Warren Buffett famously said, 'Volatility is far from synonymous with risk.' When we think about how risky a company is, we always like to look at its use of debt, since debt overload can lead to ruin. We can see that SSR Mining Inc. (TSE:SSRM) does use debt in its business. But should shareholders be worried about its use of debt?

When Is Debt A Problem?

Debt is a tool to help businesses grow, but if a business is incapable of paying off its lenders, then it exists at their mercy. If things get really bad, the lenders can take control of the business. However, a more usual (but still expensive) situation is where a company must dilute shareholders at a cheap share price simply to get debt under control. Of course, debt can be an important tool in businesses, particularly capital heavy businesses. The first step when considering a company's debt levels is to consider its cash and debt together.

View our latest analysis for SSR Mining

What Is SSR Mining's Net Debt?

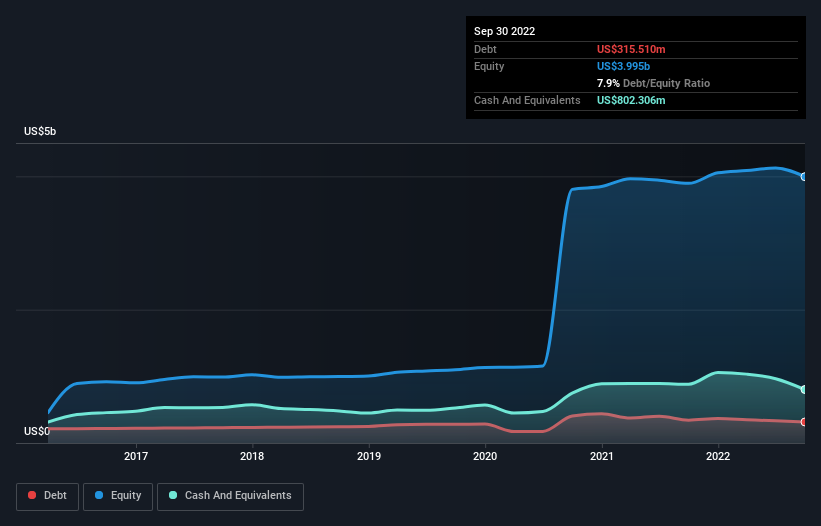

The image below, which you can click on for greater detail, shows that SSR Mining had debt of US$315.5m at the end of September 2022, a reduction from US$343.1m over a year. However, its balance sheet shows it holds US$802.3m in cash, so it actually has US$486.8m net cash.

How Strong Is SSR Mining's Balance Sheet?

Zooming in on the latest balance sheet data, we can see that SSR Mining had liabilities of US$247.1m due within 12 months and liabilities of US$753.6m due beyond that. On the other hand, it had cash of US$802.3m and US$136.8m worth of receivables due within a year. So it has liabilities totalling US$61.6m more than its cash and near-term receivables, combined.

Having regard to SSR Mining's size, it seems that its liquid assets are well balanced with its total liabilities. So while it's hard to imagine that the US$3.53b company is struggling for cash, we still think it's worth monitoring its balance sheet. Despite its noteworthy liabilities, SSR Mining boasts net cash, so it's fair to say it does not have a heavy debt load!

The modesty of its debt load may become crucial for SSR Mining if management cannot prevent a repeat of the 48% cut to EBIT over the last year. Falling earnings (if the trend continues) could eventually make even modest debt quite risky. The balance sheet is clearly the area to focus on when you are analysing debt. But it is future earnings, more than anything, that will determine SSR Mining's ability to maintain a healthy balance sheet going forward. So if you want to see what the professionals think, you might find this free report on analyst profit forecasts to be interesting.

But our final consideration is also important, because a company cannot pay debt with paper profits; it needs cold hard cash. SSR Mining may have net cash on the balance sheet, but it is still interesting to look at how well the business converts its earnings before interest and tax (EBIT) to free cash flow, because that will influence both its need for, and its capacity to manage debt. During the last three years, SSR Mining produced sturdy free cash flow equating to 59% of its EBIT, about what we'd expect. This free cash flow puts the company in a good position to pay down debt, when appropriate.

Summing Up

While it is always sensible to look at a company's total liabilities, it is very reassuring that SSR Mining has US$486.8m in net cash. So we don't have any problem with SSR Mining's use of debt. When analysing debt levels, the balance sheet is the obvious place to start. However, not all investment risk resides within the balance sheet - far from it. For example - SSR Mining has 1 warning sign we think you should be aware of.

At the end of the day, it's often better to focus on companies that are free from net debt. You can access our special list of such companies (all with a track record of profit growth). It's free.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSX:SSRM

SSR Mining

Engages in the acquisition, exploration, and development of precious metal resource properties in the United States, Türkiye, Canada, and Argentina.

High growth potential with excellent balance sheet.

Similar Companies

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

Perdana Petroleum Berhad is a Zombie Business with a 27.34% Profit Margin and inflation adjusted revenue Business

Many trends acting at the same time

Engineered for Stability. Positioned for Growth.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026