- Canada

- /

- Metals and Mining

- /

- TSX:PAAS

Will a Bigger Dividend and Juanicipio Deal Reshape Pan American Silver's (TSX:PAAS) Investment Narrative?

Reviewed by Sasha Jovanovic

- Pan American Silver recently increased its quarterly dividend by 20% in the second quarter of 2025 and moved forward with a US$500 million deal to acquire full ownership of the Juanicipio project, aiming to improve silver production and reduce costs.

- This commitment to shareholder returns comes while the company continues to face uncertainty at its Escobal mine in Guatemala due to ongoing local opposition and legal issues.

- We’ll examine how the Juanicipio acquisition progress and enhanced dividends shape Pan American Silver’s broader investment narrative.

Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

What Is Pan American Silver's Investment Narrative?

For anyone considering Pan American Silver, it’s really about whether you buy into the company’s efforts to boost production and return capital to shareholders, while managing complex risks. The 20% dividend increase highlights a strong commitment to direct shareholder returns, especially following a period of rising earnings, robust sales, and index inclusion. Importantly, the Juanicipio acquisition looks set to play into one of the biggest short-term catalysts, higher silver output and potentially lower costs. This could ease some concerns about growth amid limited production guidance increases. At the same time, persistent local opposition and legal wrangling keeping the Escobal mine idle still represent the company’s largest operational risk, offsetting some of these positive catalysts. The new developments are meaningful, but don’t eliminate the mine’s unresolved status as a key uncertainty. On the other hand, potential for a reopening at Escobal remains an important unknown investors should pay attention to.

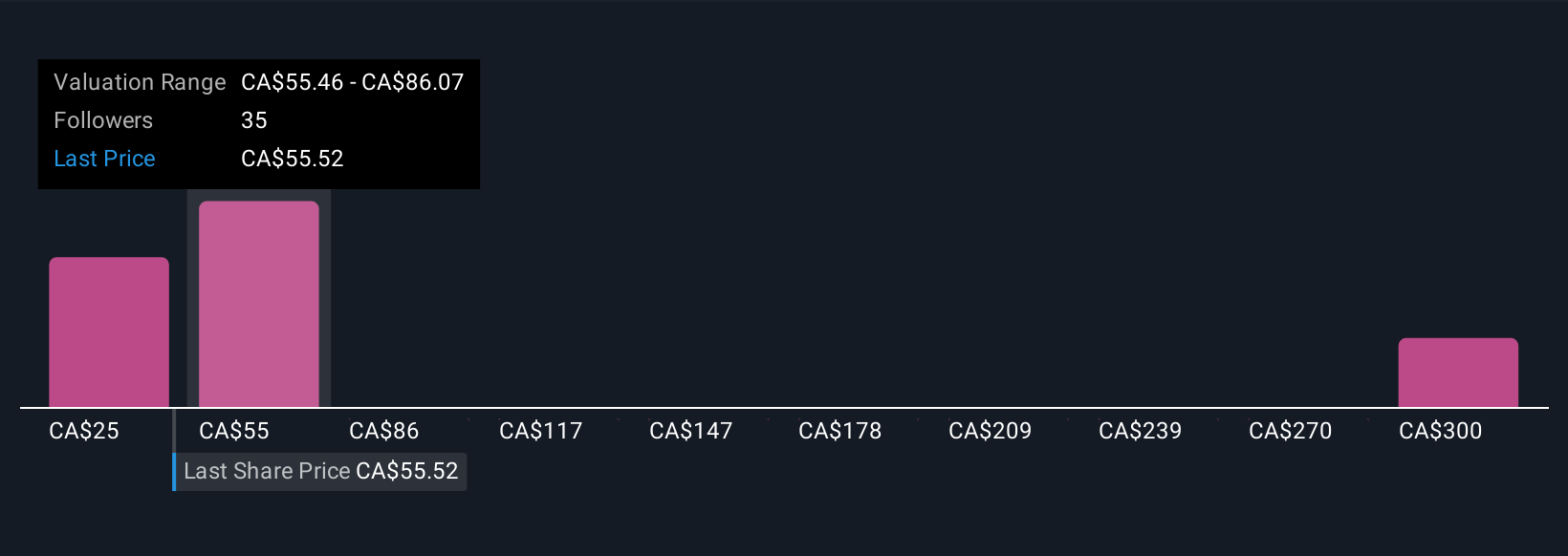

Pan American Silver's share price has been on the slide but might be dropping deeper into value territory. Find out whether it's a bargain at this price.Exploring Other Perspectives

Explore 7 other fair value estimates on Pan American Silver - why the stock might be worth less than half the current price!

Build Your Own Pan American Silver Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Pan American Silver research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Pan American Silver research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Pan American Silver's overall financial health at a glance.

Want Some Alternatives?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- Find companies with promising cash flow potential yet trading below their fair value.

- The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:PAAS

Pan American Silver

Engages in the exploration, mine development, extraction, processing, refining, and reclamation of mines in Canada, Mexico, Peru, Bolivia, Argentina, Chile, and Brazil.

Excellent balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives