- Canada

- /

- Real Estate

- /

- TSX:CIGI

Top TSX Growth Companies With Insider Ownership January 2025

Reviewed by Simply Wall St

As the Canadian market navigates through a landscape of shifting bond yields and potential rate cuts by the Bank of Canada, investors find themselves weighing the benefits of bonds over cash in pursuit of higher returns. In this environment, growth companies with high insider ownership on the TSX present intriguing opportunities, as strong internal commitment can often signal confidence in a company's future prospects amidst evolving economic conditions.

Top 10 Growth Companies With High Insider Ownership In Canada

| Name | Insider Ownership | Earnings Growth |

| Propel Holdings (TSX:PRL) | 23.8% | 37.6% |

| Robex Resources (TSXV:RBX) | 28.2% | 130.7% |

| Artemis Gold (TSXV:ARTG) | 30% | 60.7% |

| Almonty Industries (TSX:AII) | 17.7% | 43.9% |

| Alvopetro Energy (TSXV:ALV) | 19.4% | 33% |

| Enterprise Group (TSX:E) | 39.8% | 56.3% |

| Aritzia (TSX:ATZ) | 16.1% | 59.7% |

| Colliers International Group (TSX:CIGI) | 14.1% | 23.5% |

| Profound Medical (TSX:PRN) | 10.2% | 54.6% |

| CHAR Technologies (TSXV:YES) | 10.7% | 58.3% |

Let's dive into some prime choices out of the screener.

Aya Gold & Silver (TSX:AYA)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Aya Gold & Silver Inc. is involved in the exploration, evaluation, and development of precious metals projects in Morocco and has a market capitalization of CA$1.40 billion.

Operations: The company generates revenue from the production at the Zgounder Silver Mine in Morocco, amounting to $40.85 million.

Insider Ownership: 10.2%

Earnings Growth Forecast: 96.7% p.a.

Aya Gold & Silver's significant insider ownership aligns with its robust growth prospects, driven by the recent commencement of commercial production at its Zgounder Mine in Morocco. Despite past shareholder dilution, the company is forecast to achieve substantial earnings and revenue growth, outpacing Canadian market averages. Recent high-grade silver drill results support this potential. However, past production delays and current trading below fair value estimates highlight some risks for investors.

- Click here and access our complete growth analysis report to understand the dynamics of Aya Gold & Silver.

- The valuation report we've compiled suggests that Aya Gold & Silver's current price could be quite moderate.

Colliers International Group (TSX:CIGI)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Colliers International Group Inc. offers commercial real estate and investment management services to corporate and institutional clients across the Americas, Europe, the Middle East, Africa, and the Asia Pacific with a market cap of CA$9.86 billion.

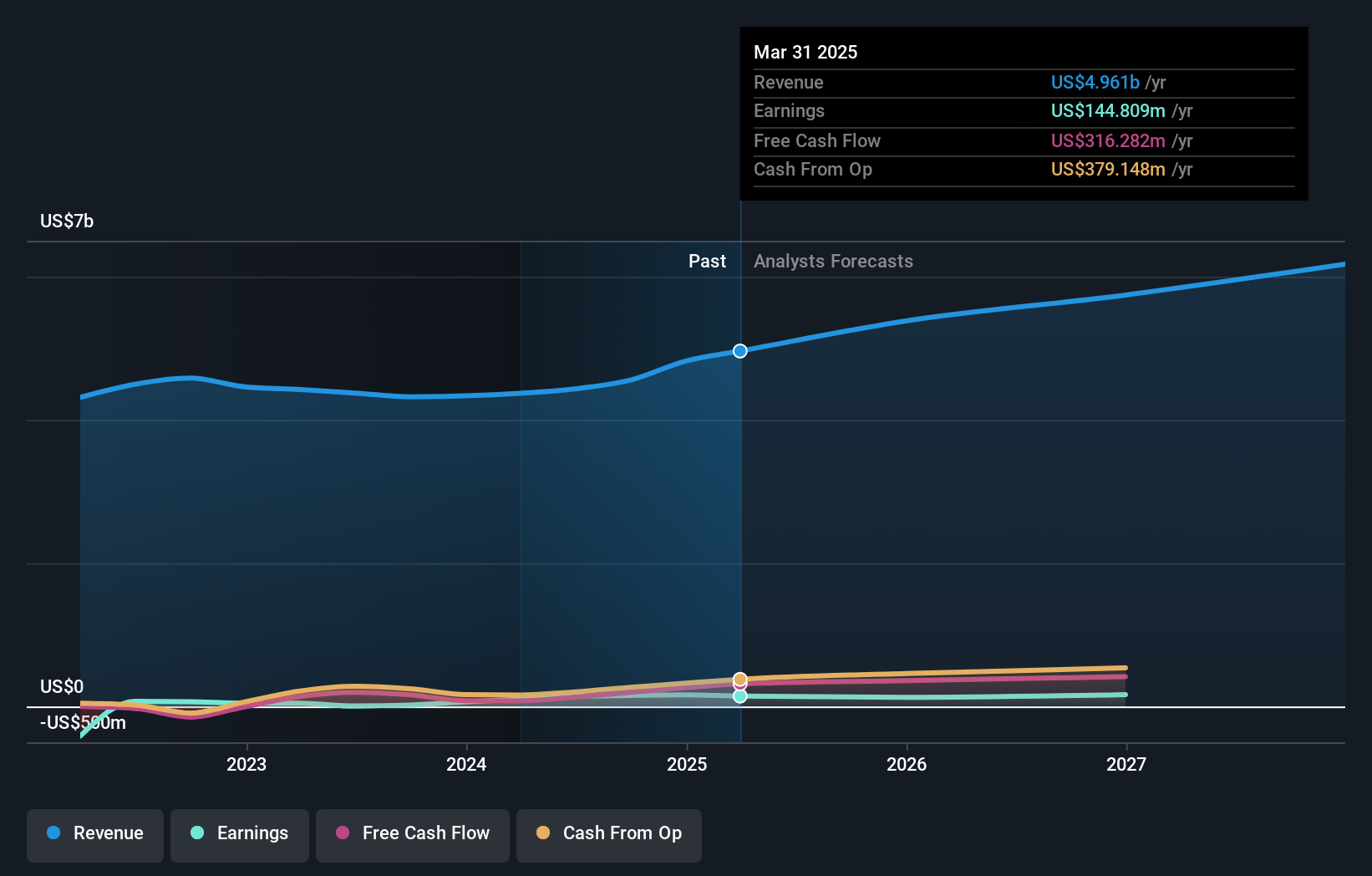

Operations: The company's revenue segments include $0.43 million from Corporate and $505.11 million from Investment Management, with a Segment Adjustment of $4.05 billion.

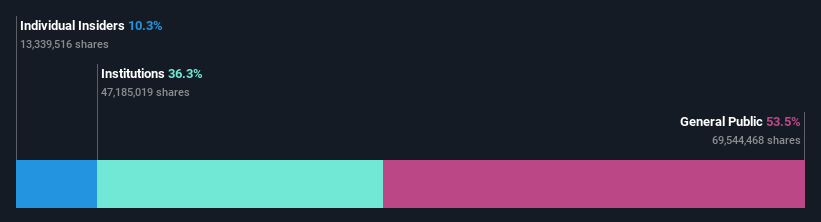

Insider Ownership: 14.1%

Earnings Growth Forecast: 23.5% p.a.

Colliers International Group demonstrates strong growth potential with earnings forecasted to grow significantly, outpacing the Canadian market. Recent board appointments, including John Sullivan, enhance its strategic direction. The company expanded its credit facility to $2.25 billion, providing over $1 billion for growth initiatives despite past shareholder dilution. While insider buying hasn't been substantial recently, Colliers' revenue is expected to grow faster than the market average, supporting its position in the real estate sector.

- Click here to discover the nuances of Colliers International Group with our detailed analytical future growth report.

- Upon reviewing our latest valuation report, Colliers International Group's share price might be too optimistic.

Savaria (TSX:SIS)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Savaria Corporation offers accessibility solutions for the elderly and physically challenged across Canada, the United States, Europe, and internationally, with a market cap of CA$1.42 billion.

Operations: The company's revenue segments include Patient Care, which generated CA$184.01 million, and Segment Adjustment, contributing CA$677.25 million.

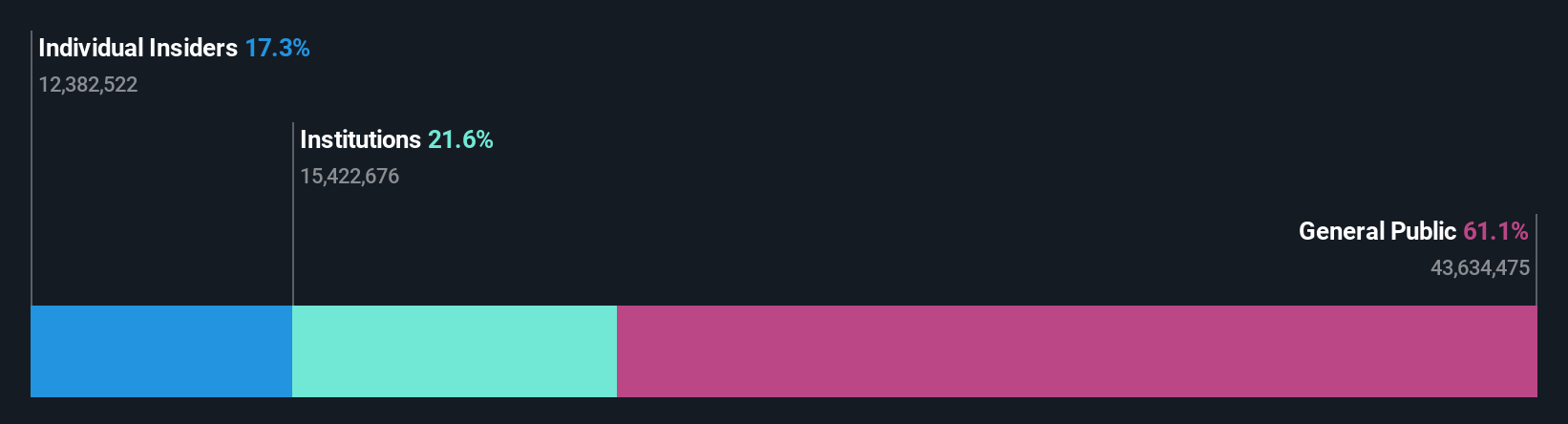

Insider Ownership: 17.2%

Earnings Growth Forecast: 31.4% p.a.

Savaria Corporation shows promising growth with earnings expected to grow significantly, surpassing the Canadian market's average. Trading below its fair value estimate, it has seen substantial insider buying recently, indicating confidence in its future prospects. Despite past shareholder dilution and slower revenue growth compared to earnings, Savaria maintains a reliable monthly dividend policy. Recent financial results highlight steady sales and net income increases year-over-year, reinforcing its potential as a growth-oriented company.

- Click to explore a detailed breakdown of our findings in Savaria's earnings growth report.

- According our valuation report, there's an indication that Savaria's share price might be on the cheaper side.

Taking Advantage

- Reveal the 40 hidden gems among our Fast Growing TSX Companies With High Insider Ownership screener with a single click here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:CIGI

Colliers International Group

Provides commercial real estate professional and investment management services to corporate and institutional clients in the Americas, Europe, the Middle East, Africa, and the Asia Pacific.

High growth potential with solid track record.