- Canada

- /

- Metals and Mining

- /

- TSX:ORE

Enghouse Systems And 2 Other Undiscovered Gems In Canada

Reviewed by Simply Wall St

As trade tensions ease with new agreements and the Federal Reserve maintains its interest rate stance, the Canadian market is navigating a landscape of mixed economic indicators, including a stable yet cautious approach by the Bank of Canada. In this environment, investors may find opportunities in lesser-known stocks that demonstrate resilience and potential for growth amid evolving market conditions.

Top 10 Undiscovered Gems With Strong Fundamentals In Canada

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| TWC Enterprises | 4.02% | 13.46% | 16.81% | ★★★★★★ |

| Yellow Pages | NA | -11.96% | -15.73% | ★★★★★★ |

| Pinetree Capital | 0.20% | 63.68% | 65.79% | ★★★★★★ |

| Itafos | 25.35% | 11.11% | 49.69% | ★★★★★★ |

| Reconnaissance Energy Africa | NA | 9.16% | 15.11% | ★★★★★★ |

| Mako Mining | 8.59% | 38.81% | 59.80% | ★★★★★☆ |

| Corby Spirit and Wine | 59.18% | 8.79% | -5.67% | ★★★★☆☆ |

| Genesis Land Development | 48.16% | 31.08% | 55.45% | ★★★★☆☆ |

| Senvest Capital | 81.59% | -11.73% | -12.63% | ★★★★☆☆ |

| Dundee | 3.91% | -36.42% | 49.66% | ★★★★☆☆ |

Let's dive into some prime choices out of from the screener.

Enghouse Systems (TSX:ENGH)

Simply Wall St Value Rating: ★★★★★★

Overview: Enghouse Systems Limited, along with its subsidiaries, is involved in the development of enterprise software solutions globally and has a market capitalization of approximately CA$1.45 billion.

Operations: Enghouse Systems generates revenue primarily from its Asset Management Group and Interactive Management Group, contributing CA$200.01 million and CA$306.00 million, respectively.

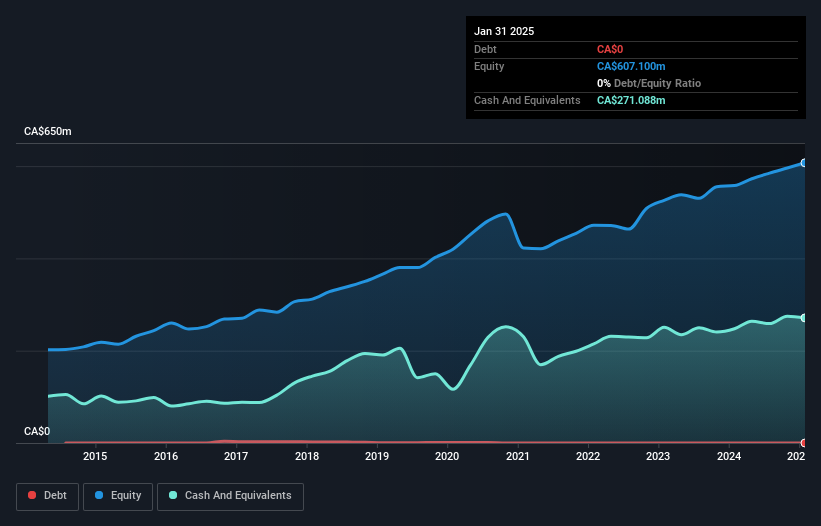

Enghouse Systems, a nimble player in the tech space, is leveraging its debt-free status and solid cash flow to drive growth. Recent strategic acquisitions like Aculab and Margento aim to boost service offerings in high-demand sectors. Despite earnings growth of 16% lagging behind the software industry’s 42%, Enghouse's net income rose to CAD 21.9 million from CAD 18.13 million year-over-year, with EPS climbing to CAD 0.4 from CAD 0.33. The company repurchased shares worth CAD 10.9 million recently, potentially enhancing shareholder value as it trades at a notable discount of around 48% below fair value estimates.

Orezone Gold (TSX:ORE)

Simply Wall St Value Rating: ★★★★★☆

Overview: Orezone Gold Corporation focuses on the mining, exploration, and development of gold properties with a market capitalization of approximately CA$563.85 million.

Operations: Orezone Gold generates revenue primarily from the acquisition, exploration, and potential development of precious metal properties, amounting to $283.52 million.

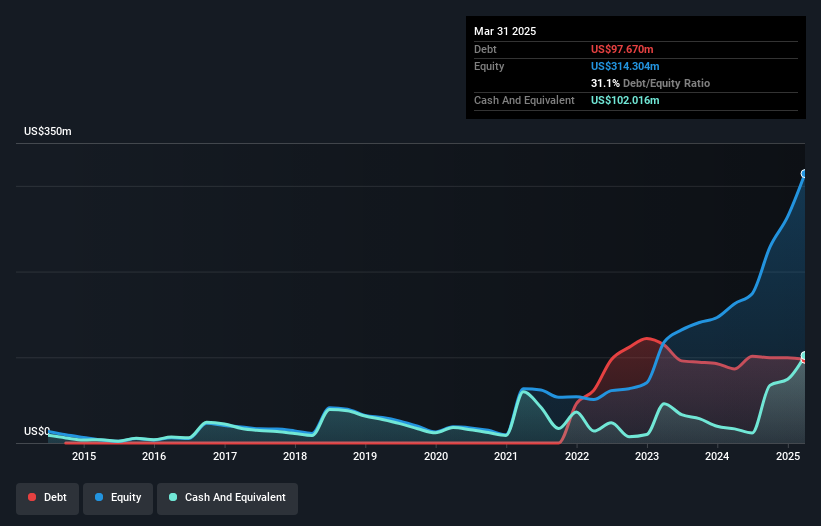

Orezone Gold is making significant strides with its Bomboré Gold Mine, marked by a 65.2% annual earnings growth over the past five years and robust net income of US$15.98 million for Q1 2025, up from US$11.7 million the previous year. The company is advancing its Phase 2 expansion to boost production to between 220,000 and 250,000 ounces annually by late 2026. Despite facing short-term challenges such as increased CapEx and regional power issues, Orezone's strategic investments in a diesel power plant and tailings management are expected to enhance operational efficiency while maintaining a satisfactory net debt-to-equity ratio of 9.5%.

Rogers Sugar (TSX:RSI)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Rogers Sugar Inc. is involved in the refining, packaging, marketing, and distribution of sugar, maple, and related products across Canada, the United States, Europe, and internationally with a market cap of CA$721.02 million.

Operations: Rogers Sugar generates revenue through the sale of refined sugar and maple products across various regions, including Canada, the United States, and Europe. The company focuses on refining and distributing these products internationally.

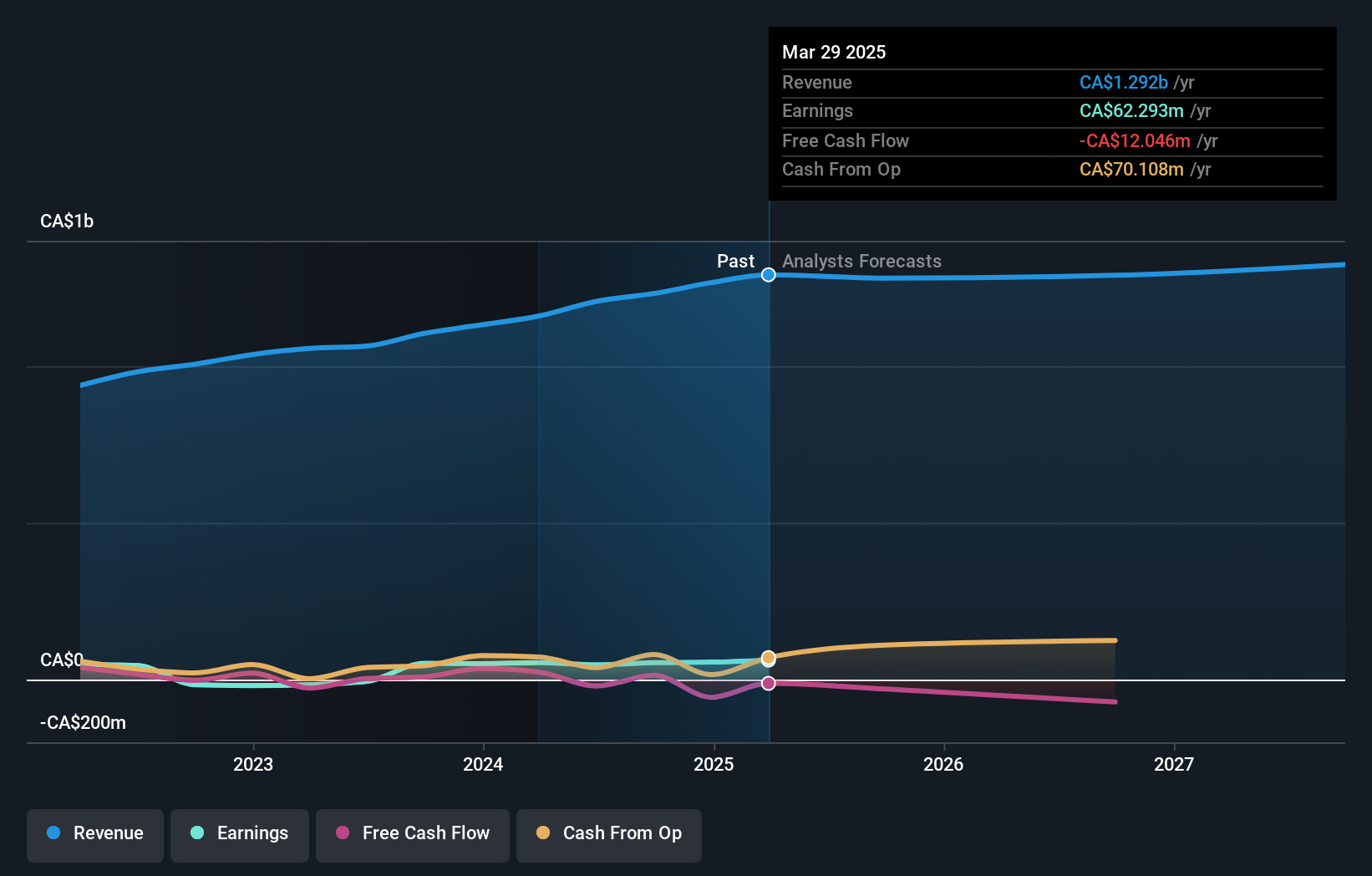

Rogers Sugar, a notable player in the Canadian market, has shown robust performance with sales reaching C$326.31 million in Q2 2025, up from C$300.94 million last year. Net income also rose to C$20.54 million compared to C$13.94 million previously, reflecting its high-quality earnings profile. Despite trading at 83.5% below fair value estimates and having a net debt to equity ratio of 93.8%, the company maintains solid interest coverage of 4.9 times EBIT on its debts, indicating financial resilience amidst industry challenges and opportunities for future growth with increased sugar and maple syrup volumes this year.

Make It Happen

- Take a closer look at our TSX Undiscovered Gems With Strong Fundamentals list of 46 companies by clicking here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:ORE

Orezone Gold

Engages in the mining, exploration, and development of gold properties.

Undervalued with high growth potential.

Similar Companies

Market Insights

Community Narratives