- Canada

- /

- Metals and Mining

- /

- TSX:QRC

Exploring Canada's Undervalued Small Caps With Insider Buying In October 2024

Reviewed by Simply Wall St

As we head into the fourth quarter, the Canadian stock market has experienced volatility following a strong performance earlier in the year, driven by uncertainties surrounding global events and economic indicators. Despite these challenges, solid fundamentals in both U.S. and Canadian economies provide a backdrop for exploring investment opportunities in small-cap stocks, particularly those that may be undervalued and exhibit insider buying—a potential signal of confidence amid current market conditions.

Top 10 Undervalued Small Caps With Insider Buying In Canada

| Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

| Trican Well Service | 7.5x | 0.9x | 15.36% | ★★★★★☆ |

| Nexus Industrial REIT | 3.7x | 3.7x | 21.66% | ★★★★★☆ |

| AutoCanada | NA | 0.1x | 48.68% | ★★★★★☆ |

| Foraco International | 5.5x | 0.5x | -25.90% | ★★★★☆☆ |

| Rogers Sugar | 15.4x | 0.6x | 48.00% | ★★★★☆☆ |

| Primaris Real Estate Investment Trust | 12.4x | 3.3x | 48.15% | ★★★★☆☆ |

| Sagicor Financial | 1.3x | 0.3x | -42.32% | ★★★★☆☆ |

| Vermilion Energy | NA | 1.2x | -73.71% | ★★★★☆☆ |

| Calfrac Well Services | 2.5x | 0.2x | -59.32% | ★★★☆☆☆ |

| Spartan Delta | 4.5x | 2.3x | -45.34% | ★★★☆☆☆ |

We're going to check out a few of the best picks from our screener tool.

Badger Infrastructure Solutions (TSX:BDGI)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Badger Infrastructure Solutions specializes in providing non-destructive excavating services, with a market cap of approximately CAD $1.14 billion.

Operations: Badger Infrastructure Solutions generates revenue primarily from its non-destructive excavating services, with recent quarterly revenue reaching $717.10 million. The company's cost of goods sold (COGS) was $514.27 million, resulting in a gross profit margin of 28.29%. Operating expenses include significant allocations to general and administrative costs and depreciation & amortization, impacting the net income margin which stood at 5.81% for the latest period analyzed.

PE: 23.4x

Badger Infrastructure Solutions, a Canadian company with a market capitalization often considered smaller in scale, is catching attention due to its earnings growth forecast of 36.46% annually. Despite carrying high external debt risk, the firm reported increased sales for Q2 2024 at US$186.84 million from US$171.89 million the previous year and net income rising to US$11.91 million from US$11.01 million. Insider confidence was evident as they purchased shares recently, reflecting optimism about future prospects amidst discussions on potential share repurchases and consistent dividend payouts of C$0.18 per share for Q3 2024.

Queen's Road Capital Investment (TSX:QRC)

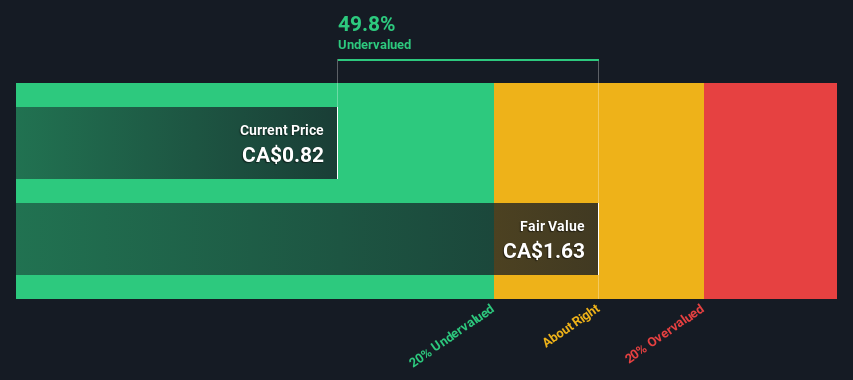

Simply Wall St Value Rating: ★★★☆☆☆

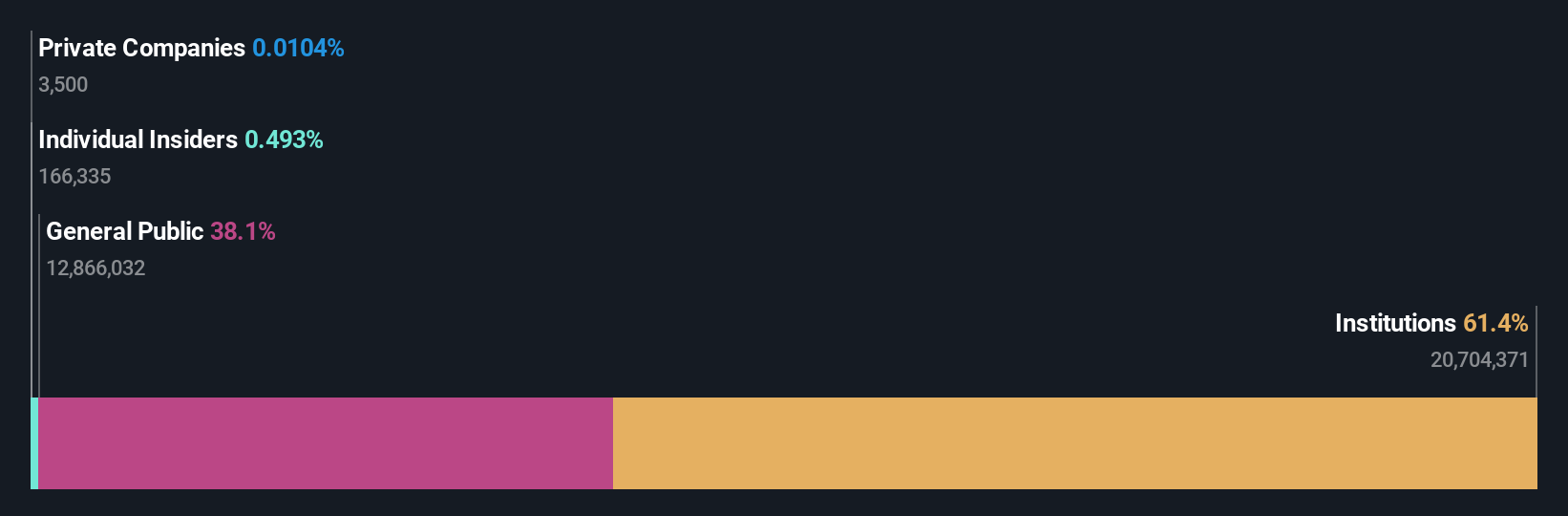

Overview: Queen's Road Capital Investment focuses on the selection, acquisition, and management of investments with a market capitalization of approximately CAD 1.02 billion.

Operations: Queen's Road Capital Investment generates revenue primarily from the selection, acquisition, and management of investments, with recent figures showing $115.10 million in this segment. The company has consistently shown a gross profit margin of 100%, indicating no cost of goods sold is reported against its revenues. Operating expenses have been observed to fluctuate over time but are currently at $3.72 million, impacting net income margins which have varied significantly across periods.

PE: 2.4x

Queen's Road Capital Investment, a Canadian investment company, has shown promising financial performance with USD 30.15 million in net income for the third quarter of 2024, bouncing back from a loss the previous year. The company recently completed a CAD 14.99 million private placement and repurchased shares worth CAD 0.57 million between March and May 2024, reflecting strategic capital management. Their focus on high-quality earnings and insider confidence through share purchases could signal potential growth opportunities despite reliance on external borrowing for funding.

Vermilion Energy (TSX:VET)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Vermilion Energy is a Canadian company engaged in the exploration and production of oil and gas, with a market cap of CA$3.5 billion.

Operations: The company generates revenue primarily from oil and gas exploration and production, with a recent quarterly revenue of CA$1.81 billion. The gross profit margin has shown fluctuations, most recently recorded at 65.72%. Operating expenses have varied significantly, impacting overall profitability, with the latest net income margin at -45.56%.

PE: -2.6x

Vermilion Energy, a smaller Canadian player in the energy sector, is making strategic moves to bolster its position. Recent operational updates highlight successful deep gas exploration in Germany and increased production in Croatia, with promising flow test results. Despite a net loss of C$82 million for Q2 2024, insider confidence remains evident through share repurchases totaling 6.9 million shares for C$112 million since July 2023. With plans to expand drilling activities and optimize costs, Vermilion aims to enhance future returns amidst fluctuating market conditions.

Next Steps

- Gain an insight into the universe of 17 Undervalued TSX Small Caps With Insider Buying by clicking here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Queen's Road Capital Investment might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:QRC

Queen's Road Capital Investment

A resource focused investment company, invests in privately held and publicly traded resource companies.

Solid track record with adequate balance sheet.