- Canada

- /

- Metals and Mining

- /

- TSXV:RDU

RTG Mining Leads 3 Promising Penny Stocks On The TSX

Reviewed by Simply Wall St

As Canada navigates the economic implications of new U.S. policies, including energy reforms and potential tariff changes, the TSX index has shown resilience with a positive trend since Inauguration Day. Penny stocks, while often seen as a term from past market eras, continue to offer intriguing investment opportunities due to their affordability and growth potential. In this article, we explore three promising penny stocks on the TSX that stand out for their financial strength and potential upside in today's market conditions.

Top 10 Penny Stocks In Canada

| Name | Share Price | Market Cap | Financial Health Rating |

| Alvopetro Energy (TSXV:ALV) | CA$4.95 | CA$182.43M | ★★★★★★ |

| Silvercorp Metals (TSX:SVM) | CA$4.46 | CA$944.22M | ★★★★★★ |

| Mandalay Resources (TSX:MND) | CA$4.57 | CA$422.59M | ★★★★★★ |

| Pulse Seismic (TSX:PSD) | CA$2.29 | CA$125.06M | ★★★★★★ |

| Foraco International (TSX:FAR) | CA$2.21 | CA$220.49M | ★★★★★☆ |

| Findev (TSXV:FDI) | CA$0.48 | CA$14.18M | ★★★★★★ |

| PetroTal (TSX:TAL) | CA$0.67 | CA$619.93M | ★★★★★★ |

| NamSys (TSXV:CTZ) | CA$1.00 | CA$26.86M | ★★★★★★ |

| East West Petroleum (TSXV:EW) | CA$0.04 | CA$3.62M | ★★★★★★ |

| DIRTT Environmental Solutions (TSX:DRT) | CA$1.14 | CA$214.68M | ★★★★☆☆ |

Click here to see the full list of 931 stocks from our TSX Penny Stocks screener.

Let's review some notable picks from our screened stocks.

RTG Mining (TSX:RTG)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: RTG Mining Inc. is involved in the exploration and development of mineral properties, with a market cap of CA$33.86 million.

Operations: RTG Mining Inc. has not reported any revenue segments.

Market Cap: CA$33.86M

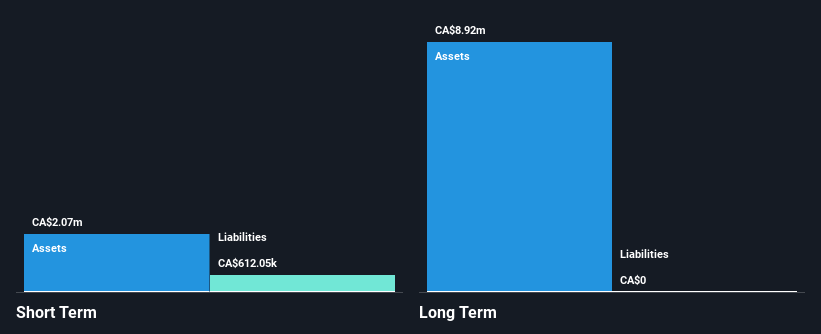

RTG Mining Inc., with a market cap of CA$33.86 million, is currently pre-revenue and unprofitable, yet it has reduced losses by 25% annually over the past five years. Despite having less than a year of cash runway, RTG's financial position shows short-term assets of $3.2M exceeding both short-term liabilities ($1.2M) and long-term liabilities ($651K), while remaining debt-free. The seasoned management team and board bring stability to the company amid recent delisting from OTC Equity due to inactivity, reflecting potential challenges in maintaining investor interest amidst high share price volatility over the last three months.

- Click here and access our complete financial health analysis report to understand the dynamics of RTG Mining.

- Learn about RTG Mining's historical performance here.

Radius Gold (TSXV:RDU)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Radius Gold Inc. is involved in the acquisition and exploration of mineral properties, with a market capitalization of CA$11.28 million.

Operations: Currently, Radius Gold Inc. does not report any revenue segments.

Market Cap: CA$11.28M

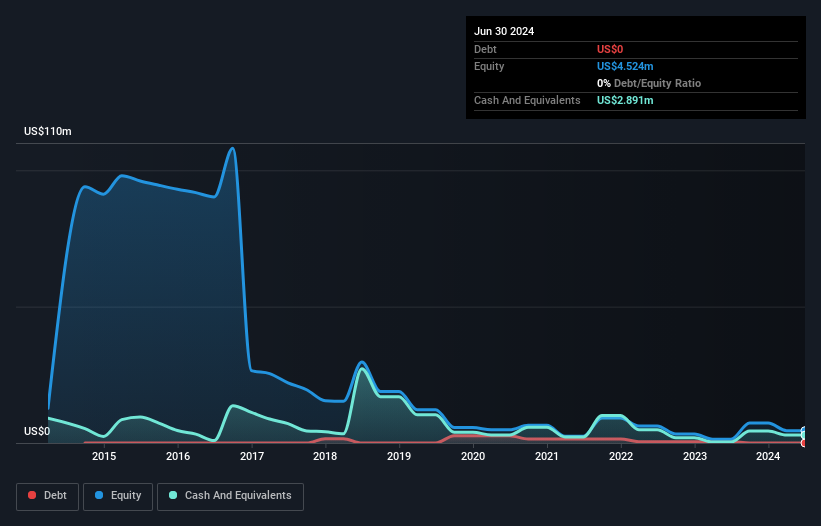

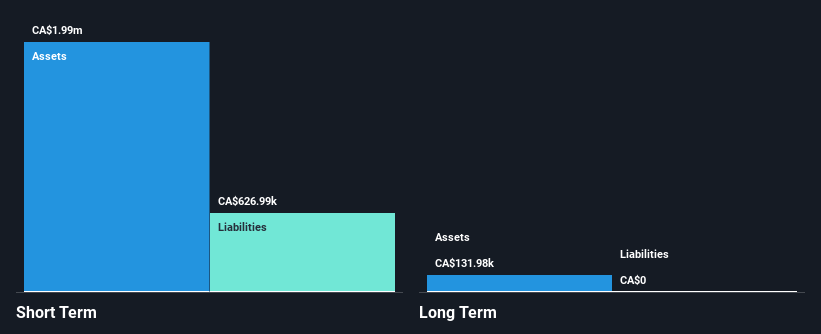

Radius Gold Inc., with a market capitalization of CA$11.28 million, is pre-revenue and unprofitable but has reduced losses over the past year. The company recently expanded its Tierra Roja Project in Peru from 600 to 1,870 hectares, indicating potential exploration upside. Despite high share price volatility and a negative return on equity, Radius remains debt-free with short-term assets of CA$1.1M exceeding liabilities by a considerable margin. Its seasoned management team continues to explore promising geological formations at Tierra Roja, supported by recent capital raises that extend its cash runway beyond seven months.

- Get an in-depth perspective on Radius Gold's performance by reading our balance sheet health report here.

- Gain insights into Radius Gold's past trends and performance with our report on the company's historical track record.

Group Eleven Resources (TSXV:ZNG)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Group Eleven Resources Corp. is a mineral exploration company focused on acquiring, exploring, and evaluating mineral properties in Ireland, with a market cap of CA$40.46 million.

Operations: The company has not reported any revenue segments.

Market Cap: CA$40.46M

Group Eleven Resources Corp., with a market cap of CA$40.46 million, is pre-revenue and focuses on its Ballywire zinc-lead-silver discovery in Ireland. Recent drilling results revealed high-grade mineralization, including germanium, which has strategic importance due to its applications in high-tech industries. Despite being debt-free and having short-term assets exceeding liabilities, the company faces financial challenges with less than a year of cash runway and ongoing losses. The management team is experienced, and recent board appointments suggest strategic efforts to navigate the junior mining sector's complexities while continuing exploration activities at Ballywire.

- Take a closer look at Group Eleven Resources' potential here in our financial health report.

- Assess Group Eleven Resources' previous results with our detailed historical performance reports.

Turning Ideas Into Actions

- Embark on your investment journey to our 931 TSX Penny Stocks selection here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSXV:RDU

Radius Gold

Engages in the acquisition and exploration of mineral properties.

Flawless balance sheet low.

Market Insights

Community Narratives