- Canada

- /

- Metals and Mining

- /

- TSX:TI

Can You Imagine How Jubilant Titan Mining's (TSE:TI) Shareholders Feel About Its 117% Share Price Gain?

It might be of some concern to shareholders to see the Titan Mining Corporation (TSE:TI) share price down 27% in the last month. Despite this, the stock is a strong performer over the last year, no doubt about that. Indeed, the share price is up an impressive 117% in that time. So it is important to view the recent reduction in price through that lense. Investors should be wondering whether the business itself has the fundamental value required to continue to drive gains.

View our latest analysis for Titan Mining

Given that Titan Mining didn't make a profit in the last twelve months, we'll focus on revenue growth to form a quick view of its business development. When a company doesn't make profits, we'd generally expect to see good revenue growth. As you can imagine, fast revenue growth, when maintained, often leads to fast profit growth.

In the last year Titan Mining saw its revenue grow by 1,126%. That's stonking growth even when compared to other loss-making stocks. Meanwhile, the market has paid attention, sending the share price soaring 117% in response. It's great to see strong revenue growth, but the question is whether it can be sustained. The strong share price rise indicates optimism, so there may be a better opportunity for buyers as the hype fades a bit.

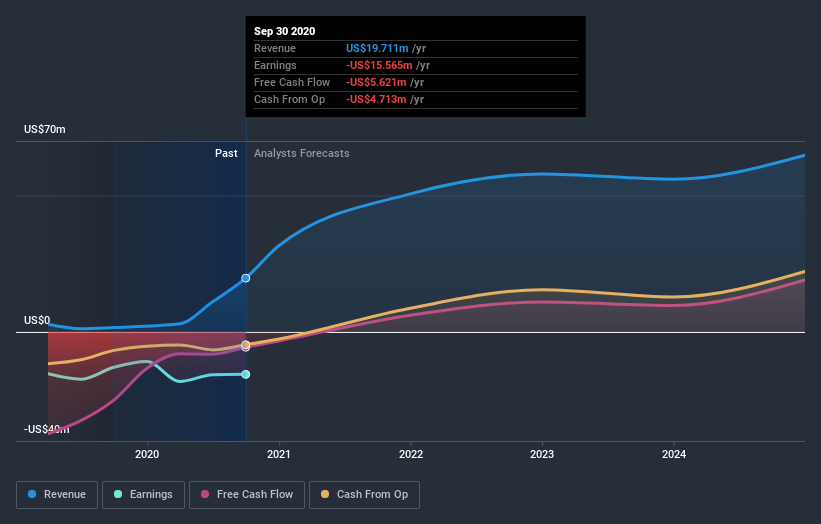

The image below shows how earnings and revenue have tracked over time (if you click on the image you can see greater detail).

It's probably worth noting we've seen significant insider buying in the last quarter, which we consider a positive. On the other hand, we think the revenue and earnings trends are much more meaningful measures of the business. You can see what analysts are predicting for Titan Mining in this interactive graph of future profit estimates.

A Different Perspective

Pleasingly, Titan Mining's total shareholder return last year was 117%. This recent result is much better than the 14% drop suffered by shareholders each year (on average) over the last three. It could well be that the business has turned around -- or else regained the confidence of investors. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. Like risks, for instance. Every company has them, and we've spotted 4 warning signs for Titan Mining (of which 1 is a bit unpleasant!) you should know about.

Titan Mining is not the only stock that insiders are buying. For those who like to find winning investments this free list of growing companies with recent insider purchasing, could be just the ticket.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on CA exchanges.

If you’re looking to trade Titan Mining, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if Titan Mining might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About TSX:TI

Titan Mining

A natural resource company, acquires, explores, develops, produces, and extracts mineral properties.

Good value with acceptable track record.

Market Insights

Community Narratives