- Canada

- /

- Metals and Mining

- /

- TSX:SKE

Should Investors Rethink Skeena Resources After Its 87% Surge and Recent Production Update?

Reviewed by Bailey Pemberton

If you have been watching Skeena Resources lately, you are not alone. With a jaw-dropping year-to-date return of 86.7% and a massive 124.9% gain over the past year, it is no wonder investors are asking if this run still has legs or if it is simply running too hot to handle. Over the past five years, Skeena’s stock has delivered a stunning 152.8% return, proving it is not just a recent phenomenon. The last seven days show a modest pullback of -2.2% after a strong 5.2% move up over the past month. These shifts reflect how news in the resource sector is always at play, shaping both sentiment and risk appetite. Whether you are weighing your next move or considering whether to hold on tight, it all comes down to what the numbers say about value.

To cut through the noise, we will dig into Skeena’s current valuation using six classic metrics that gauge whether a stock is truly undervalued. Here is the first headline: Skeena scores a 0 on our value checks, meaning it does not come up as undervalued on any of the typical measures. Still, the story does not end with simple scores. Let us look at how the usual valuation approaches stack up for this company, and keep reading for a fresh perspective on valuation that goes beyond the standard checklist.

Skeena Resources scores just 0/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: Skeena Resources Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow (DCF) model estimates a company's intrinsic value by projecting its future cash flows and discounting them back to their value today. This approach gives investors a way to look past the short-term market noise and focus squarely on the fundamentals.

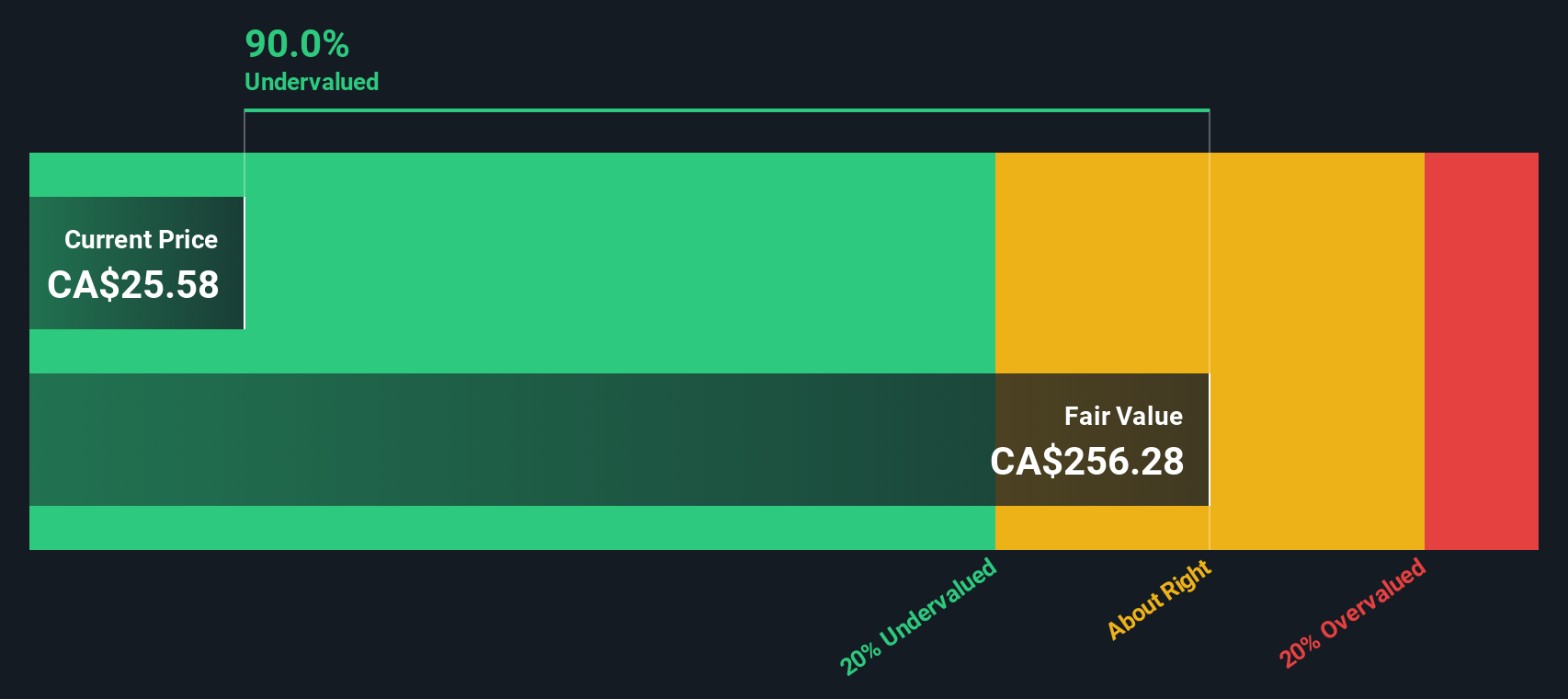

For Skeena Resources, the most recent reported Free Cash Flow (FCF) stands at -CA$221.7 million, reflecting ongoing operational and development costs typical for a pre-production mining company. According to analysts, cash flow projections turn positive over the next five years, with a notable swing to CA$253 million by 2029. Beyond these analyst estimates, Simply Wall St extrapolates FCF changes up to 2035, projecting values that fluctuate but trend toward stability.

Using these cash flow estimates and discounting them, the DCF model arrives at an intrinsic value of CA$11.18 per share for Skeena. Compared to the current market price, this calculation suggests the stock is trading at a 126.0% premium. In other words, it appears significantly overvalued based on baseline cash flow assumptions.

Result: OVERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Skeena Resources may be overvalued by 126.0%. Find undervalued stocks or create your own screener to find better value opportunities.

Approach 2: Skeena Resources Price vs Book Value

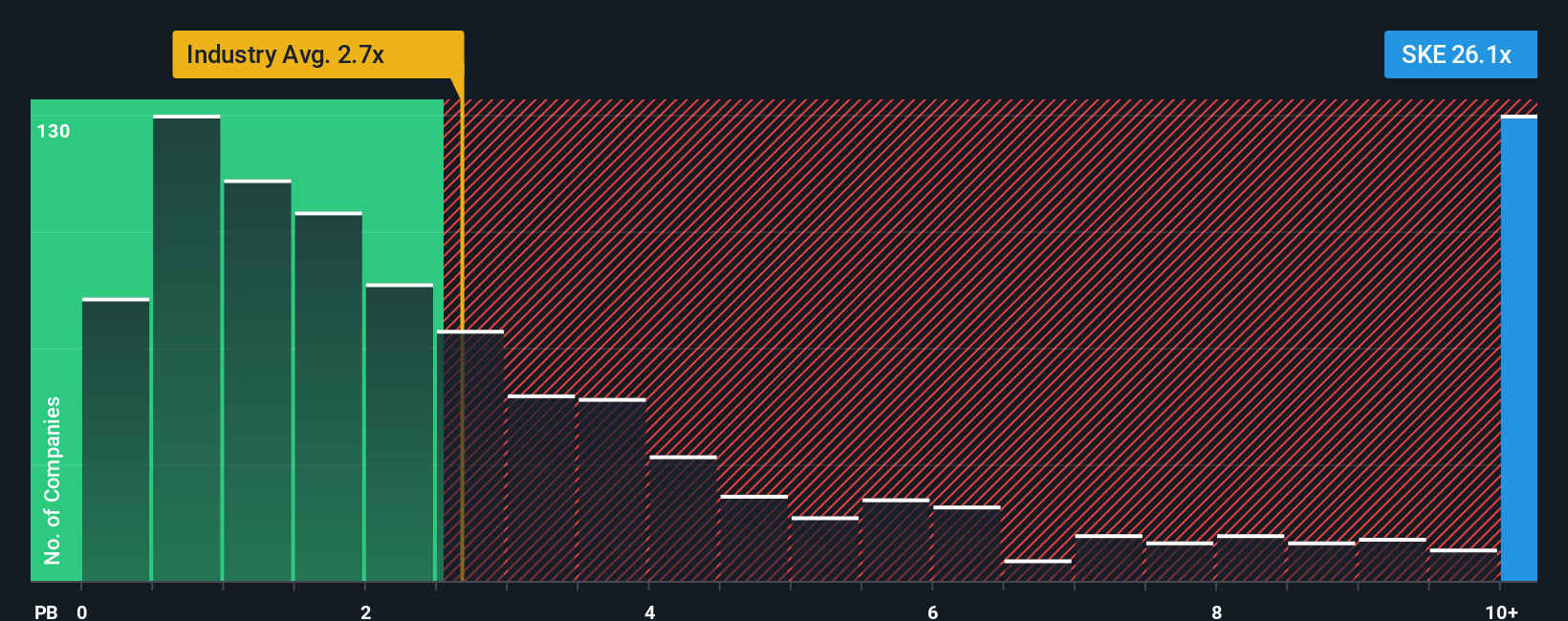

The price-to-book (P/B) ratio is often the go-to metric for evaluating mining and resource companies, especially when earnings are erratic or negative. It helps investors judge whether the company’s assets, such as mining properties and equipment, are being valued sensibly by the market. Typically, a lower P/B ratio signals that a stock might be undervalued, but this only tells part of the story. Companies with higher growth prospects or lower risk often trade at a premium.

Looking at the numbers, Skeena Resources’ current P/B ratio stands at a sky-high 25.8x, which is well above the Metals and Mining industry average of 2.6x and the peer group average of 6.2x. Such a premium suggests investors are paying a lot relative to the company’s net assets, possibly banking on significant upside or future value creation.

Simply Wall St’s proprietary Fair Ratio model steps in here. Unlike basic peer comparisons, the Fair Ratio accounts for factors like earnings trajectory, risk profile, profit margins, and the company’s size within its sector. This produces a more tailored benchmark for what Skeena’s P/B should be, given its unique circumstances and outlook.

In Skeena’s case, the actual P/B ratio is much higher than any reasonable Fair Ratio, highlighting that the stock is firmly in overvalued territory based on this approach.

Result: OVERVALUED

PB ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Skeena Resources Narrative

Earlier we mentioned that there is an even better way to understand valuation. Let us introduce you to Narratives. A Narrative is your personal investment story for a company, combining your outlook and assumptions about future growth, earnings, and margins with the financial forecast and fair value you believe in. Narratives bridge the gap between a company’s story and its underlying numbers, helping you connect what you know with what you can calculate.

On Simply Wall St’s Community page, millions of investors use Narratives to easily express and test their perspectives, with no technical expertise required. Narratives automatically update as new information, such as news or earnings, becomes available. This ensures your thesis reflects the latest market developments. With this tool, you can quickly sense-check your buying or selling timing by seeing if your Fair Value aligns with the current share Price. For Skeena Resources, one investor’s Narrative could reflect a high conviction in exploration success and a CA$16 Fair Value, while another could take a more cautious view, setting Fair Value closer to CA$8. Narratives make it simple and dynamic to see where you stand and what the crowd thinks at any moment.

Do you think there's more to the story for Skeena Resources? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:SKE

Skeena Resources

Engages in the exploration and development of mineral properties in Canada.

Excellent balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives