- Spain

- /

- Electrical

- /

- BME:ART

Discovering Arteche Lantegi Elkartea And Two More Stocks Estimated Below Intrinsic Value

Reviewed by Simply Wall St

As global markets navigate the uncertainties surrounding the incoming Trump administration's policies, investors are witnessing fluctuating sector performances and shifting expectations for interest rates. Amidst these developments, identifying stocks that may be trading below their intrinsic value can offer potential opportunities for those looking to capitalize on market inefficiencies. In this context, Arteche Lantegi Elkartea and two other stocks stand out as intriguing candidates worth exploring.

Top 10 Undervalued Stocks Based On Cash Flows

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Alltop Technology (TPEX:3526) | NT$273.50 | NT$554.65 | 50.7% |

| Lindab International (OM:LIAB) | SEK226.60 | SEK450.18 | 49.7% |

| SeSa (BIT:SES) | €76.00 | €150.71 | 49.6% |

| S-Pool (TSE:2471) | ¥344.00 | ¥681.84 | 49.5% |

| Solum (KOSE:A248070) | ₩17820.00 | ₩34265.45 | 48% |

| Guangdong Fenghua Advanced Technology (Holding) (SZSE:000636) | CN¥15.79 | CN¥32.31 | 51.1% |

| XD (SEHK:2400) | HK$22.40 | HK$44.60 | 49.8% |

| AirBoss of America (TSX:BOS) | CA$4.25 | CA$8.45 | 49.7% |

| Intellian Technologies (KOSDAQ:A189300) | ₩43900.00 | ₩88907.79 | 50.6% |

| iFLYTEKLTD (SZSE:002230) | CN¥48.35 | CN¥105.85 | 54.3% |

We're going to check out a few of the best picks from our screener tool.

Arteche Lantegi Elkartea (BME:ART)

Overview: Arteche Lantegi Elkartea, S.A. designs, manufactures, integrates, and supplies electrical equipment and solutions with a focus on renewable energies and smart grids both in Spain and internationally, with a market cap of €350.47 million.

Operations: The company's revenue segments include Network Reliability (€48.70 million), Systems Measurement and Monitoring (€304.31 million), and Automation of Transmission and Distribution Networks (€85.32 million).

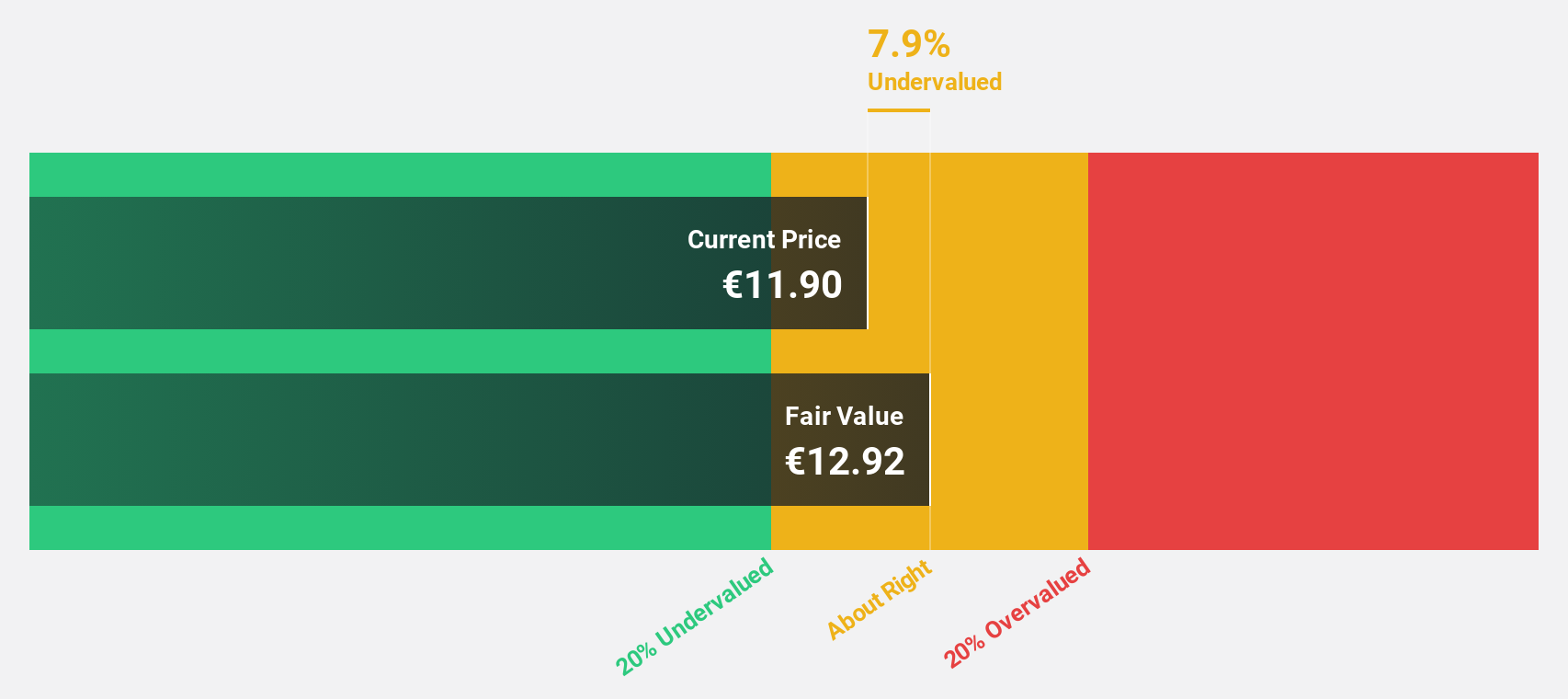

Estimated Discount To Fair Value: 48.6%

Arteche Lantegi Elkartea is trading at €6.15, significantly below its estimated fair value of €11.97, suggesting it may be undervalued based on cash flows. Despite high debt levels and recent share price volatility, the company reported strong earnings growth with net income rising to €7.42 million for H1 2024 from €4.29 million a year ago. Forecasts predict annual earnings growth of 28.8%, outpacing the Spanish market's expected growth rate of 8.6%.

- In light of our recent growth report, it seems possible that Arteche Lantegi Elkartea's financial performance will exceed current levels.

- Dive into the specifics of Arteche Lantegi Elkartea here with our thorough financial health report.

Savaria (TSX:SIS)

Overview: Savaria Corporation offers accessibility solutions for the elderly and physically challenged across Canada, the United States, Europe, and internationally with a market cap of CA$1.58 billion.

Operations: The company's revenue segments include Patient Care at CA$184.01 million and Segment Adjustment at CA$677.25 million.

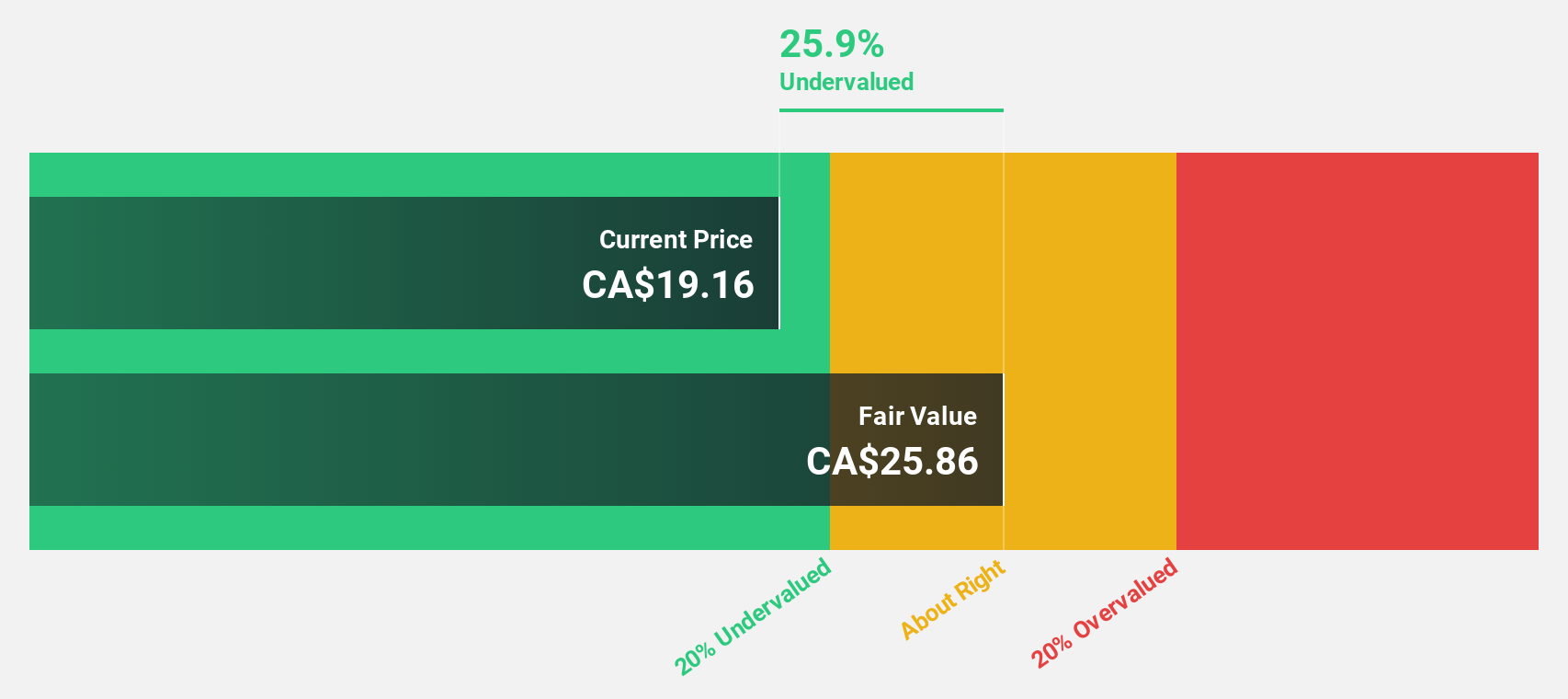

Estimated Discount To Fair Value: 21.4%

Savaria Corporation is trading at CA$22.13, below its estimated fair value of CA$28.16, highlighting potential undervaluation based on cash flows. Recent earnings show net income growth to CAD 13.03 million in Q3 2024 from CAD 12.05 million a year prior, with annual profit growth forecasted at a significant rate of over 31%. Despite substantial insider selling recently and large one-off items affecting results, the company's earnings are expected to grow robustly above market rates.

- Our earnings growth report unveils the potential for significant increases in Savaria's future results.

- Click to explore a detailed breakdown of our findings in Savaria's balance sheet health report.

Triple Flag Precious Metals (TSX:TFPM)

Overview: Triple Flag Precious Metals Corp. is a streaming and royalty company focused on acquiring and managing precious metals interests globally, with a market cap of CA$4.59 billion.

Operations: The company's revenue is primarily derived from acquiring and managing precious metal and other high-quality streams and royalties, totaling $246.52 million.

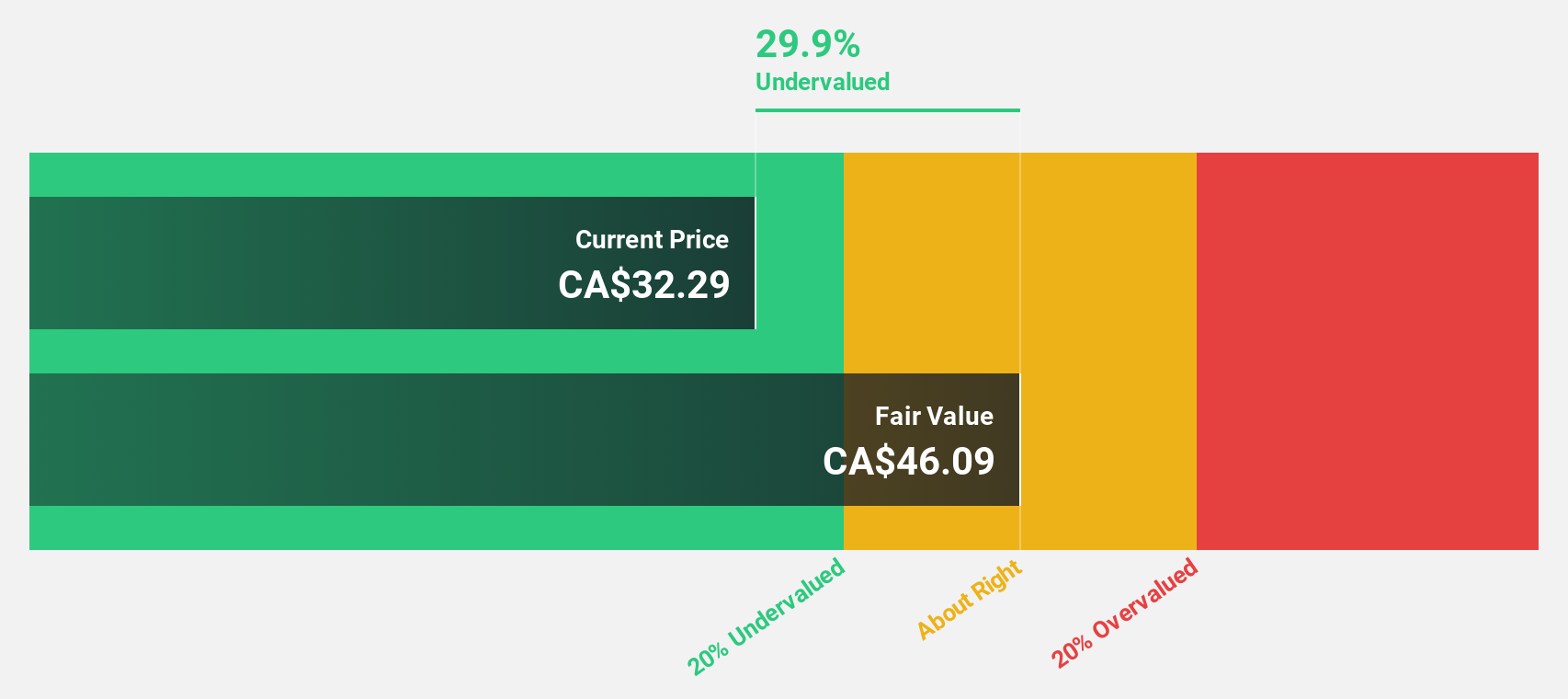

Estimated Discount To Fair Value: 40.8%

Triple Flag Precious Metals, trading at CA$22.78, is significantly undervalued with an estimated fair value of CA$38.51. The company reported a notable turnaround in Q3 2024, achieving US$29.65 million net income compared to a loss last year and expects revenue growth of 12.8% annually, surpassing the Canadian market's average growth rate. However, recent insider selling raises concerns despite the positive outlook and share repurchase program announced for up to 5% of shares outstanding.

- Our growth report here indicates Triple Flag Precious Metals may be poised for an improving outlook.

- Take a closer look at Triple Flag Precious Metals' balance sheet health here in our report.

Make It Happen

- Dive into all 935 of the Undervalued Stocks Based On Cash Flows we have identified here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About BME:ART

Arteche Lantegi Elkartea

Engages in the design, manufacture, integration, and supply of electrical equipment and solutions focusing on renewable energies and smart grids in Spain and internationally.

High growth potential with solid track record.