- Canada

- /

- Metals and Mining

- /

- TSX:NGEX

What NGEx Minerals (TSX:NGEX)'s Widening Quarterly Net Loss Means For Shareholders

Reviewed by Simply Wall St

- NGEx Minerals Ltd. recently reported its second quarter and six-month results for the period ended June 30, 2025, with net loss for the quarter at CA$21.39 million compared to CA$7.58 million a year earlier.

- This marks a significant increase in the company's net loss year over year, highlighting a period of larger financial setbacks for NGEx Minerals.

- We'll examine how the higher net losses reported for both the quarter and six months impact NGEx Minerals' current investment narrative.

Outshine the giants: these 20 early-stage AI stocks could fund your retirement.

What Is NGEx Minerals' Investment Narrative?

To be a shareholder in NGEx Minerals, you need confidence in high-impact exploration stories, with the value of the business hinging on the potential upside from recent copper-gold discoveries at Lunahuasi and future resource development. The recent second quarter financials, revealing a widened net loss, come just after strong drill results but before upcoming seasonally driven drilling pauses. This bigger-than-usual loss may sharpen investor focus on NGEx’s cash burn and ability to fund ongoing exploration, especially since the company generates no revenue and isn’t expected to become profitable in the next few years. While this doesn’t immediately shift the company's biggest catalysts, such as drilling updates, assay results, and strategic advances at Lunahuasi, the elevated losses highlight liquidity and funding risks that could influence short-term sentiment and the runway for future exploration. Longer-term, investors will need to watch how these financial pressures shape the company’s pace of progress and project timelines.

However, rising losses mean future funding questions are now more urgent for investors to consider.

Exploring Other Perspectives

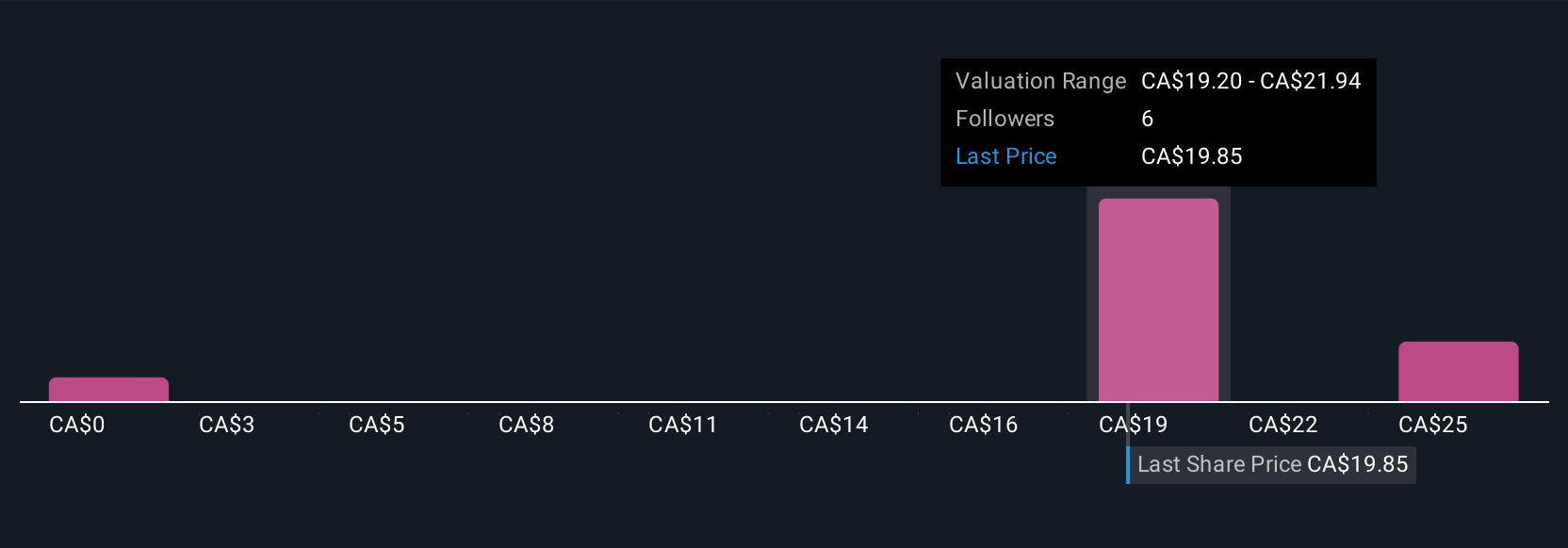

Explore 3 other fair value estimates on NGEx Minerals - why the stock might be worth as much as 40% more than the current price!

Build Your Own NGEx Minerals Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your NGEx Minerals research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

- Our free NGEx Minerals research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate NGEx Minerals' overall financial health at a glance.

Contemplating Other Strategies?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- The end of cancer? These 26 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- We've found 21 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- AI is about to change healthcare. These 27 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if NGEx Minerals might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:NGEX

NGEx Minerals

Engages in the acquisition, exploration, and development of mineral properties in South America.

Flawless balance sheet and slightly overvalued.

Market Insights

Community Narratives