand how it has performed in the past.

Next Steps

- Click through to start exploring the rest of the 43 TSX Undiscovered Gems With Strong Fundamentals now.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:SII

Flawless balance sheet average dividend payer.