- Canada

- /

- Metals and Mining

- /

- TSX:NGEX

Are NGEx Minerals Shares Still Attractive After a 95% Surge and New Drilling Updates?

Reviewed by Bailey Pemberton

If you’re debating what to do with NGEx Minerals, you’re not alone. The stock has been impossible to ignore, especially for anyone paying attention to high-growth stories in the resource sector. NGEx Minerals closed recently at $25.86 and, for those tracking the numbers, is up 2.4% over the past week and 5.0% for the last month. Those are nice gains, but it’s the outsized longer-term surge that really catches the eye: a 95.5% return so far this year, 117.9% over the past twelve months, and an unbelievable 5,344.2% over the past five years. Even among mining success stories, numbers like these stand out.

What’s driving this momentum? The market seems to have responded enthusiastically to ongoing positive developments at NGEx’s copper and gold projects in South America. Recent exploration updates have increased investor confidence that the company’s Chilean deposits could become world-class assets, helping fuel optimism around future resource estimates and project economics. Speculation around potential future partnerships and M&A activity is also creating a sense of anticipation, which can be a catalyst for stock movement. At the same time, it’s important to recognize that with such massive gains, there is always the question of whether the share price has outstripped the value of the underlying business.

By traditional valuation checks, NGEx Minerals is assessed as undervalued in 2 out of 6 categories, earning it a valuation score of 2. That presents an intriguing puzzle: are the market’s hopes justified, or has enthusiasm pushed this stock too far, too fast? Next, let’s break down just how those valuation approaches stack up. And later on, I’ll share a more insightful way to think about what NGEx Minerals is truly worth.

NGEx Minerals scores just 2/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: NGEx Minerals Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates what a company is worth by extrapolating expected future cash flows and discounting them back to today’s value. This approach integrates both analyst estimates and longer-term projections, giving investors a forward-looking view of potential performance.

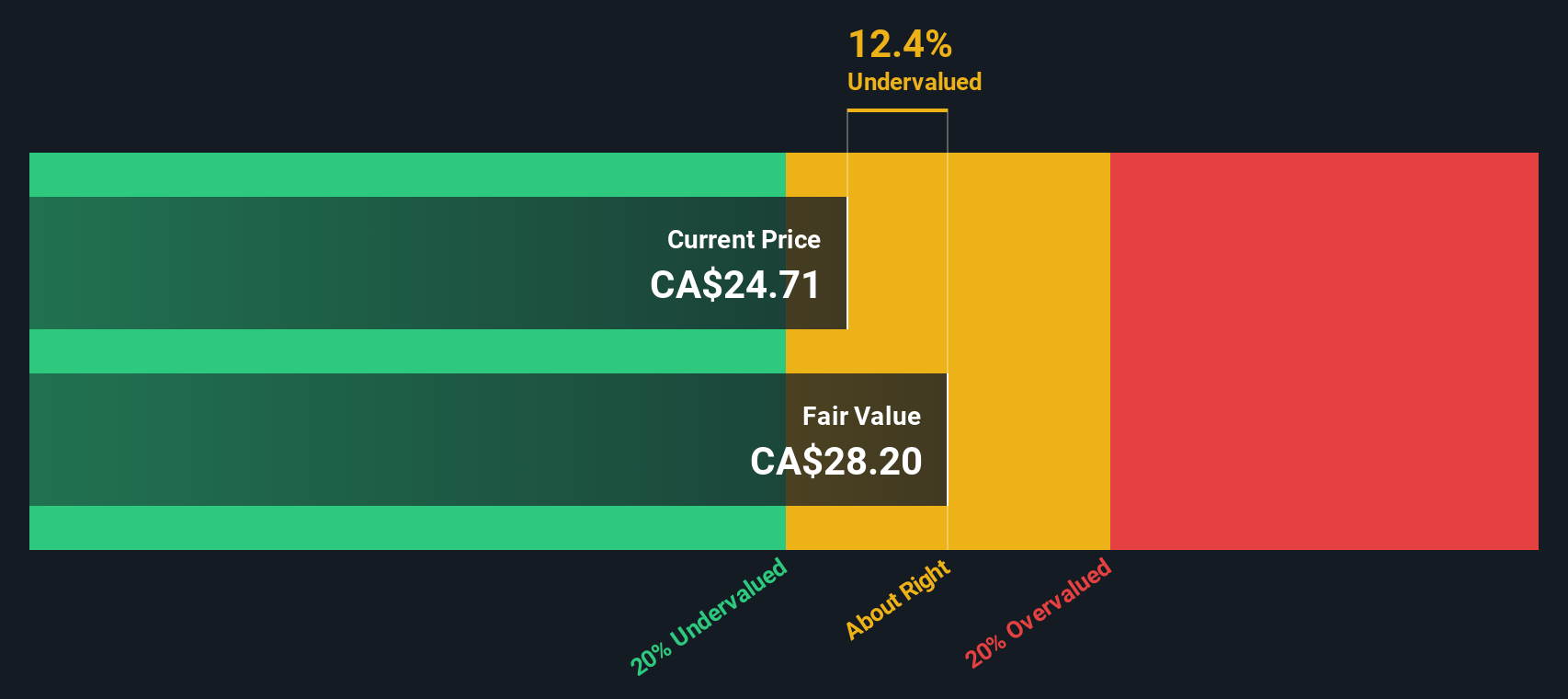

For NGEx Minerals, the most recent reported Free Cash Flow was deeply negative at CA$-78.7 Million. However, projections suggest the company will turn the corner within five years, with cash flows expected to grow rapidly. By 2029, analysts forecast annual Free Cash Flow at CA$119.7 Million, and extrapolated estimates go even higher through 2035. All of these numbers are in CA$, based on the two stage Free Cash Flow to Equity model.

According to the DCF method, the estimated intrinsic value of NGEx Minerals is CA$27.43 per share. This compares to the current trading price of CA$25.86, indicating the stock is about 5.7% undervalued. In other words, the market price and underlying value are fairly well matched, with only a small discount for investors today.

Result: ABOUT RIGHT

Simply Wall St performs a valuation analysis on every stock in the world every day (check out NGEx Minerals's valuation analysis). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes.

Approach 2: NGEx Minerals Price vs Book

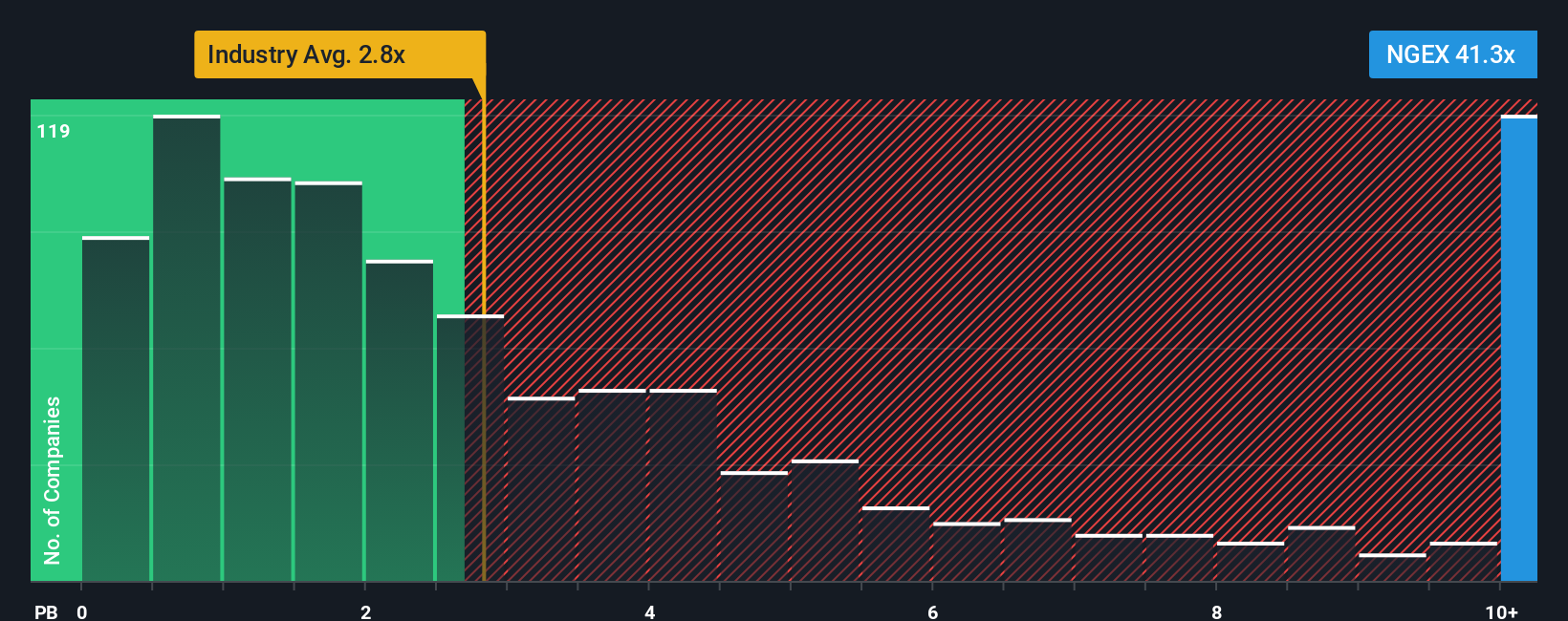

The Price-to-Book (P/B) ratio is a well-established valuation metric, especially useful for analyzing resources companies where assets on the balance sheet are a critical part of underlying value. For profitable mining firms, the P/B provides insight into what investors are paying for each dollar of net assets, offering a straightforward comparison point across the industry.

Expectations of future growth and perceived risks play a big role in deciding what a “normal” or “fair” P/B ratio should be. Higher ratios often signal optimism about future returns from a company’s assets, while lower ones can point to doubts about growth prospects, asset quality, or sector headwinds.

Currently, NGEx Minerals trades at a lofty 38.51x P/B, noticeably above the metals and mining industry average of just 2.62x and even higher than the peer group average of 54.87x. While at first this may seem expensive, context is important. Simply Wall St’s proprietary "Fair Ratio" takes the analysis further by adjusting for factors like the company’s expected growth, profitability outlook, risk profile, market capitalization, and overall sector conditions.

Because the Fair Ratio model incorporates more than just basic benchmarks, it can highlight situations where a seemingly high multiple might actually be justified or where apparent bargains come with hidden risks. In NGEx Minerals’ case, the lack of a published Fair Ratio makes it tough to draw a strong conclusion. With a P/B this elevated, investors should be cautious and ensure future growth justifies the premium.

Result: OVERVALUED

PB ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your NGEx Minerals Narrative

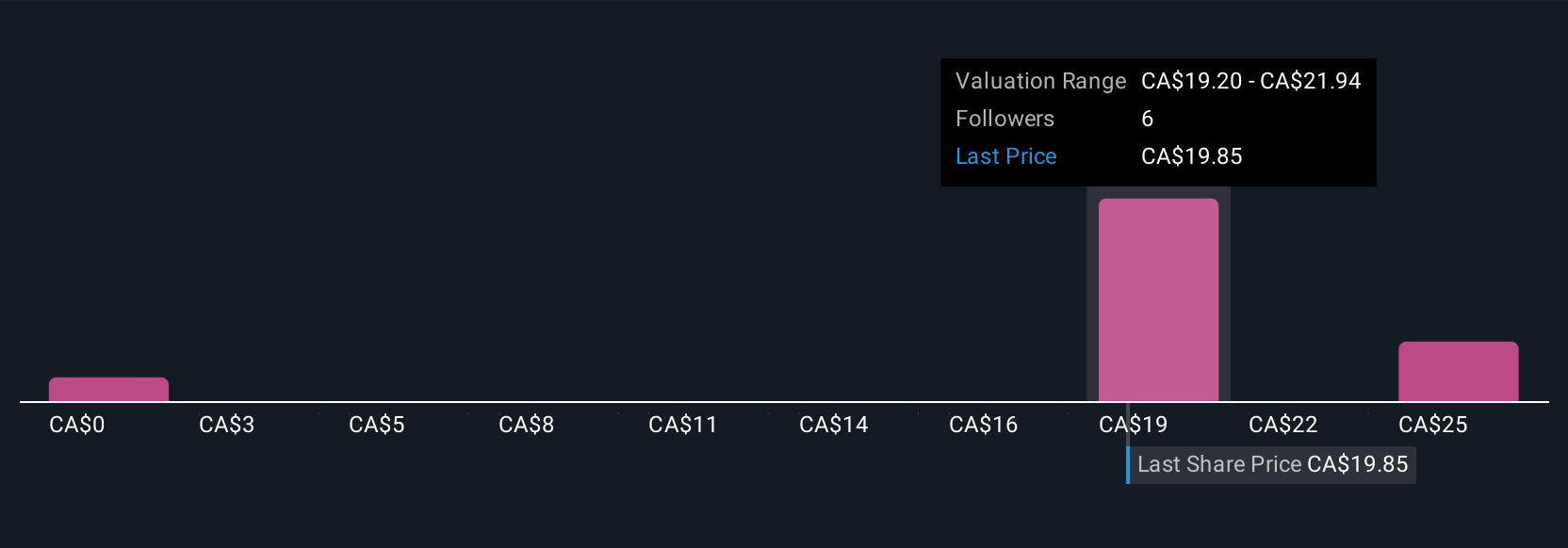

Earlier we mentioned that there's an even better way to understand valuation, so let's introduce you to Narratives. A Narrative is simply your story or point of view about a company, built on your own estimates for things like future revenue, profit margins and what you think a fair price should be. Narratives connect the company’s unique story to a financial forecast and link it directly to a calculated fair value, letting you back up your view with real data instead of just opinions.

This approach is easy and accessible on Simply Wall St’s Community page, trusted by millions of investors. Narratives help you decide when to buy or sell by updating your fair value automatically whenever the latest news or earnings come out, so your investment thesis stays current. For example, while one investor’s Narrative might value NGEx Minerals at over CA$40 per share based on bullish copper demand and strong drilling results, another might be more conservative and see fair value closer to CA$15 due to perceived risks. Narratives make it simple to compare your outlook to the current price and see what the rest of the community thinks at a glance.

Do you think there's more to the story for NGEx Minerals? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if NGEx Minerals might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:NGEX

NGEx Minerals

Engages in the acquisition, exploration, and development of mineral properties in South America.

Flawless balance sheet with low risk.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Jackson Financial Stock: When Insurance Math Meets a Shifting Claims Landscape

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion