- Canada

- /

- Metals and Mining

- /

- TSX:TFPM

Triple Flag Precious Metals (TSX:TFPM) Reports Q3 Revenue Growth, Declares Dividend Increase

Reviewed by Simply Wall St

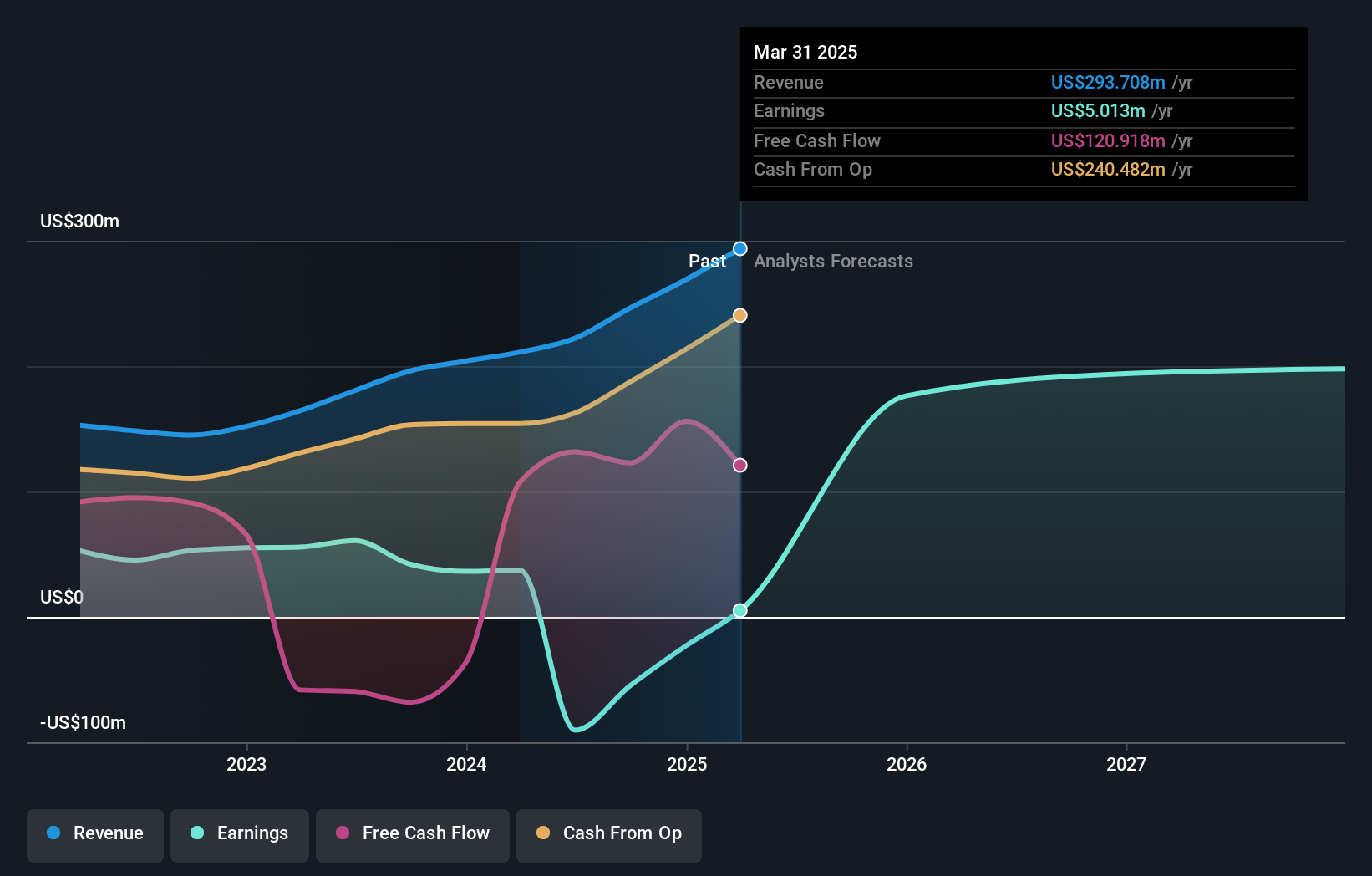

Triple Flag Precious Metals (TSX:TFPM) has reported impressive financial results for Q3 2024, with sales soaring to $73.67 million and net income reaching $29.65 million, marking a significant turnaround from the previous year's net loss. Despite these gains, the company faces challenges such as operational inefficiencies and rising costs, which could impact future profitability. In the following discussion, we will explore the company's strategic initiatives, financial performance, and market challenges, providing a comprehensive overview of its current position and future prospects.

Click to explore a detailed breakdown of our findings on Triple Flag Precious Metals.

Core Advantages Driving Sustained Success for Triple Flag Precious Metals

Triple Flag Precious Metals has demonstrated strong operational performance, achieving record production and revenue growth. With sales reaching $73.67 million in Q3 2024, up from $49.43 million the previous year, the company showcases its strong market position. CEO Sheldon Vanderkooy highlighted the company's strategic partnerships, which have secured favorable terms and enhanced project execution. The company's net income of $29.65 million, compared to a net loss of $6.04 million a year ago, underscores its financial health and future growth potential. Furthermore, the expected revenue growth of 12.8% per year is set to outpace the broader Canadian market, indicating a promising trajectory.

Internal Limitations Hindering Triple Flag Precious Metals's Growth

Despite these achievements, the company faces challenges. Operational inefficiencies, as noted by Vanderkooy, suggest areas needing improvement to prevent hindrances to profitability. Rising costs in specific jurisdictions have pressured margins, as CFO Eban Bari pointed out, necessitating active mitigation strategies. The company's current unprofitability, with a return on equity of -3.19%, and increased losses over the past five years, highlight areas for financial improvement. Additionally, while the share price trades below its estimated fair value, it remains expensive based on its SWS Price-To-Sales Ratio compared to peers, requiring careful consideration.

Areas for Expansion and Innovation for Triple Flag Precious Metals

The company is poised for expansion, particularly in emerging markets like Asia and Africa, where demand for precious metals is rising. COO James Dendle emphasized this proactive approach, which could significantly bolster revenue streams. Investments in new technologies are set to enhance operational capabilities and resource extraction processes, reflecting a commitment to innovation. Moreover, exploring new product lines aligned with market trends and customer needs could diversify offerings and mitigate market fluctuation risks.

Market Volatility Affecting Triple Flag Precious Metals's Position

External factors, such as geopolitical tensions, pose risks to operations and market access, as noted by Vanderkooy. Regulatory changes remain a significant concern, potentially challenging the business model and operational strategies. Furthermore, the intensifying competitive environment necessitates agility and innovation to maintain market position. Despite these challenges, the company's strategic focus on emerging markets and technological advancements positions it well for future growth.

Conclusion

Triple Flag Precious Metals exhibits a promising trajectory with its strong market position and strategic partnerships, leading to significant revenue growth and a return to profitability. However, the company must address operational inefficiencies and rising costs that pressure margins to sustain this progress. Despite trading below its estimated fair value, the share price's high Price-To-Sales Ratio compared to peers suggests careful evaluation is needed to ensure alignment with financial performance. Looking forward, the company's focus on expanding into emerging markets and investing in technological advancements could drive future growth, but it must remain vigilant against external risks like geopolitical tensions and regulatory changes to maintain its competitive edge.

Taking Advantage

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

Valuation is complex, but we're here to simplify it.

Discover if Triple Flag Precious Metals might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Simply Wall St analyst Simply Wall St and Simply Wall St have no position in any of the companies mentioned. This article is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

About TSX:TFPM

Triple Flag Precious Metals

A precious metals streaming and royalty company, engages in acquiring and managing precious metals, streams, royalties, and other mineral interests in Australia, Canada, Colombia, Cote d’Ivoire, Honduras, Mexico, Mongolia, Peru, South Africa, and the United States.

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

SLI is share to watch next 5 years

The "Molecular Pencil": Why Beam's Technology is Built to Win

PRME remains a long shot but publication in the New England Journal of Medicine helps.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026