- Canada

- /

- Metals and Mining

- /

- TSX:SEA

What Seabridge Gold (TSX:SEA)'s Valor Gold Spinout Means For Shareholders

Reviewed by Sasha Jovanovic

- Earlier in 2025, Seabridge Gold Inc. announced plans to spin out its wholly owned subsidiary Seabridge Gold (NWT) Inc., to be renamed Valor Gold, which holds the Courageous Lake Gold Project in Canada’s Northwest Territories and is expected to list on a major stock exchange with shares distributed to existing Seabridge shareholders.

- The move is designed to highlight and advance Courageous Lake as a standalone gold company, potentially giving investors more flexibility in how they gain exposure to Seabridge’s portfolio of assets beyond its flagship KSM project.

- Next, we’ll examine how separating Courageous Lake into Valor Gold could reshape Seabridge’s investment narrative and portfolio focus.

The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

What Is Seabridge Gold's Investment Narrative?

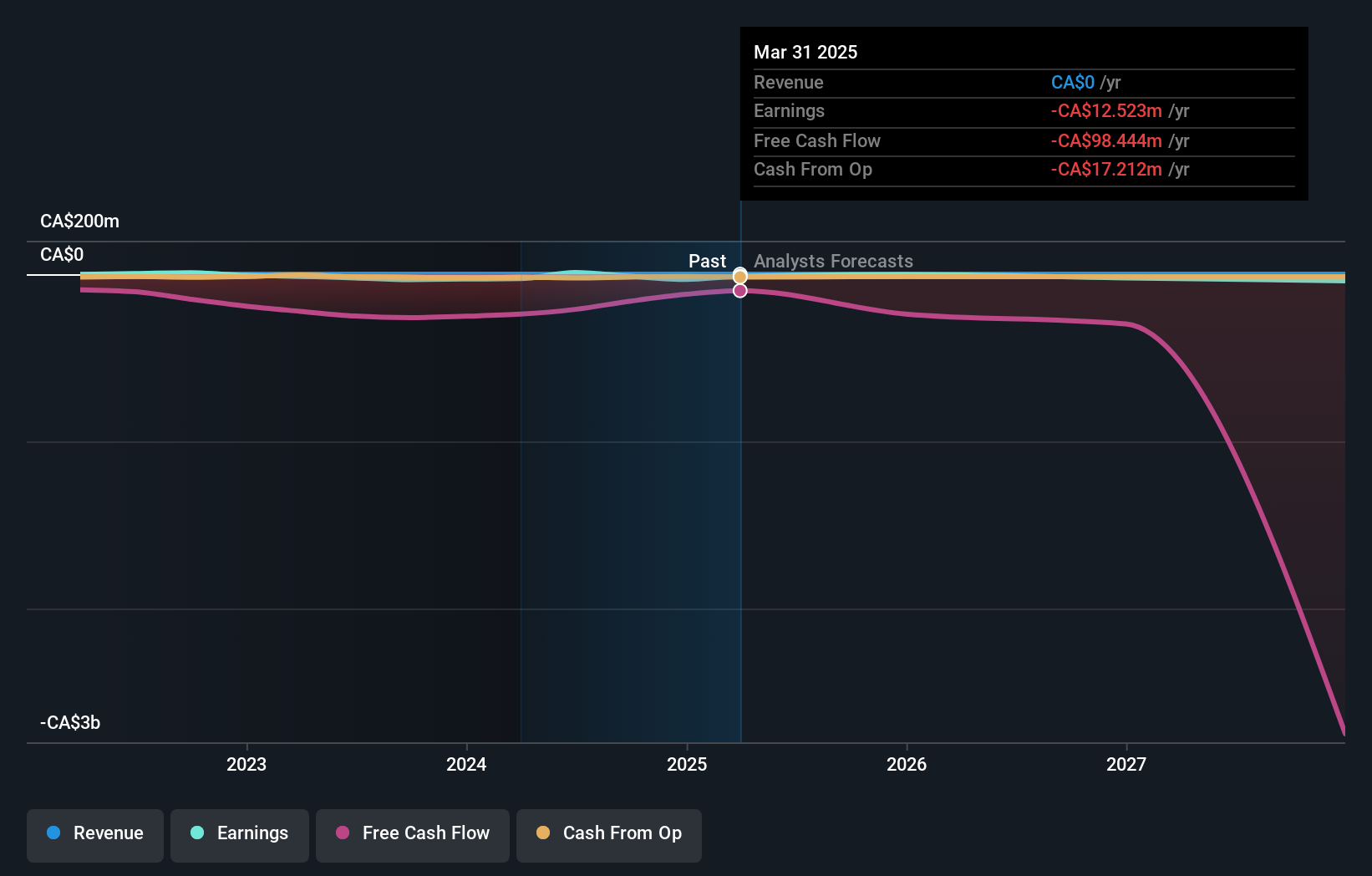

To own Seabridge, you really have to believe in the long game of permitting, funding and eventually monetizing very large, long‑life gold and copper deposits, despite zero current revenue and recurring losses. Near term, the story is still driven by progress at KSM, access to capital after the heavy 2025 equity issuance, and how efficiently management deploys its fresh CA$147 million‑plus in proceeds. The planned Valor Gold spin‑out fits into this by potentially sharpening Seabridge’s focus on KSM while giving Courageous Lake its own currency and investor base, which could modestly shift what investors watch in the short term toward transaction terms, listing timing and any follow‑on financing needs. The biggest risk, though, remains Seabridge’s dependence on external funding with less than a year of cash runway and no operating cash flow.

However, one financing risk in particular is worth understanding in more detail before getting comfortable as a shareholder. Upon reviewing our latest valuation report, Seabridge Gold's share price might be too optimistic.Exploring Other Perspectives

Explore 2 other fair value estimates on Seabridge Gold - why the stock might be worth as much as 50% more than the current price!

Build Your Own Seabridge Gold Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Seabridge Gold research is our analysis highlighting 4 important warning signs that could impact your investment decision.

- Our free Seabridge Gold research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Seabridge Gold's overall financial health at a glance.

Want Some Alternatives?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- We've found 13 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 33 best rare earth metal stocks of the very few that mine this essential strategic resource.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:SEA

Seabridge Gold

Engages in the acquisition and exploration of gold properties in North America.

Slight risk and overvalued.

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

A case for USD $14.81 per share based on book value. Be warned, this is a micro-cap dependent on a single mine.

Occidental Petroleum to Become Fairly Priced at $68.29 According to Future Projections

Agfa-Gevaert is a digital and materials turnaround opportunity, with growth potential in ZIRFON, but carrying legacy risks.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)