Stock Analysis

- Canada

- /

- Metals and Mining

- /

- TSX:IVN

Ivanhoe Mines And Two Additional TSX Stocks Considered For Value Investing

Reviewed by Simply Wall St

In recent weeks, Canadian markets have shown resilience amidst global economic shifts, with the TSX displaying stability even as tech sectors experienced volatility and interest rates declined. This environment underscores the importance of identifying stocks with solid fundamentals that can offer value in a landscape where diversified investment strategies are becoming increasingly crucial.

Top 10 Undervalued Stocks Based On Cash Flows In Canada

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Trisura Group (TSX:TSU) | CA$44.28 | CA$79.84 | 44.5% |

| Kraken Robotics (TSXV:PNG) | CA$1.13 | CA$2.24 | 49.5% |

| Endeavour Mining (TSX:EDV) | CA$31.04 | CA$50.00 | 37.9% |

| Viemed Healthcare (TSX:VMD) | CA$10.45 | CA$20.08 | 48% |

| Amerigo Resources (TSX:ARG) | CA$1.55 | CA$2.74 | 43.4% |

| Hamilton Thorne (TSX:HTL) | CA$2.14 | CA$4.06 | 47.3% |

| Green Thumb Industries (CNSX:GTII) | CA$16.24 | CA$30.15 | 46.1% |

| Opsens (TSX:OPS) | CA$2.90 | CA$4.64 | 37.5% |

| Pan American Silver (TSX:PAAS) | CA$31.59 | CA$60.26 | 47.6% |

| Kits Eyecare (TSX:KITS) | CA$9.83 | CA$16.81 | 41.5% |

Let's take a closer look at a couple of our picks from the screened companies.

Ivanhoe Mines (TSX:IVN)

Overview: Ivanhoe Mines Ltd. is a company focused on the mining, development, and exploration of minerals and precious metals primarily in Africa, with a market capitalization of approximately CA$24.77 billion.

Operations: The company primarily generates revenue from the mining, development, and exploration of minerals and precious metals in Africa.

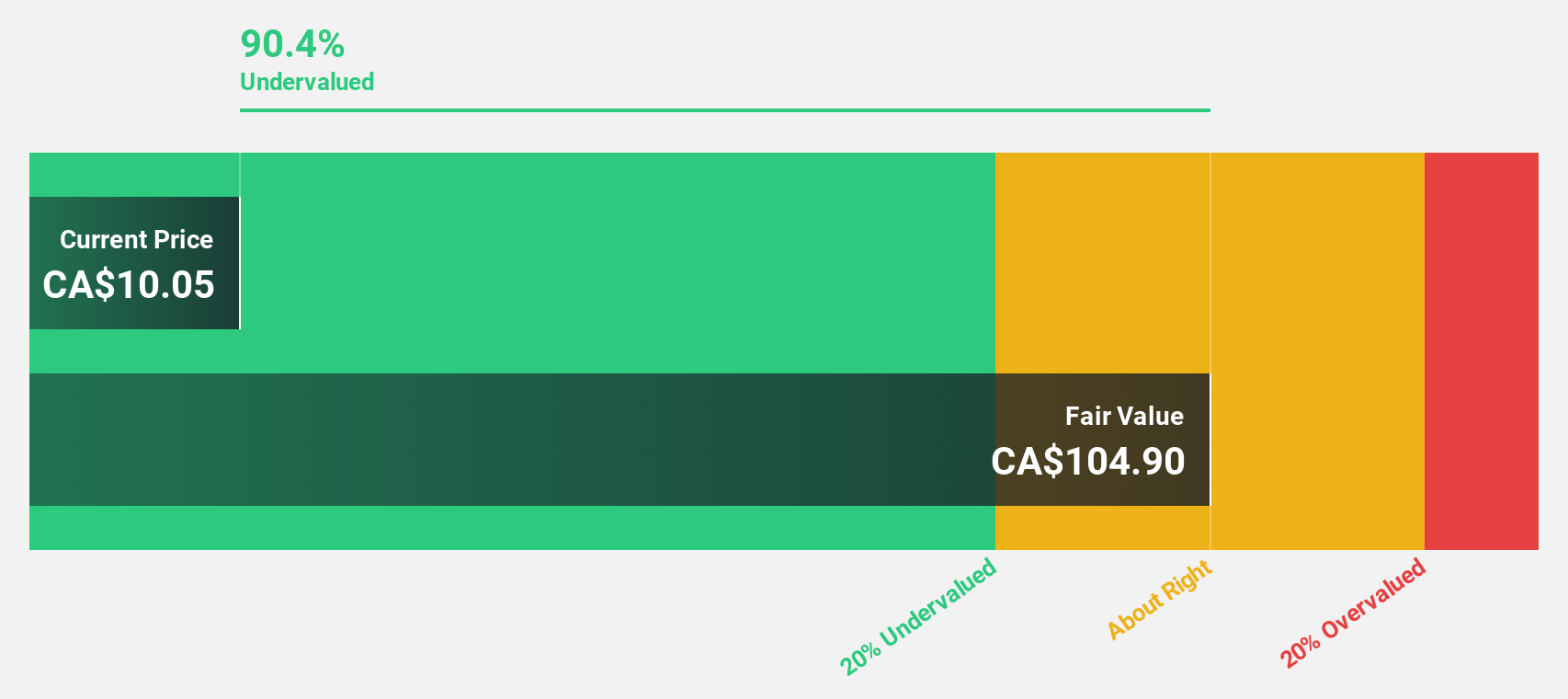

Estimated Discount To Fair Value: 11.4%

Ivanhoe Mines, priced at CA$17.82, is considered undervalued with a fair value estimate of CA$20.12 based on discounted cash flow analysis. Despite recent shareholder dilution and low Return on Equity projections (19.4%), the company's earnings are expected to grow by 67.2% annually, outpacing the Canadian market's 14.8%. Additionally, Ivanhoe's revenue growth forecast at 75.8% annually significantly exceeds market expectations (7.3%). Recent operational advancements include early completion of its Phase 3 concentrator at Kamoa-Kakula, enhancing production capabilities substantially ahead of schedule.

- According our earnings growth report, there's an indication that Ivanhoe Mines might be ready to expand.

- Unlock comprehensive insights into our analysis of Ivanhoe Mines stock in this financial health report.

Pan American Silver (TSX:PAAS)

Overview: Pan American Silver Corp. operates in the exploration, development, extraction, processing, refining, and reclamation of silver and other metals across North and South America with a market capitalization of approximately CA$11.41 billion.

Operations: The company generates revenue from various operations including CA$141.70 million from Huaron, CA$193.90 million from La Arena in Peru, CA$262.60 million from Timmins in Canada, CA$255.50 million from Dolores and CA$106.30 million from La Colorada in Mexico, as well as CA$280.20 million from Shahuindo in Peru, and CA$78.70 million from SAN Vicente in Bolivia.

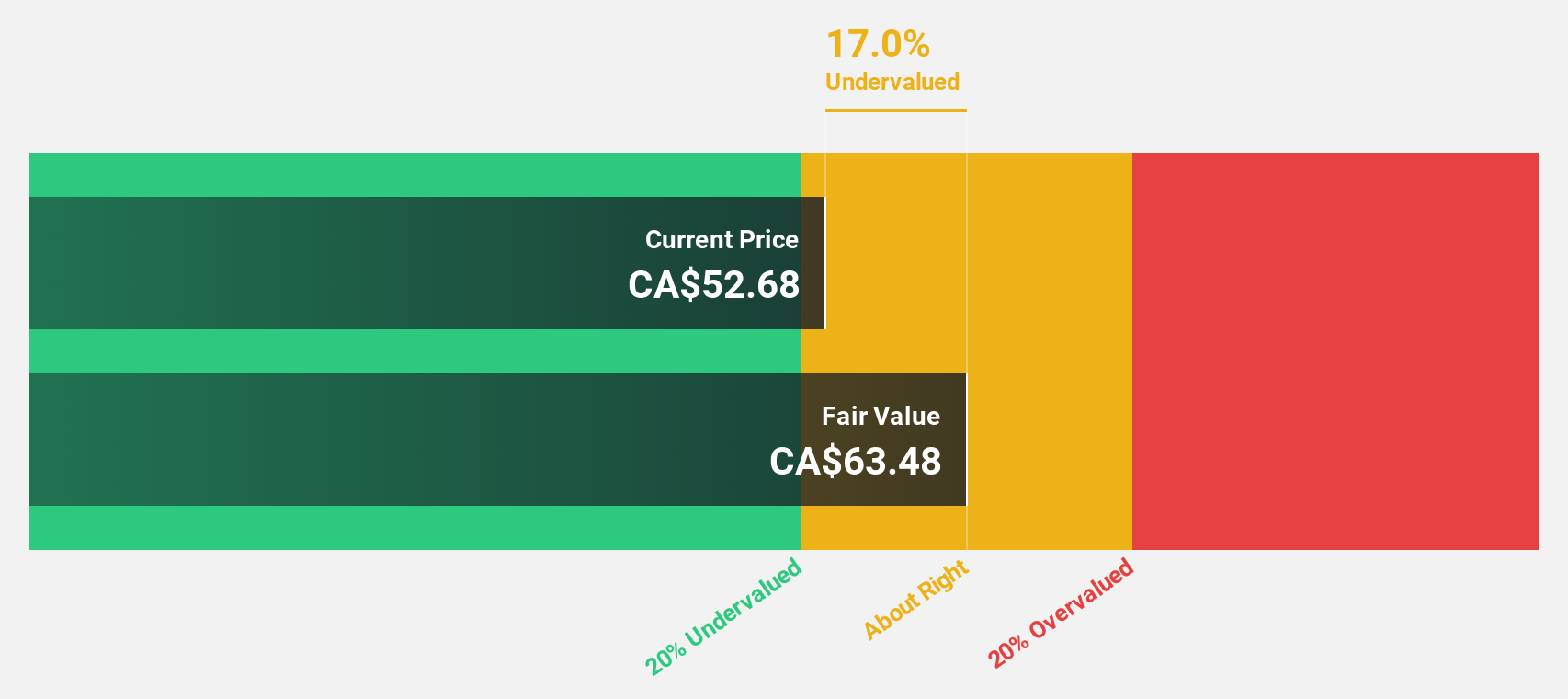

Estimated Discount To Fair Value: 47.6%

Pan American Silver, trading at CA$31.59, is recognized as significantly undervalued based on a discounted cash flow (DCF) analysis, with an estimated fair value of CA$60.26. The company is poised for profitability within the next three years, showcasing potential above-average market growth. However, its revenue growth forecast at 1.6% per year lags behind the Canadian market projection of 7.3%. Recent strategic moves include active exploration and potential M&A to bolster its asset base and enhance operational synergies, evidenced by promising drill results across multiple properties and ongoing acquisition searches.

- Our growth report here indicates Pan American Silver may be poised for an improving outlook.

- Click here to discover the nuances of Pan American Silver with our detailed financial health report.

Triple Flag Precious Metals (TSX:TFPM)

Overview: Triple Flag Precious Metals Corp. is a streaming and royalty company focused on precious metals, managing assets across multiple countries including Australia, Canada, and the United States, with a market capitalization of approximately CA$4.39 billion.

Operations: The company's revenue from acquiring and managing precious metal streams and royalties totaled $211.28 million.

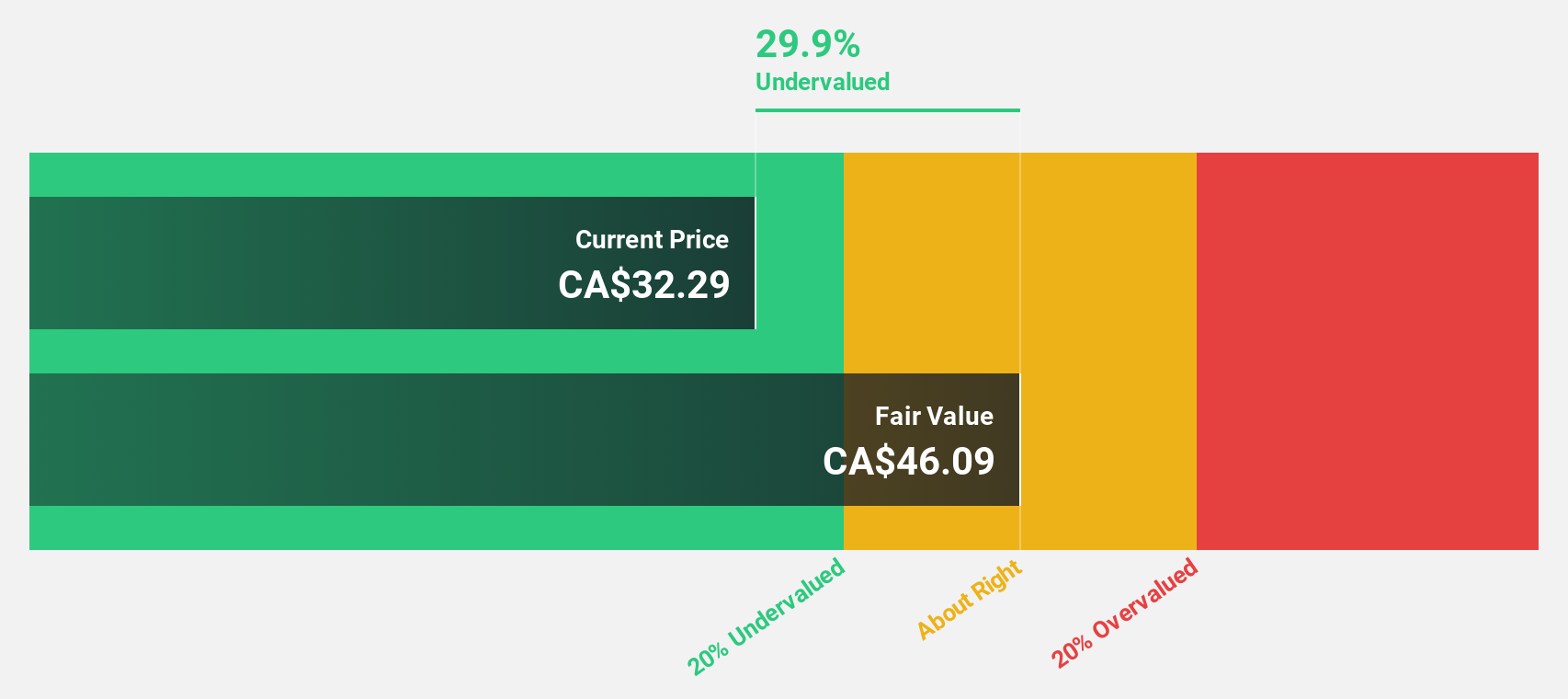

Estimated Discount To Fair Value: 14.8%

Triple Flag Precious Metals, valued at CA$21.42, appears undervalued compared to a fair value estimate of CA$25.14 based on discounted cash flow analysis. Despite significant insider selling recently, the company's earnings are expected to grow by 37.6% annually, outpacing the Canadian market's 14.8%. However, profit margins have declined from last year's 33.9% to 17.6%. Recent leadership changes with Sheldon Vanderkooy taking over as CEO may influence future strategic directions and stability.

- Our earnings growth report unveils the potential for significant increases in Triple Flag Precious Metals' future results.

- Navigate through the intricacies of Triple Flag Precious Metals with our comprehensive financial health report here.

Turning Ideas Into Actions

- Click here to access our complete index of 24 Undervalued TSX Stocks Based On Cash Flows.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:IVN

Ivanhoe Mines

Engages in the mining, development, and exploration of minerals and precious metals primarily in Africa.

High growth potential slight.