- Canada

- /

- Metals and Mining

- /

- TSX:OLA

Pinning Down Orla Mining Ltd.'s (TSE:OLA) P/E Is Difficult Right Now

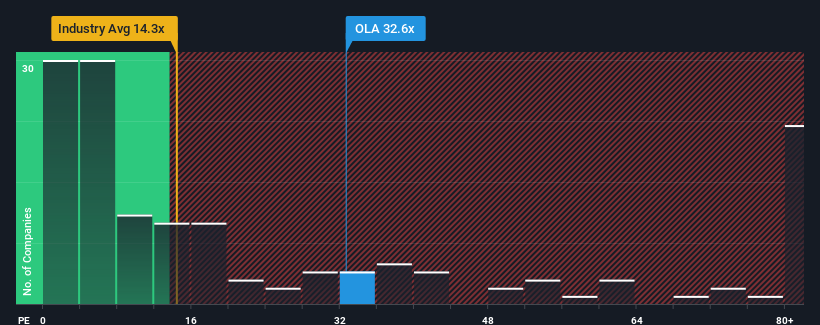

Orla Mining Ltd.'s (TSE:OLA) price-to-earnings (or "P/E") ratio of 32.6x might make it look like a strong sell right now compared to the market in Canada, where around half of the companies have P/E ratios below 10x and even P/E's below 5x are quite common. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly elevated P/E.

With earnings growth that's inferior to most other companies of late, Orla Mining has been relatively sluggish. It might be that many expect the uninspiring earnings performance to recover significantly, which has kept the P/E from collapsing. If not, then existing shareholders may be very nervous about the viability of the share price.

See our latest analysis for Orla Mining

How Is Orla Mining's Growth Trending?

There's an inherent assumption that a company should far outperform the market for P/E ratios like Orla Mining's to be considered reasonable.

Taking a look back first, we see that there was hardly any earnings per share growth to speak of for the company over the past year. That's essentially a continuation of what we've seen over the last three years, as its EPS growth has been virtually non-existent for that entire period. Therefore, it's fair to say that earnings growth has definitely eluded the company recently.

Looking ahead now, EPS is anticipated to slump, contracting by 35% during the coming year according to the four analysts following the company. With the market predicted to deliver 7.0% growth , that's a disappointing outcome.

In light of this, it's alarming that Orla Mining's P/E sits above the majority of other companies. It seems most investors are hoping for a turnaround in the company's business prospects, but the analyst cohort is not so confident this will happen. Only the boldest would assume these prices are sustainable as these declining earnings are likely to weigh heavily on the share price eventually.

What We Can Learn From Orla Mining's P/E?

It's argued the price-to-earnings ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

We've established that Orla Mining currently trades on a much higher than expected P/E for a company whose earnings are forecast to decline. Right now we are increasingly uncomfortable with the high P/E as the predicted future earnings are highly unlikely to support such positive sentiment for long. Unless these conditions improve markedly, it's very challenging to accept these prices as being reasonable.

Before you settle on your opinion, we've discovered 3 warning signs for Orla Mining (1 makes us a bit uncomfortable!) that you should be aware of.

If you're unsure about the strength of Orla Mining's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSX:OLA

Orla Mining

Acquires, explores, develops, and exploits mineral properties.

High growth potential with excellent balance sheet.

Market Insights

Community Narratives