- Canada

- /

- Paper and Forestry Products

- /

- TSX:SXP

Why We Think The CEO Of Supremex Inc. (TSE:SXP) May Soon See A Pay Rise

Key Insights

- Supremex will host its Annual General Meeting on 9th of May

- Total pay for CEO Stewart Emerson includes CA$504.7k salary

- The total compensation is 34% less than the average for the industry

- Supremex's EPS grew by 36% over the past three years while total shareholder return over the past three years was 102%

The impressive results at Supremex Inc. (TSE:SXP) recently will be great news for shareholders. At the upcoming AGM on 9th of May, they would be interested to hear about the company strategy going forward and get a chance to cast their votes on resolutions such as executive remuneration and other company matters. Here we will show why we think CEO compensation is appropriate and discuss the case for a pay rise.

Check out our latest analysis for Supremex

Comparing Supremex Inc.'s CEO Compensation With The Industry

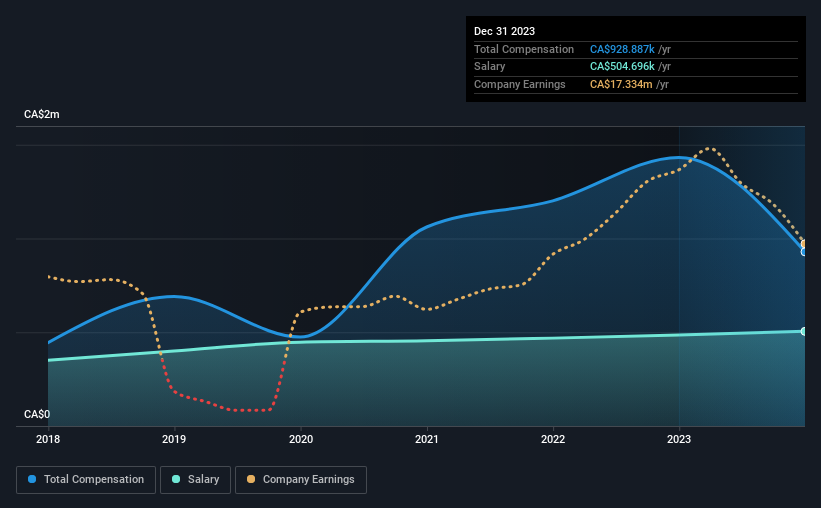

At the time of writing, our data shows that Supremex Inc. has a market capitalization of CA$102m, and reported total annual CEO compensation of CA$929k for the year to December 2023. Notably, that's a decrease of 35% over the year before. Notably, the salary which is CA$504.7k, represents a considerable chunk of the total compensation being paid.

On comparing similar-sized companies in the Canadian Forestry industry with market capitalizations below CA$274m, we found that the median total CEO compensation was CA$1.4m. In other words, Supremex pays its CEO lower than the industry median. Furthermore, Stewart Emerson directly owns CA$853k worth of shares in the company.

| Component | 2023 | 2022 | Proportion (2023) |

| Salary | CA$505k | CA$485k | 54% |

| Other | CA$424k | CA$947k | 46% |

| Total Compensation | CA$929k | CA$1.4m | 100% |

Talking in terms of the industry, salary represented approximately 38% of total compensation out of all the companies we analyzed, while other remuneration made up 62% of the pie. Supremex is paying a higher share of its remuneration through a salary in comparison to the overall industry. If salary dominates total compensation, it suggests that CEO compensation is leaning less towards the variable component, which is usually linked with performance.

Supremex Inc.'s Growth

Supremex Inc. has seen its earnings per share (EPS) increase by 36% a year over the past three years. Its revenue is up 11% over the last year.

Shareholders would be glad to know that the company has improved itself over the last few years. It's also good to see decent revenue growth in the last year, suggesting the business is healthy and growing. Looking ahead, you might want to check this free visual report on analyst forecasts for the company's future earnings..

Has Supremex Inc. Been A Good Investment?

We think that the total shareholder return of 102%, over three years, would leave most Supremex Inc. shareholders smiling. As a result, some may believe the CEO should be paid more than is normal for companies of similar size.

To Conclude...

Given the company's decent performance, the CEO remuneration policy might not be shareholders' central point of focus in the AGM. Instead, investors might be more interested in discussions that would help manage their longer-term growth expectations such as company business strategies and future growth potential.

CEO compensation can have a massive impact on performance, but it's just one element. We did our research and spotted 4 warning signs for Supremex that investors should look into moving forward.

Important note: Supremex is an exciting stock, but we understand investors may be looking for an unencumbered balance sheet and blockbuster returns. You might find something better in this list of interesting companies with high ROE and low debt.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSX:SXP

Supremex

Manufactures and markets envelopes, and paper-based packaging solutions and specialty products for corporations, direct mailers, resellers, government entities, small and medium sized enterprises, and solution providers in Canada and the United States.

Excellent balance sheet and good value.

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Sunrun Stock: When the Energy Transition Collides With the Cost of Capital

Salesforce Stock: AI-Fueled Growth Is Real — But Can Margins Stay This Strong?

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)