- Canada

- /

- Communications

- /

- TSXV:TTZ

CDN Maverick Capital And 2 Other TSX Penny Stocks To Watch

Reviewed by Simply Wall St

As the Canadian market navigates a landscape shaped by economic trends and strategic insights, investors are increasingly seeking opportunities that align with long-term financial goals. Penny stocks, while an older term, continue to capture interest due to their potential for growth and affordability, particularly when they exhibit strong financials. In this context, we'll explore three promising penny stocks on the TSX that could offer both stability and growth potential in today's market.

Top 10 Penny Stocks In Canada

| Name | Share Price | Market Cap | Financial Health Rating |

| Pulse Seismic (TSX:PSD) | CA$2.26 | CA$115M | ★★★★★★ |

| Findev (TSXV:FDI) | CA$0.54 | CA$13.61M | ★★★★★★ |

| PetroTal (TSX:TAL) | CA$0.55 | CA$528.97M | ★★★★★★ |

| Foraco International (TSX:FAR) | CA$2.25 | CA$221.48M | ★★★★★☆ |

| East West Petroleum (TSXV:EW) | CA$0.04 | CA$3.62M | ★★★★★★ |

| Silvercorp Metals (TSX:SVM) | CA$4.37 | CA$948.57M | ★★★★★★ |

| NamSys (TSXV:CTZ) | CA$1.20 | CA$33.04M | ★★★★★★ |

| Hemisphere Energy (TSXV:HME) | CA$1.87 | CA$182.38M | ★★★★★☆ |

| Orezone Gold (TSX:ORE) | CA$0.63 | CA$302.67M | ★★★★★☆ |

| Enterprise Group (TSX:E) | CA$1.85 | CA$108.95M | ★★★★☆☆ |

Click here to see the full list of 939 stocks from our TSX Penny Stocks screener.

Underneath we present a selection of stocks filtered out by our screen.

CDN Maverick Capital (CNSX:CDN)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: CDN Maverick Capital Corp. focuses on acquiring, exploring, and developing mineral properties in North and South America, with a market cap of CA$1.82 million.

Operations: CDN Maverick Capital Corp. does not report any specific revenue segments.

Market Cap: CA$1.82M

CDN Maverick Capital Corp., with a market cap of CA$1.82 million, operates in the mineral exploration sector and is currently pre-revenue, having recently achieved profitability. The company reported a small net income for the third quarter of 2024 compared to losses in previous periods, indicating financial improvement. CDN Maverick has no debt or long-term liabilities, and its short-term assets exceed its liabilities by a significant margin. Despite high volatility in share price and an inexperienced management team with an average tenure of 0.9 years, the company's Return on Equity is notably high at 37.7%.

- Jump into the full analysis health report here for a deeper understanding of CDN Maverick Capital.

- Review our historical performance report to gain insights into CDN Maverick Capital's track record.

High Arctic Energy Services (TSX:HWO)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: High Arctic Energy Services Inc. is an oilfield services company that offers services to exploration and production companies in Canada and Papua New Guinea, with a market cap of CA$14.32 million.

Operations: The company generates revenue from its Rental Services segment, amounting to CA$19.70 million, along with a Segment Adjustment of CA$47.91 million.

Market Cap: CA$14.32M

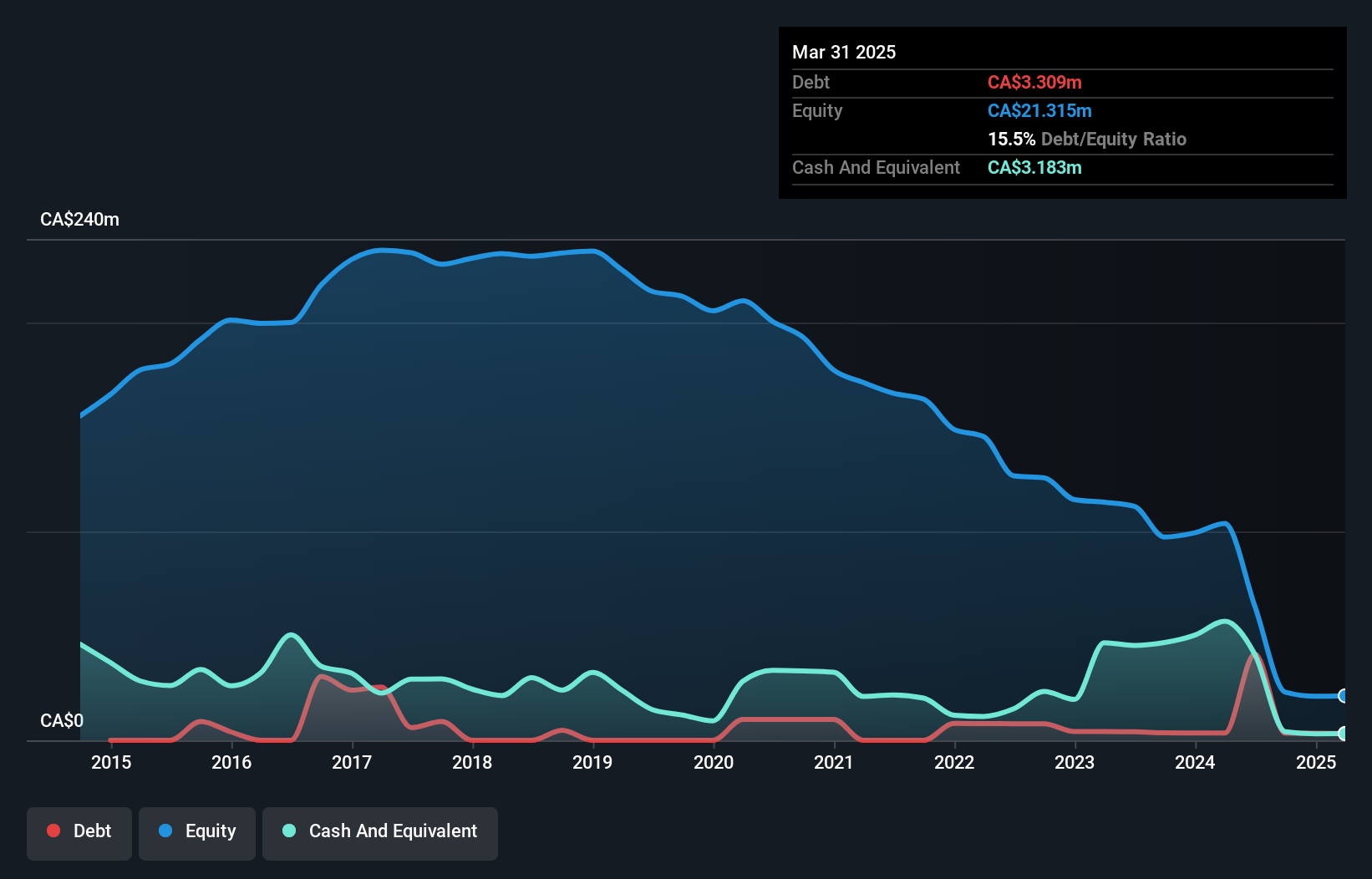

High Arctic Energy Services, with a market cap of CA$14.32 million, has shown significant revenue growth in its recent earnings report, with third-quarter sales increasing to CA$2.51 million from CA$1.02 million the previous year. Despite being unprofitable over the past five years, it reported a net income of CA$27.22 million for Q3 2024 compared to a net loss previously. The company is actively seeking acquisitions and investments as part of its strategic plan and benefits from having more cash than debt, suggesting financial stability despite challenges in profitability and management turnover.

- Dive into the specifics of High Arctic Energy Services here with our thorough balance sheet health report.

- Explore historical data to track High Arctic Energy Services' performance over time in our past results report.

Total Telcom (TSXV:TTZ)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Total Telcom Inc., via its subsidiary ROM Communications Inc., specializes in developing and providing remote asset monitoring and tracking products and services in the United States and Canada, with a market cap of CA$5.81 million.

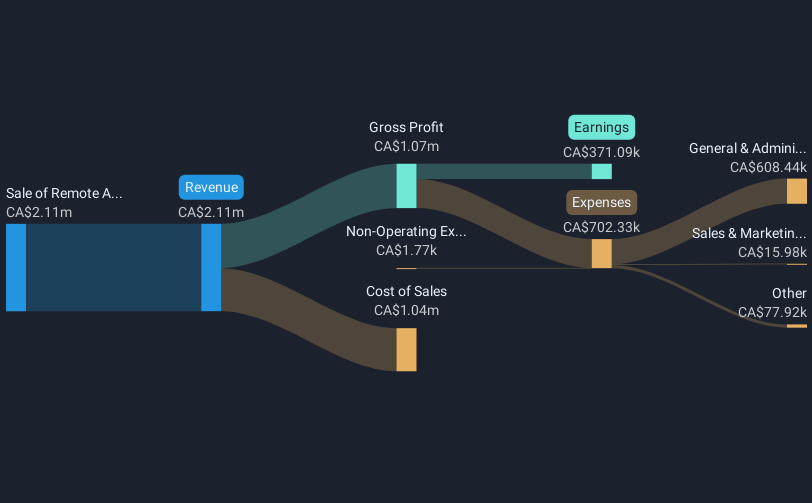

Operations: The company generates CA$2.11 million in revenue from the sale of its remote asset monitoring and tracking products and services.

Market Cap: CA$5.81M

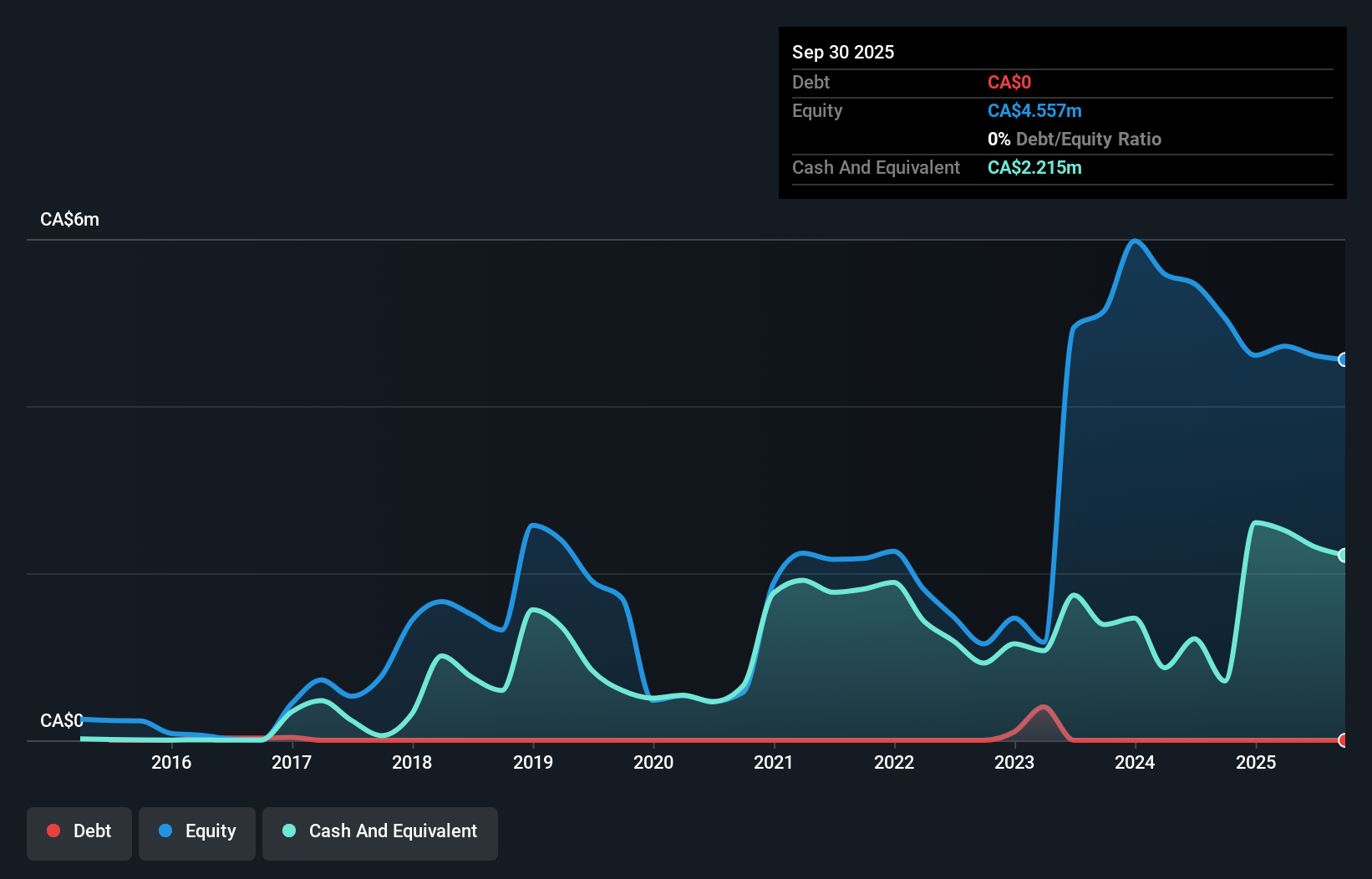

Total Telcom Inc., with a market cap of CA$5.81 million, has demonstrated modest financial improvements, reporting first-quarter sales of CA$0.48 million compared to CA$0.34 million the previous year and achieving a net income of CA$0.063 million versus a net loss previously. The company benefits from having no debt and short-term assets exceeding both short- and long-term liabilities, indicating sound liquidity management. However, it faces challenges such as negative earnings growth over the past year and low return on equity at 7.5%. Its price-to-earnings ratio is favorable compared to industry averages, suggesting potential value for investors interested in penny stocks.

- Click here and access our complete financial health analysis report to understand the dynamics of Total Telcom.

- Understand Total Telcom's track record by examining our performance history report.

Make It Happen

- Dive into all 939 of the TSX Penny Stocks we have identified here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade Total Telcom, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Total Telcom might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSXV:TTZ

Total Telcom

Through its subsidiary, ROM Communications Inc., develops and provides remote asset monitoring and tracking products and services in the United States and Canada.

Flawless balance sheet and good value.

Market Insights

Community Narratives