- Canada

- /

- Metals and Mining

- /

- TSX:SVM

The Bull Case For Silvercorp Metals (TSX:SVM) Could Change Following Increased Stake in New Pacific Metals—Learn Why

Reviewed by Sasha Jovanovic

- Silvercorp Metals recently increased its stake in New Pacific Metals, investing approximately C$9.86 million to subscribe to 2,776,950 shares and raising its ownership to about 28.05% following New Pacific Metals' equity offering.

- This move gives Silvercorp a larger footprint in New Pacific’s portfolio, highlighting its ongoing efforts to broaden asset exposure and corporate growth opportunities.

- We'll explore how expanding its ownership stake in New Pacific Metals could influence Silvercorp's investment outlook going forward.

These 10 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

Silvercorp Metals Investment Narrative Recap

To be a shareholder in Silvercorp Metals, one has to see value in rising silver demand, operational scale in China, and diversification into projects like New Pacific Metals. The recent increase in Silvercorp’s stake in New Pacific Metals strengthens asset exposure, but does not materially change the primary near-term catalyst, execution on safe, efficient production ramp-up, especially given recent regulatory scrutiny in China, and does little to offset the ongoing risk of cost inflation and region-specific disruptions.

One recent company development that ties directly to this news is Silvercorp’s August 2025 update on operational efficiencies, which showcased rising ore processing volumes and higher silver output year over year. While these improvements support management’s focus on growth and margin preservation, the company’s increasing exposure to non-core assets like New Pacific highlights both its appetite for expansion and the added complexity of successful execution across a broader portfolio.

However, investors should not overlook that the company’s operations remain concentrated in China, so if tighter local regulations or safety-related mine closures arise...

Read the full narrative on Silvercorp Metals (it's free!)

Silvercorp Metals' outlook anticipates $504.4 million in revenue and $143.0 million in earnings by 2028. This is based on a projected annual revenue growth rate of 17.9% and represents an $88.6 million increase in earnings from the current $54.4 million.

Uncover how Silvercorp Metals' forecasts yield a CA$10.45 fair value, a 9% upside to its current price.

Exploring Other Perspectives

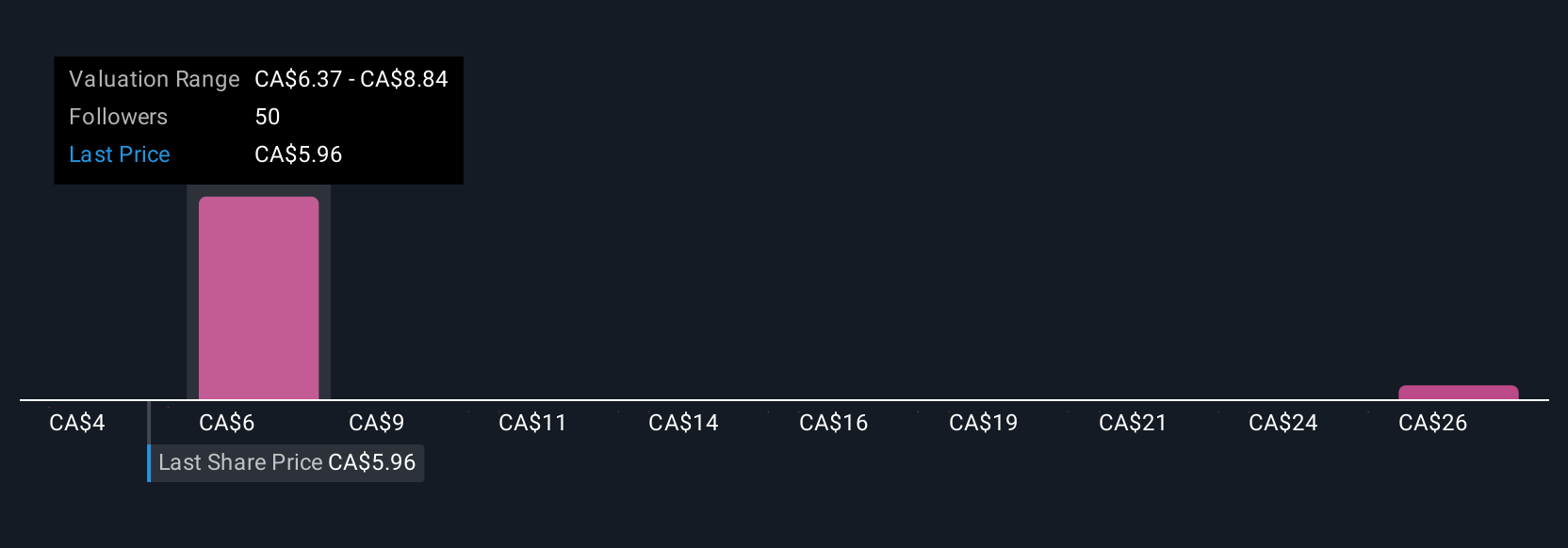

Simply Wall St Community members assigned fair values from C$3.90 to C$28.58, reflecting wide-ranging views across nine individual analyses. As you consider these varied perspectives, remember that recent moves by Silvercorp to boost its asset base add both opportunities and integration risk for future performance.

Explore 9 other fair value estimates on Silvercorp Metals - why the stock might be worth less than half the current price!

Build Your Own Silvercorp Metals Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Silvercorp Metals research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Silvercorp Metals research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Silvercorp Metals' overall financial health at a glance.

Interested In Other Possibilities?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- The latest GPUs need a type of rare earth metal called Terbium and there are only 38 companies in the world exploring or producing it. Find the list for free.

- Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- We've found 18 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:SVM

Silvercorp Metals

Acquires, explores, develops, and mines mineral properties in China.

Excellent balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives