- Canada

- /

- Metals and Mining

- /

- TSX:MND

Exploring Canadian Small Caps With Promising Potential

Reviewed by Simply Wall St

As the Canadian market navigates a landscape shaped by easing trade tensions and a more accommodative monetary policy from the Bank of Canada, small-cap stocks are poised to potentially benefit from reduced borrowing costs and improved economic sentiment. In this environment, identifying promising small-cap companies involves looking for those with strong fundamentals and growth potential that can capitalize on these favorable conditions.

Top 10 Undiscovered Gems With Strong Fundamentals In Canada

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| TWC Enterprises | 4.98% | 13.46% | 16.87% | ★★★★★★ |

| Majestic Gold | NA | 11.96% | 12.21% | ★★★★★★ |

| Pinetree Capital | 0.20% | 63.68% | 65.79% | ★★★★★★ |

| Itafos | 25.35% | 11.11% | 49.69% | ★★★★★★ |

| Reconnaissance Energy Africa | NA | 9.16% | 15.11% | ★★★★★★ |

| Mako Mining | 8.59% | 38.81% | 59.80% | ★★★★★☆ |

| Corby Spirit and Wine | 59.18% | 8.79% | -5.67% | ★★★★☆☆ |

| Genesis Land Development | 48.16% | 31.08% | 55.45% | ★★★★☆☆ |

| Senvest Capital | 81.59% | -11.73% | -12.63% | ★★★★☆☆ |

| Dundee | 3.91% | -36.42% | 49.66% | ★★★★☆☆ |

Underneath we present a selection of stocks filtered out by our screen.

GDI Integrated Facility Services (TSX:GDI)

Simply Wall St Value Rating: ★★★★☆☆

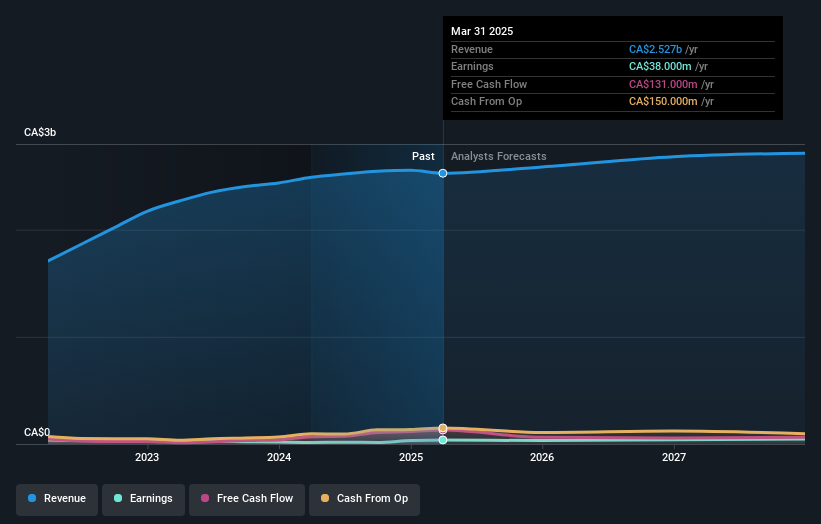

Overview: GDI Integrated Facility Services Inc., along with its subsidiaries, operates in the outsourced facility services industry across Canada and the United States, with a market cap of CA$770.07 million.

Operations: GDI generates revenue through its facility services operations within Canada and the United States. The company's cost structure includes expenses related to service delivery, labor, and materials. Its financial performance is influenced by these operational costs and market conditions in the facility services sector.

GDI Integrated Facility Services, a nimble player in the facility management sector, has shown impressive earnings growth of 153.3% over the past year, outpacing its industry peers. Despite interest payments being only 1.5 times covered by EBIT, GDI is reducing its debt-to-equity ratio from 85.3% to 75.9% over five years and maintaining positive free cash flow at CA$131 million as of March 2025. The company recently announced a buyback program for up to 450,000 shares to boost shareholder value while focusing on higher-margin accounts and new client acquisitions to counteract revenue volatility and enhance profitability prospects.

Mandalay Resources (TSX:MND)

Simply Wall St Value Rating: ★★★★★★

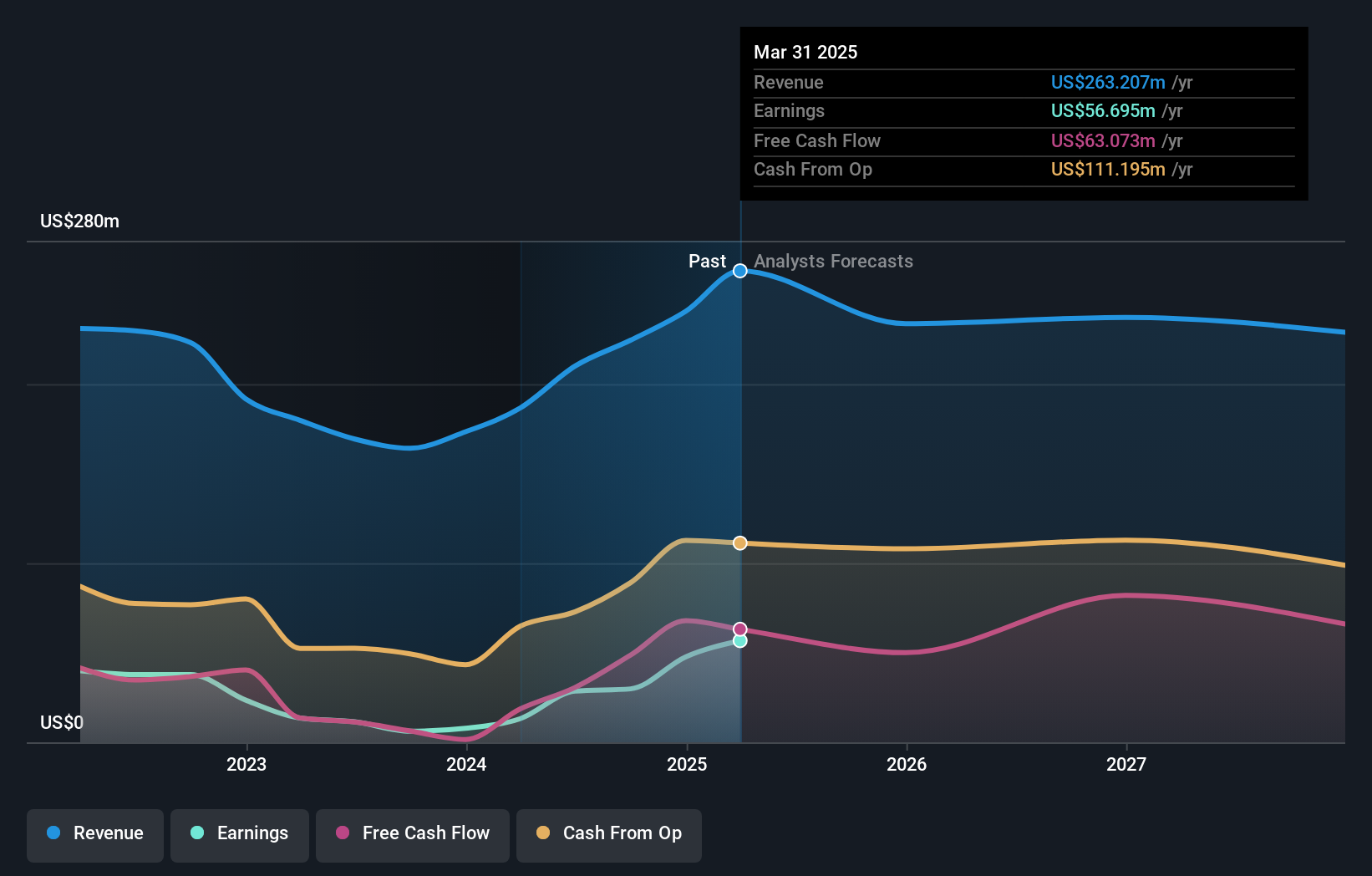

Overview: Mandalay Resources Corporation, along with its subsidiaries, is involved in the acquisition, exploration, extraction, processing, and reclamation of mineral properties across Australia, Sweden, Chile, and Canada with a market cap of CA$489.41 million.

Operations: Mandalay Resources generates revenue primarily through its mining operations across various countries. The company focuses on the acquisition, exploration, and processing of mineral properties.

Mandalay Resources, a nimble player in the mining sector, reported impressive Q1 2025 earnings with net income jumping to US$14.82 million from US$5.89 million a year prior, and sales reaching US$78.06 million compared to US$55.51 million previously. The company is trading at 71% below its estimated fair value and has reduced its debt-to-equity ratio significantly over five years from 75% to just 2.6%. A merger with Alkane Resources could enhance strategic positioning, although significant insider selling recently raises questions about internal confidence in future prospects despite strong past performance indicators like high-quality earnings growth of over 329%.

Winpak (TSX:WPK)

Simply Wall St Value Rating: ★★★★★★

Overview: Winpak Ltd. is a company that manufactures and distributes packaging materials and related packaging machines across the United States, Canada, and Mexico, with a market capitalization of CA$2.65 billion.

Operations: Winpak generates revenue primarily from three segments: Flexible Packaging ($604.10 million), Rigid Packaging and Flexible Lidding ($499.86 million), and Packaging Machinery ($34.96 million).

Winpak, a notable player in the packaging sector, showcases a robust financial profile with no debt for the past five years and trades at 15.3% below estimated fair value. Despite earnings growth of 8.8% annually over five years, last year's performance lagged behind the industry's impressive 54.4%. The company remains free cash flow positive with a recent quarterly sales increase to US$284.8 million from US$276.78 million year-over-year, while net income slightly dipped to US$34.58 million from US$35.52 million previously reported. A share repurchase program aims to buy back up to 5% of outstanding shares by March 2026, indicating confidence in its valuation and future prospects.

Key Takeaways

- Click here to access our complete index of 43 TSX Undiscovered Gems With Strong Fundamentals.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade Mandalay Resources, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:MND

Mandalay Resources

Engages in the acquisition, exploration, extraction, processing, and reclamation of mineral properties in Australia, Sweden, Chile, and Canada.

Outstanding track record with flawless balance sheet.

Market Insights

Community Narratives