- Canada

- /

- Metals and Mining

- /

- TSX:OR

Did Record Q2 Cash Margin Just Shift OR Royalties' (TSX:OR) Investment Narrative?

Reviewed by Simply Wall St

- OR Royalties Inc. recently announced its second quarter 2025 results, reporting preliminary revenues from royalties and streams of US$60.4 million and achieving a record quarterly cash margin of approximately US$57.8 million, or 95.8%.

- The company also reported strong gold equivalent production of 19,700 attributable ounces for the quarter, underscoring significant operational efficiency and sustained performance in its core royalty and streaming activities.

- We'll examine how this record cash margin highlights OR Royalties' operational strength and shapes its broader investment narrative.

What Is OR Royalties' Investment Narrative?

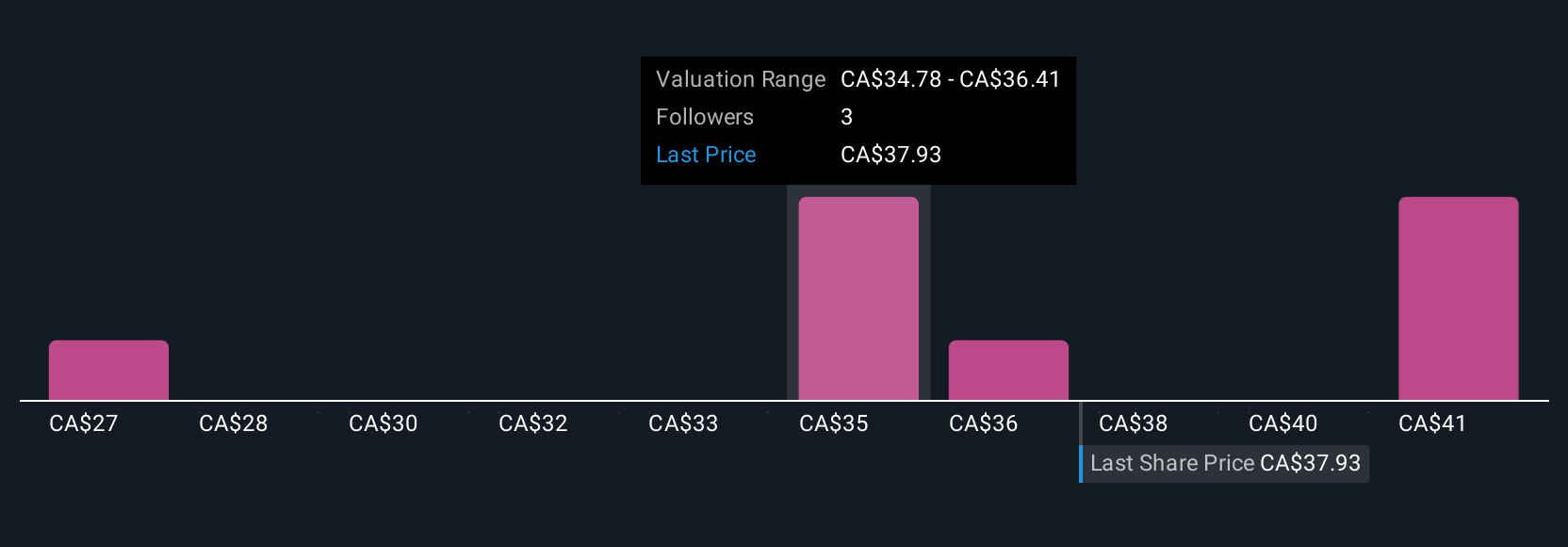

If you’re considering a position in OR Royalties, the story remains centered on the predictability of royalty revenues and cash flow margins. The latest Q2 figures, with revenue climbing to US$60.4 million and a record 95.8% cash margin, fall right in line with expectations for a resilient, margin-focused business model. These outcomes reinforce the perception that OR’s short-term catalysts, steady precious metals prices, successful deployment of its recently upsized credit facility, and dividend growth, remain intact and possibly even strengthened. While the share price only nudged up after the release, it’s a sign that the market had largely anticipated strong results and is watching for more material developments, such as new royalty deals or significant asset additions. The main risks still revolve around potential disruptions at operating mines, the company’s high valuation multiples versus sector standards, and recent board turnover, all of which are worth tracking following this results beat.

But the board's limited tenure and ongoing changes could still be a concern. OR Royalties' share price has been on the slide but might be dropping deeper into value territory. Find out whether it's a bargain at this price.Exploring Other Perspectives

Build Your Own OR Royalties Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your OR Royalties research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free OR Royalties research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate OR Royalties' overall financial health at a glance.

No Opportunity In OR Royalties?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- Find companies with promising cash flow potential yet trading below their fair value.

- We've found 17 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- The end of cancer? These 25 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:OR

OR Royalties

Acquires and manages precious metal and other royalties, streams, and other interests in Canada and internationally.

Excellent balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives