- Canada

- /

- Metals and Mining

- /

- TSX:TXG

Is Torex Gold a Growth Opportunity After Recent Exploration Success and Sharp Share Price Moves?

Reviewed by Bailey Pemberton

Thinking about what to do with Torex Gold Resources stock? You are far from alone. The company’s recent price action has been remarkable, and if you are trying to decide whether to hold, buy more, or finally take some profits, there is a lot to consider right now. Torex’s share price closed at 58.32, and while it did slide 14.6% over the past week, that dip sits against a backdrop of eye-catching long-term gains. Year-to-date, shares have increased 98.6%, and over the past three years, they are up an astonishing 467.9%.

This kind of volatility often tracks back to shifting perceptions of risk and growth potential. Over the past month, the stock has moved 1.2% higher, with performance driven in part by sector-wide optimism around gold prices and investor interest in Torex’s solid operational results. These recent moves have not been tied to any earnings release. Recent announcements about successful exploration projects and progress in expanding existing mines have reinforced Torex’s image as a growth story within the gold sector. While none of the latest news items have single-handedly moved the stock, they have contributed to a sense that Torex is building a more resilient business model for the long term.

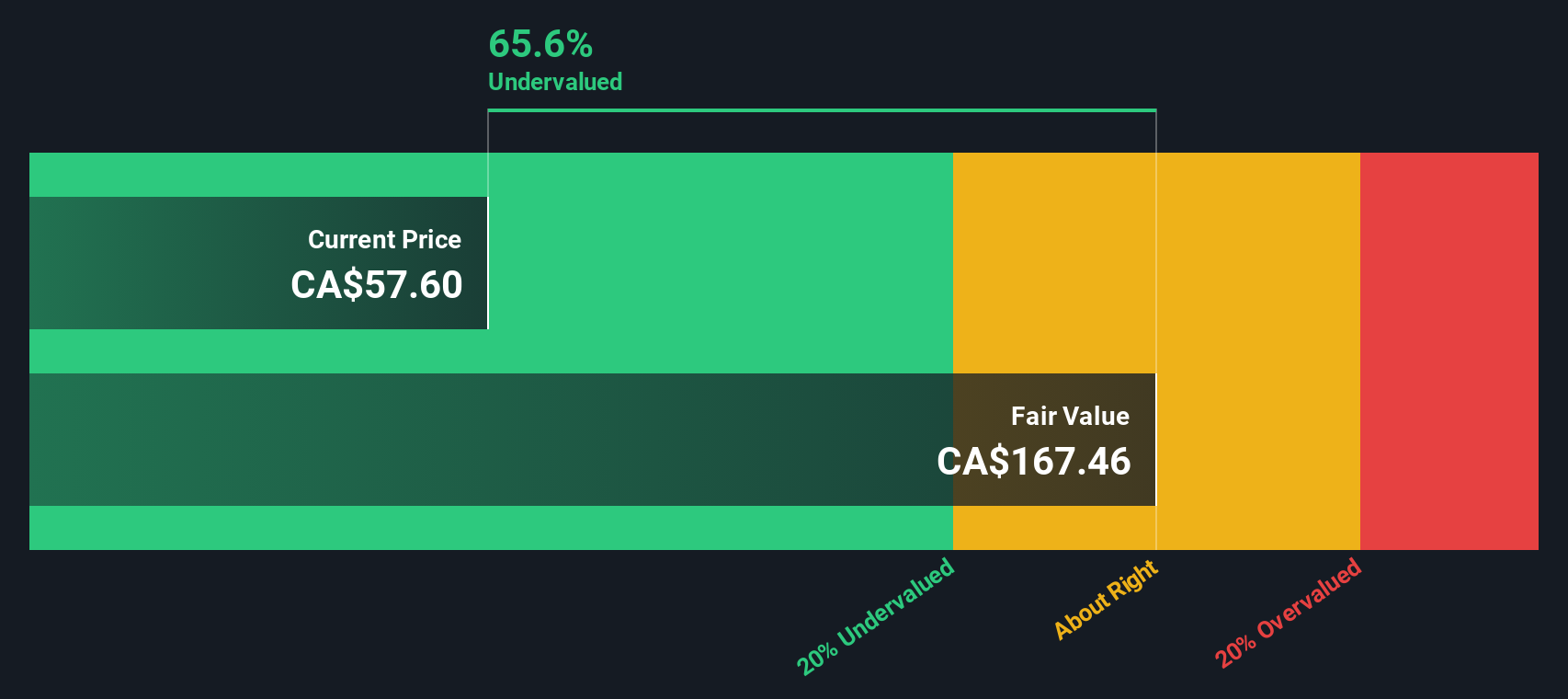

All this raises a crucial question: Is the current share price justified or overheated? To help answer that, we will look at Torex’s valuation through several tried-and-true metrics. The company currently has a value score of 5 out of 6, meaning it appears undervalued on nearly every important check. We will break down which valuation methods point toward opportunity and, even more importantly, reveal a smarter way to think about valuation that puts all the numbers in proper context.

Approach 1: Torex Gold Resources Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates the value of a company by forecasting its future cash flows and then discounting those amounts back to today, using a rate that reflects the risks involved. This method offers a way to look past temporary market moves and gets to the heart of what the business may be worth, based on its potential to generate cash.

Torex Gold Resources’ most recent reported Free Cash Flow (FCF) stands at a negative $187.2 Million. Analyst forecasts project rapidly improving cash flows in coming years, with FCF expected to reach $499.4 Million by 2029. While analyst estimates span several years, projections beyond that are extrapolated by Simply Wall St to give a long-term perspective. Over the next decade, discounted FCFs suggest a steadily rising cash generation profile as new projects come online and operational efficiencies take hold. All cash flow figures are presented in dollars, in line with Torex’s financial reporting.

The resulting DCF-based intrinsic value comes out to $171.21 per share, which is a substantial 65.9% above the current share price. This signals that, on a DCF basis, the stock is significantly undervalued when compared to where it trades today.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Torex Gold Resources is undervalued by 65.9%. Track this in your watchlist or portfolio, or discover more undervalued stocks.

Approach 2: Torex Gold Resources Price vs Earnings

The Price-to-Earnings (PE) ratio is one of the most widely used valuation metrics for profitable companies like Torex Gold Resources. It is useful because it shows how much investors are willing to pay per dollar of earnings, offering a simple way to gauge whether a stock is expensive or cheap relative to its profits. Generally, higher growth prospects or lower risks justify a higher PE ratio, while slower-growing or riskier companies tend to command lower multiples.

Currently, Torex trades at a PE ratio of 17x. To put this in perspective, the average PE ratio in the Metals and Mining industry is about 20.3x, which means Torex is valued at a discount relative to its sector peers. For comparison, the peer group average is -20.8x, which can sometimes be skewed by unprofitable companies in the group and is less instructive here.

To get a more tailored assessment, Simply Wall St calculates a “Fair Ratio” for each stock. This Fair Ratio, at 32.2x for Torex, reflects an optimal PE multiple based on the company’s growth outlook, risk profile, profit margins, industry characteristics, and market cap. Unlike simple peer or industry comparisons, the Fair Ratio method delivers a more nuanced view, capturing the factors that most affect future performance and risk for Torex specifically.

Comparing the actual PE ratio of 17x to the Fair Ratio of 32.2x highlights a sizable gap, strongly suggesting that Torex is undervalued on this metric when you consider its robust fundamentals and brighter prospects.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Torex Gold Resources Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let’s introduce you to Narratives. Narratives are an approach that combines what you believe about Torex Gold Resources’ story—its operations, potential, and risks—with your financial expectations, such as future revenue, margins, and fair value. In other words, a Narrative connects your personal perspective or outlook on the company to the hard numbers, so you can see how your beliefs translate into a target price.

On Simply Wall St’s platform, Narratives make this easy and accessible for everyone. Within the Community page, you will find millions of investors sharing their own Narratives, each one linking a unique view of Torex’s business to projections and a calculated fair value. Narratives help you decide if it is time to buy, hold, or sell by directly comparing Fair Value (what you think shares are worth) to today’s market price. As new information comes in, like news or earnings results, Narratives update automatically, ensuring your view stays relevant.

For example, one investor might see Torex’s fair value near CA$97, factoring in gold as a safe haven during market turmoil, while another may set it closer to CA$52, focusing on potential cost overruns and regulatory risks. Narratives let you test both perspectives against real numbers, bringing clarity and confidence to your investment decision.

Do you think there's more to the story for Torex Gold Resources? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Torex Gold Resources might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:TXG

Exceptional growth potential with flawless balance sheet.

Similar Companies

Market Insights

Community Narratives