- Canada

- /

- Metals and Mining

- /

- TSX:USA

A Look at Americas Gold and Silver (TSX:USA) Valuation Following Idaho Antimony Plant Partnership and U.S. Supply Chain Ambitions

Reviewed by Kshitija Bhandaru

Americas Gold and Silver (TSX:USA) is making headlines after partnering with Lot Sixteen to work with the U.S. government on antimony production and a potential new processing plant in Idaho’s Silver Valley.

See our latest analysis for Americas Gold and Silver.

Momentum has accelerated for Americas Gold and Silver as talk of a new Idaho processing plant and critical mineral expansion helped fuel a 60.6% 30-day share price return, with year-to-date gains of 348.6% and a remarkable 1-year total shareholder return of 311.8%. Despite earlier volatility, the recent surge suggests investors are increasingly optimistic about the company’s strategic direction and future prospects.

If you’re inspired by moves in the mining sector, now is an ideal moment to broaden your search and discover fast growing stocks with high insider ownership

With such a rapid rebound in the share price, investors may be wondering whether Americas Gold and Silver is still undervalued or if expectations for future growth are already fully reflected in the current price.

Most Popular Narrative: 48.9% Undervalued

According to Agricola, the narrative’s fair value range sits far above the last close of CA$6.28, suggesting Americas Gold and Silver may be considerably undervalued by the market. Investors are watching the ambitious 2029 forecast and underlying production assumptions that drive such a bullish outlook.

“Cosalá Operations: EC120 project achieves commercial production by end of 2025, contributing significant silver and zinc output. San Rafael continues steady production.”

What’s the secret spark behind that sky-high price target? The forecast leans on major new volumes, high-multiple potential, and robust growth, qualities often reserved for market leaders. Only in the full narrative will you uncover which bold production numbers and margin assumptions back up this striking valuation.

Result: Fair Value of $12.29 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, setbacks such as production delays at Cosalá or weaker silver prices could quickly dampen the current bullish outlook for Americas Gold and Silver.

Find out about the key risks to this Americas Gold and Silver narrative.

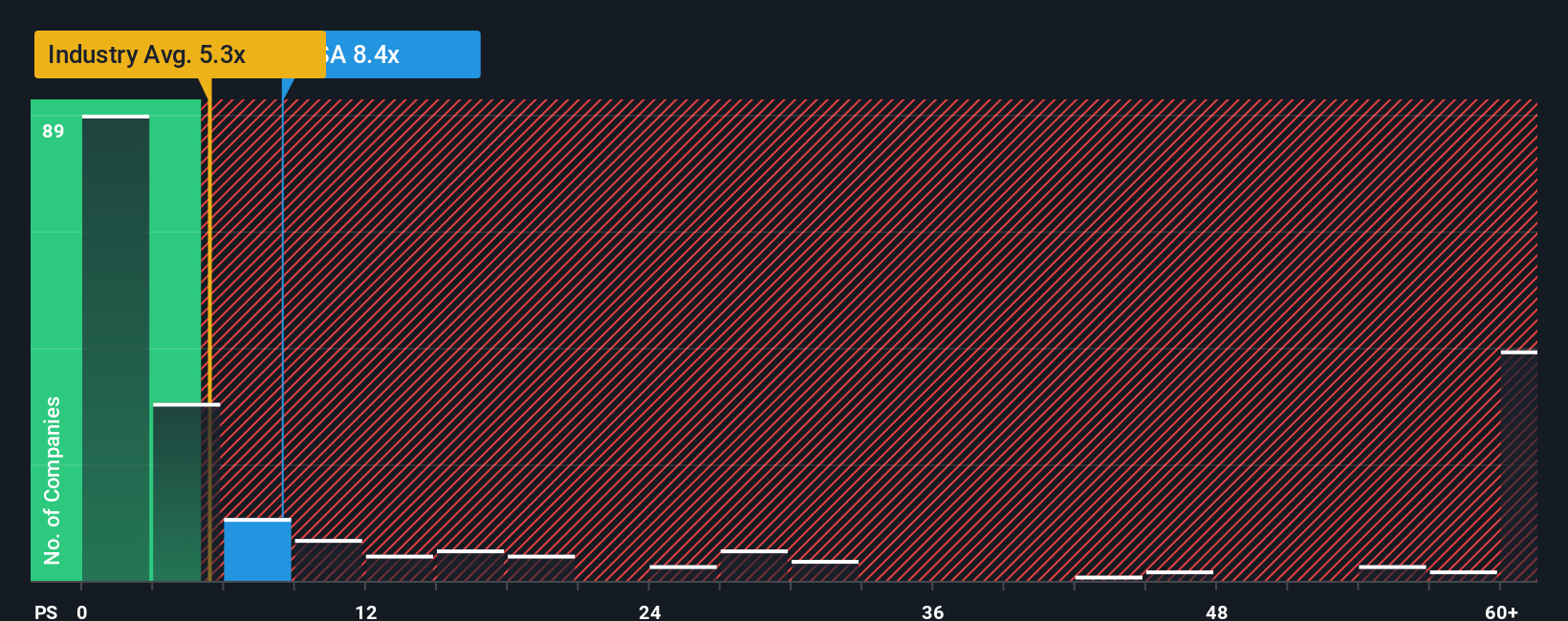

Another View: Multiples Show a Caution Flag

While the previous valuation suggests Americas Gold and Silver is deeply undervalued, looking at the price-to-sales ratio tells a more cautious story. At 12.6x, the stock is trading well above the Canadian Metals and Mining industry average of 5.8x and notably higher than its fair ratio of 3x. This suggests the market is already factoring in a significant growth premium, which increases the risk that shares could correct if results disappoint. Is optimism outpacing reality, or could long-term growth justify these high multiples?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Americas Gold and Silver Narrative

If you have a different perspective or want to examine the numbers firsthand, dive in and assemble your own story in just minutes using Do it your way.

A great starting point for your Americas Gold and Silver research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Don’t wait while others seize opportunities ahead of the market. These hidden sectors and powerful trends continue to evolve. Tap into our exclusive list of screeners designed to match your goals and keep you at the forefront of investing success.

- Unlock yield potential and boost your income by checking out these 18 dividend stocks with yields > 3% offering reliable returns above 3%.

- Ride the momentum in artificial intelligence innovations by selecting these 24 AI penny stocks poised to shake up tomorrow’s industries.

- Supercharge your search for true value with these 878 undervalued stocks based on cash flows, featuring companies the market hasn’t fully recognized yet.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:USA

Americas Gold and Silver

Engages in the exploration, development, and production of mineral properties in the Americas.

High growth potential with mediocre balance sheet.

Market Insights

Community Narratives