- Canada

- /

- Metals and Mining

- /

- TSX:SVM

Exploring 3 Canadian Undiscovered Gems with Promising Potential

Reviewed by Simply Wall St

As the Canadian market navigates a landscape marked by fluctuating economic indicators and shifts in key indices, small-cap stocks have garnered attention for their potential to offer unique opportunities amidst broader market sentiment. In this environment, identifying promising stocks often involves assessing innovative business models and strong growth prospects that align with current economic trends.

Top 10 Undiscovered Gems With Strong Fundamentals In Canada

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Reconnaissance Energy Africa | NA | 9.16% | 15.11% | ★★★★★★ |

| Lithium Chile | NA | nan | 42.01% | ★★★★★★ |

| Amerigo Resources | 14.04% | 7.04% | 11.73% | ★★★★★☆ |

| Maxim Power | 25.01% | 12.79% | 17.14% | ★★★★★☆ |

| Mako Mining | 10.21% | 38.44% | 58.78% | ★★★★★☆ |

| Grown Rogue International | 24.92% | 43.35% | 67.95% | ★★★★★☆ |

| Corby Spirit and Wine | 65.79% | 7.46% | -5.76% | ★★★★☆☆ |

| Petrus Resources | 19.44% | 17.20% | 46.03% | ★★★★☆☆ |

| DIRTT Environmental Solutions | 58.73% | -5.34% | -5.43% | ★★★★☆☆ |

| Dundee | 3.76% | -37.57% | 44.64% | ★★★★☆☆ |

Below we spotlight a couple of our favorites from our exclusive screener.

Extendicare (TSX:EXE)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Extendicare Inc., with a market cap of CA$848.86 million, operates in Canada offering care and services for seniors through its subsidiaries.

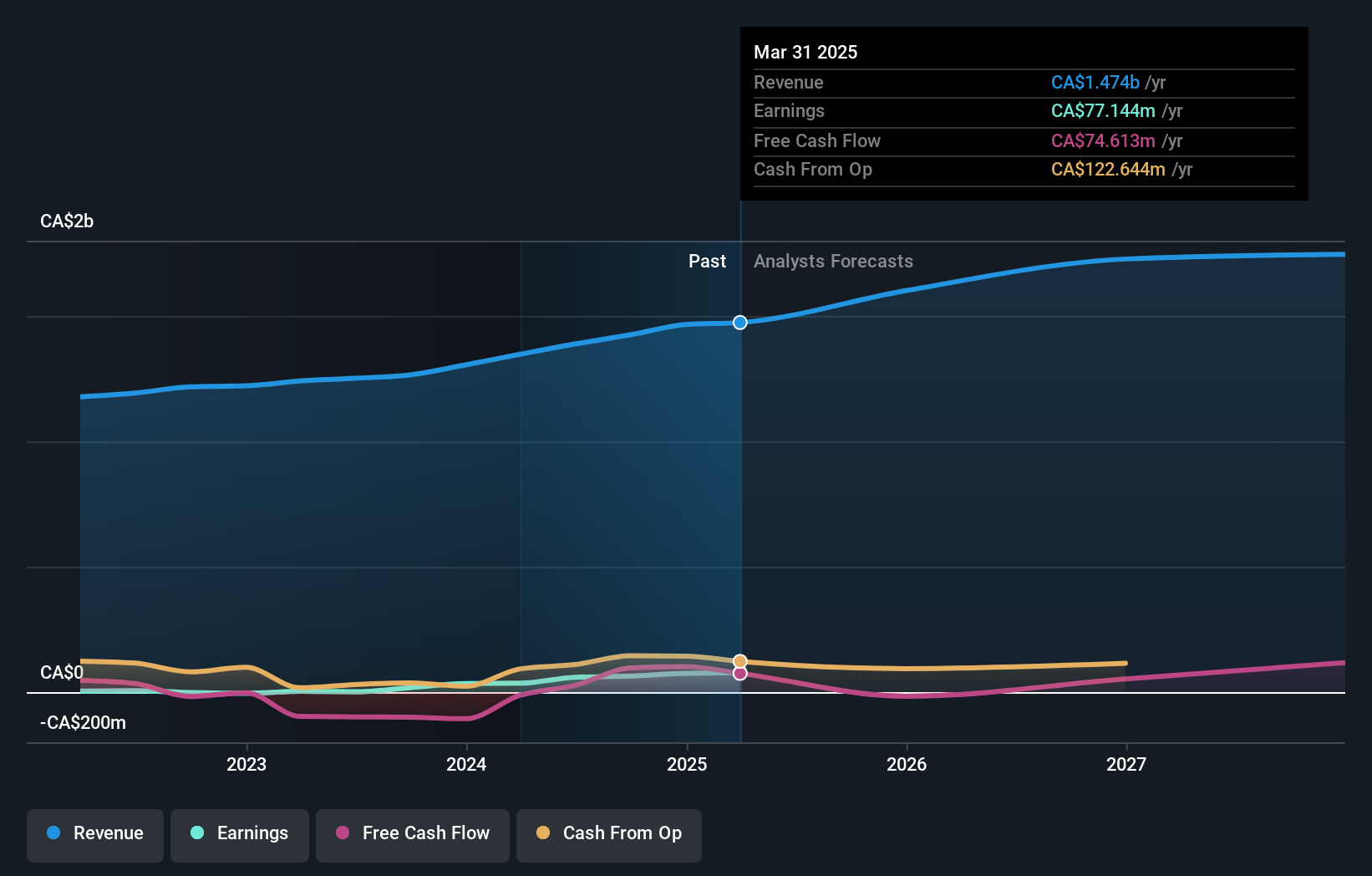

Operations: Extendicare generates revenue primarily from Long-Term Care (CA$808.94 million) and Home Health Care (CA$545.46 million), with a smaller contribution from Managed Services (CA$70.43 million).

With a notable earnings growth of 261.9% over the past year, Extendicare stands out in the healthcare sector, surpassing industry growth of 11.8%. The company has reduced its debt to equity ratio from 412.5% to 244.3% over five years, though it still holds a high net debt to equity ratio of 108.5%. Its price-to-earnings ratio at 13.2x is attractive compared to the Canadian market's average of 14.3x, and interest payments are well covered by EBIT at an impressive coverage of 8.4 times, indicating strong financial management despite high leverage levels.

- Click here to discover the nuances of Extendicare with our detailed analytical health report.

Gain insights into Extendicare's past trends and performance with our Past report.

Silvercorp Metals (TSX:SVM)

Simply Wall St Value Rating: ★★★★★★

Overview: Silvercorp Metals Inc., with a market cap of CA$939.87 million, is involved in the acquisition, exploration, development, and mining of mineral properties through its subsidiaries.

Operations: Silvercorp Metals generates revenue primarily from the sale of silver, lead, and zinc concentrates. The company's cost structure includes mining and milling costs, which impact its profitability. It has reported fluctuations in its gross profit margin over recent periods.

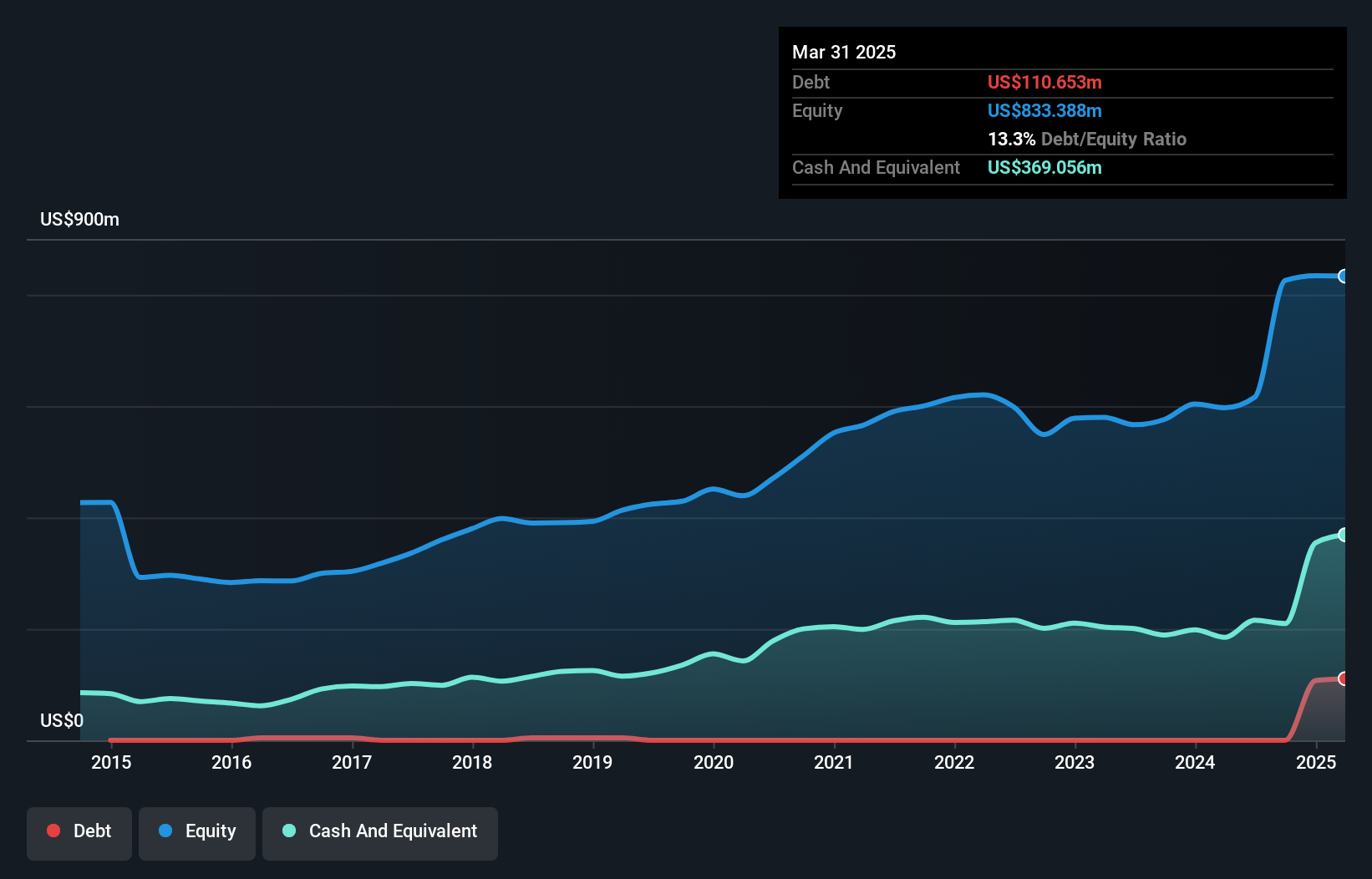

Silvercorp Metals, a Canadian player in the mining sector, showcases robust financial health with a debt-free status and impressive earnings growth of 71.8% over the past year, surpassing industry averages. The company's price-to-earnings ratio stands at 11.9x, offering good value compared to the broader Canadian market's 14.3x benchmark. Recent initiatives include a $150 million convertible notes offering and plans to advance its Condor gold project in Ecuador, highlighting strategic expansion efforts. Despite significant insider selling recently, Silvercorp remains profitable with positive free cash flow and forecasts suggesting continued earnings growth of over 41% annually.

Westshore Terminals Investment (TSX:WTE)

Simply Wall St Value Rating: ★★★★★☆

Overview: Westshore Terminals Investment Corporation operates a coal storage and unloading/loading terminal at Roberts Bank, British Columbia, with a market cap of CA$1.40 billion.

Operations: Westshore generates revenue primarily from its transportation infrastructure segment, amounting to CA$382.57 million. The company's net profit margin reflects its financial efficiency and profitability in this sector.

Westshore Terminals, a noteworthy player in the Canadian infrastructure sector, has demonstrated solid financial performance with high-quality earnings and an 11% growth rate over the past year, surpassing the industry average of 9%. The company is debt-free and maintains a favorable price-to-earnings ratio of 13.2x compared to the Canadian market's 14.3x. Recent earnings reports show third-quarter revenue at C$103 million and net income at C$34 million, slightly up from last year’s figures. Despite being dropped from several S&P/TSX indices recently, Westshore continues to distribute dividends, affirming its commitment to shareholders.

Make It Happen

- Dive into all 44 of the TSX Undiscovered Gems With Strong Fundamentals we have identified here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:SVM

Silvercorp Metals

Engages in the acquisition, exploration, development, and mining of mineral properties.

Flawless balance sheet and good value.