- Canada

- /

- Metals and Mining

- /

- TSX:WDO

High-Grade Drill Results at Eagle River Might Change The Case For Investing In Wesdome Gold Mines (TSX:WDO)

Reviewed by Simply Wall St

- Earlier in September 2025, Wesdome Gold Mines Ltd. announced high-grade gold intercepts and significant drill results from its exploration activities at the Eagle River Mine near Wawa, Ontario, highlighting multiple zones with resource expansion potential.

- These updates underscore ongoing efforts to extend high-grade zones and identify new mineralized structures, reflecting the company's focus on growing its resource base through targeted drilling and exploration.

- We'll explore how the recently confirmed high-grade extensions at Eagle River could influence Wesdome Gold Mines' long-term growth outlook and risk profile.

Find companies with promising cash flow potential yet trading below their fair value.

Wesdome Gold Mines Investment Narrative Recap

To be a Wesdome Gold Mines shareholder, you need to believe that aggressive exploration and high-grade drill results can turn into meaningful resource growth that translates into long-term production and cash flow gains. The latest high-grade intercepts at Eagle River strengthen confidence in its resource base, which supports the primary near-term catalyst: delivering on production targets. However, the most significant risk, reliance on consistent orebody performance and reserve conversion, remains, and this news only partially de-risks that concern.

Among recent updates, the company's September 2025 Eagle River exploration results stand out, with multiple high-grade discoveries in the Central, 300 Fold, and Falcon 720 Zones. These intercepts align with ongoing efforts to increase mine life and resource conversion, providing incremental validation for Wesdome’s production and growth ambitions amidst ongoing operational challenges elsewhere.

In contrast, investors should pay close attention to how ongoing labor constraints might...

Read the full narrative on Wesdome Gold Mines (it's free!)

Wesdome Gold Mines' outlook anticipates CA$986.3 million in revenue and CA$395.3 million in earnings by 2028. This scenario assumes annual revenue growth of 10.8% and an increase in earnings of CA$154.5 million from the current earnings of CA$240.8 million.

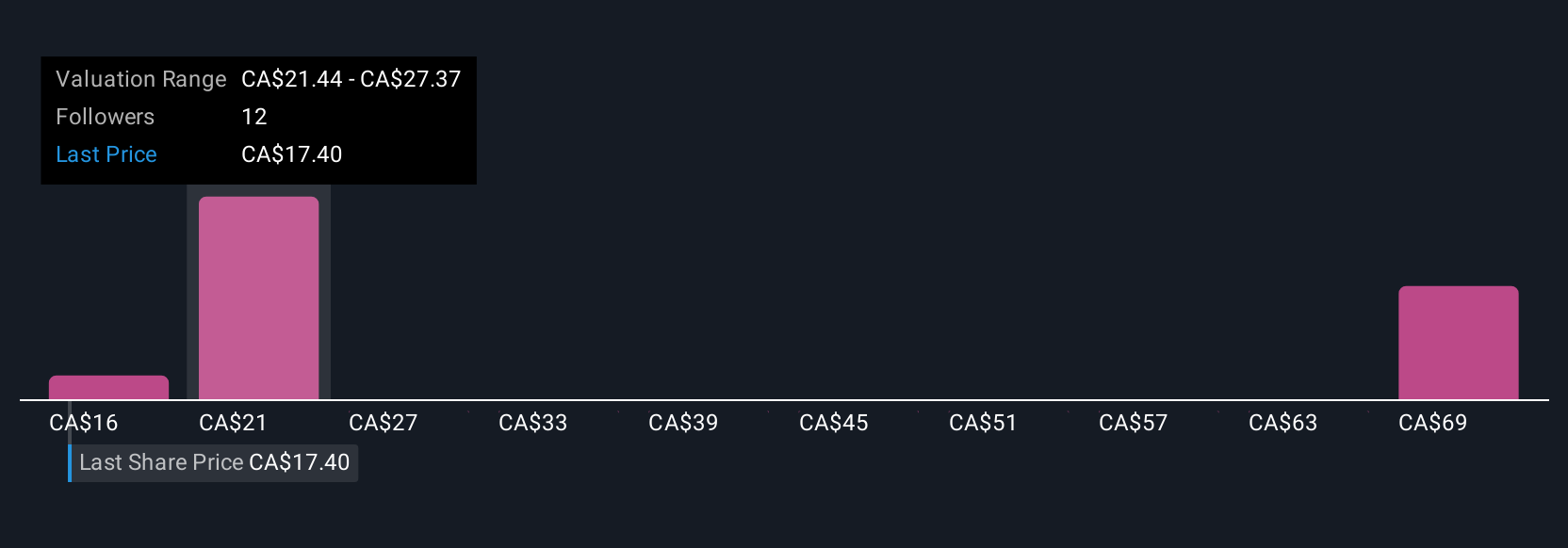

Uncover how Wesdome Gold Mines' forecasts yield a CA$22.53 fair value, a 22% upside to its current price.

Exploring Other Perspectives

Six fair value estimates from the Simply Wall St Community span from CA$15.50 to CA$75.84 per share. While some expect outsized resource gains, others are cautious given execution and reserve conversion risks that may affect future performance; explore these differing viewpoints for a fuller picture.

Explore 6 other fair value estimates on Wesdome Gold Mines - why the stock might be worth 16% less than the current price!

Build Your Own Wesdome Gold Mines Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Wesdome Gold Mines research is our analysis highlighting 5 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Wesdome Gold Mines research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Wesdome Gold Mines' overall financial health at a glance.

No Opportunity In Wesdome Gold Mines?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 28 best rare earth metal stocks of the very few that mine this essential strategic resource.

- This technology could replace computers: discover 24 stocks that are working to make quantum computing a reality.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Wesdome Gold Mines might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:WDO

Wesdome Gold Mines

Wesdome Gold Mines Ltd. mines, develops, and explores for gold and silver deposits in Canada.

Very undervalued with outstanding track record.

Similar Companies

Market Insights

Community Narratives