- Canada

- /

- Metals and Mining

- /

- TSX:PRYM

TSX Penny Stocks: Converge Technology Solutions And 2 Others With Promising Growth

Reviewed by Simply Wall St

The Canadian market has seen a robust 28% increase over the last 12 months, with earnings projected to grow by 16% annually. In such a thriving environment, identifying stocks that combine value and growth becomes essential for investors. Penny stocks, though considered an outdated term, still represent opportunities in smaller or newer companies that can offer significant potential when supported by strong financials.

Top 10 Penny Stocks In Canada

| Name | Share Price | Market Cap | Financial Health Rating |

| PetroTal (TSX:TAL) | CA$0.68 | CA$620.88M | ★★★★★★ |

| Findev (TSXV:FDI) | CA$0.41 | CA$11.75M | ★★★★★☆ |

| Winshear Gold (TSXV:WINS) | CA$0.14 | CA$4.4M | ★★★★★★ |

| Mandalay Resources (TSX:MND) | CA$3.16 | CA$297.04M | ★★★★★★ |

| Pulse Seismic (TSX:PSD) | CA$2.35 | CA$119.71M | ★★★★★★ |

| Amerigo Resources (TSX:ARG) | CA$1.83 | CA$303.72M | ★★★★★☆ |

| Foraco International (TSX:FAR) | CA$2.25 | CA$221.84M | ★★★★★☆ |

| East West Petroleum (TSXV:EW) | CA$0.035 | CA$3.17M | ★★★★★★ |

| Newport Exploration (TSXV:NWX) | CA$0.115 | CA$12.14M | ★★★★★★ |

| NamSys (TSXV:CTZ) | CA$1.15 | CA$30.89M | ★★★★★★ |

Click here to see the full list of 947 stocks from our TSX Penny Stocks screener.

We're going to check out a few of the best picks from our screener tool.

Converge Technology Solutions (TSX:CTS)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Converge Technology Solutions Corp. offers software-enabled IT and cloud solutions in the United States and Canada, with a market cap of CA$922.51 million.

Operations: The company generates revenue primarily from its Segment Adjustment, totaling CA$2.62 billion, and Portage Saas Solutions (portage), contributing CA$18.51 million.

Market Cap: CA$922.51M

Converge Technology Solutions Corp. has shown financial resilience by improving from negative shareholder equity to positive, indicating progress in its financial health. Despite being unprofitable with a net loss of CA$163.32 million in the recent quarter, it maintains a sufficient cash runway for over three years due to positive free cash flow. The company is trading at 76% below estimated fair value and offers good relative value compared to peers and industry benchmarks. However, challenges remain with a high net debt-to-equity ratio of 41.1% and ongoing unprofitability without expected profitability within the next three years.

- Dive into the specifics of Converge Technology Solutions here with our thorough balance sheet health report.

- Understand Converge Technology Solutions' earnings outlook by examining our growth report.

Prime Mining (TSX:PRYM)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Prime Mining Corp. focuses on acquiring, exploring, and developing mineral resource properties in Mexico, with a market cap of CA$298.48 million.

Operations: Prime Mining Corp. does not report specific revenue segments as it is primarily engaged in the acquisition, exploration, and development of mineral resource properties in Mexico.

Market Cap: CA$298.48M

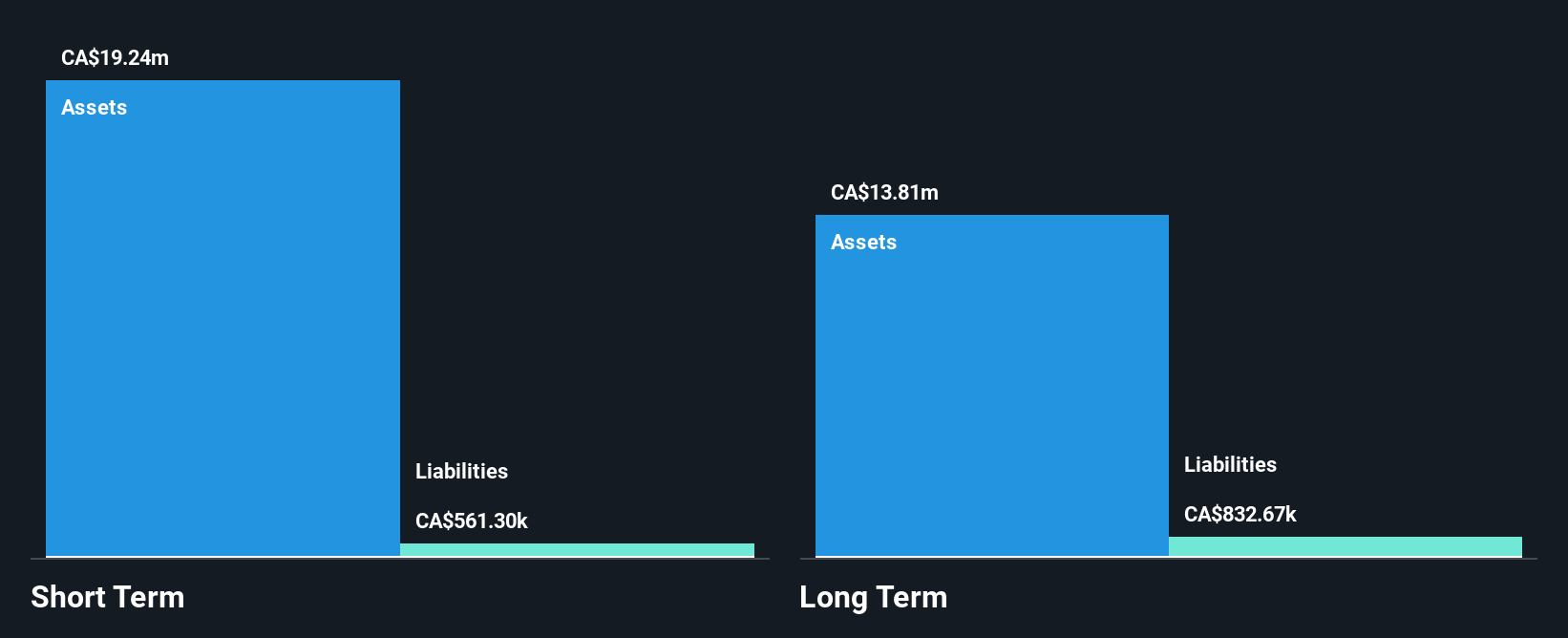

Prime Mining Corp., a pre-revenue company, has made significant strides in resource expansion at its Los Reyes Project, with recent updates showing a 49% increase in Indicated Resources to 2.2 million gold-equivalent ounces and an 11% rise in Inferred Resources. The company's strategic focus on high-grade zones aims to enhance recovery and margins. Despite being unprofitable, Prime is debt-free and maintains sufficient cash runway for over a year. Recent board appointment of Sunny Lowe adds financial expertise, potentially bolstering governance as the company navigates its exploration phase with ongoing drilling efforts targeting further resource growth.

- Take a closer look at Prime Mining's potential here in our financial health report.

- Gain insights into Prime Mining's future direction by reviewing our growth report.

Trilogy Metals (TSX:TMQ)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Trilogy Metals Inc. is a base metals exploration company focused on the exploration and development of mineral properties in the United States, with a market cap of CA$139.68 million.

Operations: Trilogy Metals Inc. does not report any revenue segments as it is focused on the exploration and development of mineral properties in the United States.

Market Cap: CA$139.68M

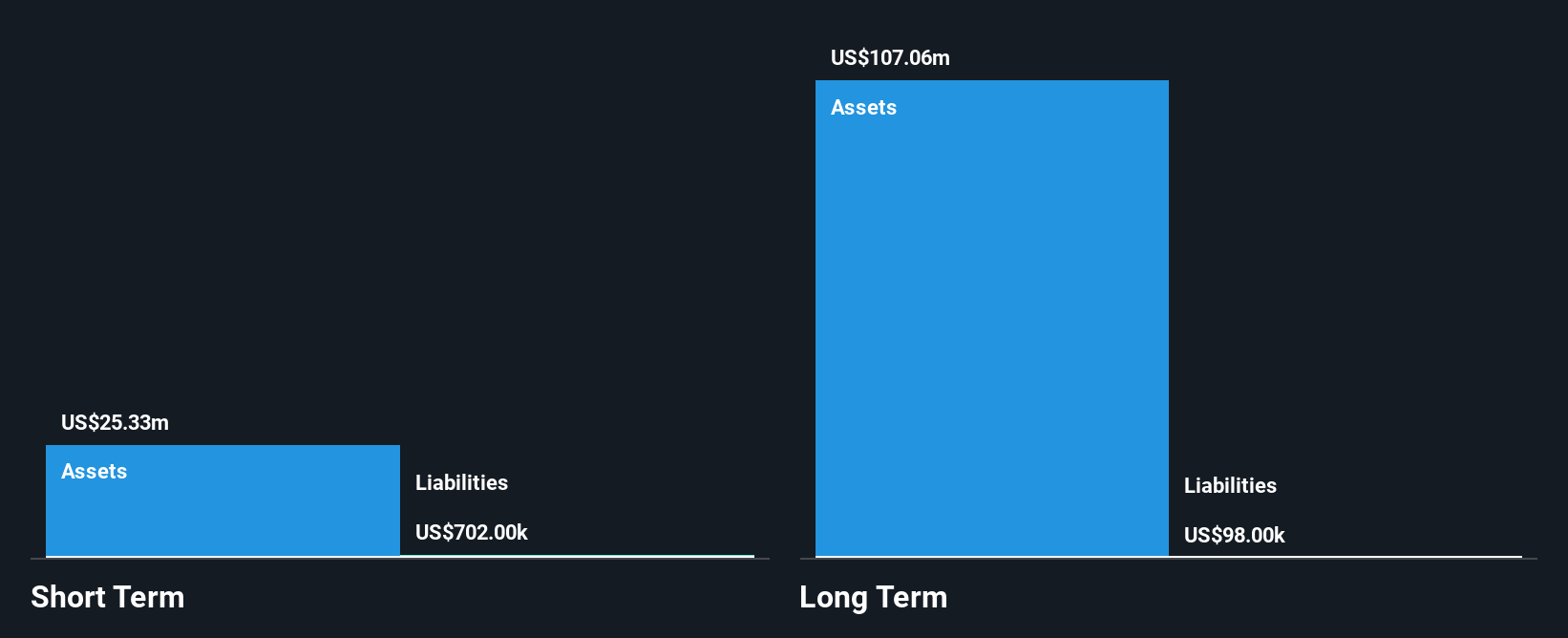

Trilogy Metals Inc., a pre-revenue exploration company, has shown improvement in reducing losses, reporting a net loss of US$1.59 million for Q3 2024 compared to US$4.05 million the previous year. The company is debt-free and possesses sufficient cash runway for over three years, supported by short-term assets of $26.1 million exceeding liabilities significantly. However, shareholders have experienced dilution with share count increasing by 3% over the past year. Despite its unprofitability and declining earnings over five years at a significant rate, Trilogy's experienced management and board may provide stability during its exploration phase.

- Unlock comprehensive insights into our analysis of Trilogy Metals stock in this financial health report.

- Explore historical data to track Trilogy Metals' performance over time in our past results report.

Taking Advantage

- Reveal the 947 hidden gems among our TSX Penny Stocks screener with a single click here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:PRYM

Prime Mining

Engages in the acquisition, exploration, and development of mineral resource properties in Mexico.

Excellent balance sheet moderate.