Neo Performance Materials (TSX:NEO) Is Down 8.4% After Opening Estonia Magnet Plant for Western EV Supply Chains

Reviewed by Sasha Jovanovic

- Neo Performance Materials recently inaugurated its Narva traction motor magnet plant in Estonia, establishing itself as the only Western-based producer of rare earth sintered permanent magnets for regional supply chains.

- This development enables Western original equipment manufacturers to source critical magnet components domestically, strengthening supply chain security and reducing reliance on international suppliers.

- We'll explore how Neo's new plant positions the company to better serve Western electric vehicle manufacturers seeking secure local magnet supplies.

The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

Neo Performance Materials Investment Narrative Recap

To own Neo Performance Materials, investors need to believe that Western EV and tech supply chains will prioritize secure, local sources for rare earth magnets. The Narva plant’s launch may accelerate European contract wins, currently the main catalyst, though near-term revenue swings driven by restocking trends and inventory normalization still pose a risk that could overshadow immediate gains from new capacity.

Neo’s recently announced $50 million supply contract for EV traction motors with a European Tier 1 supplier ties directly to the new plant, showing early momentum in capturing localized OEM demand, a crucial pillar for ongoing revenue and earnings growth as more manufacturers pivot toward Western-made components.

By contrast, investors should also be mindful that, despite the excitement, a rapid unwinding of elevated customer orders related to recent geopolitical tensions...

Read the full narrative on Neo Performance Materials (it's free!)

Neo Performance Materials' narrative projects $444.0 million revenue and $50.5 million earnings by 2028. This requires a 2.7% annual revenue decline and a $60.9 million earnings increase from current earnings of $-10.4 million.

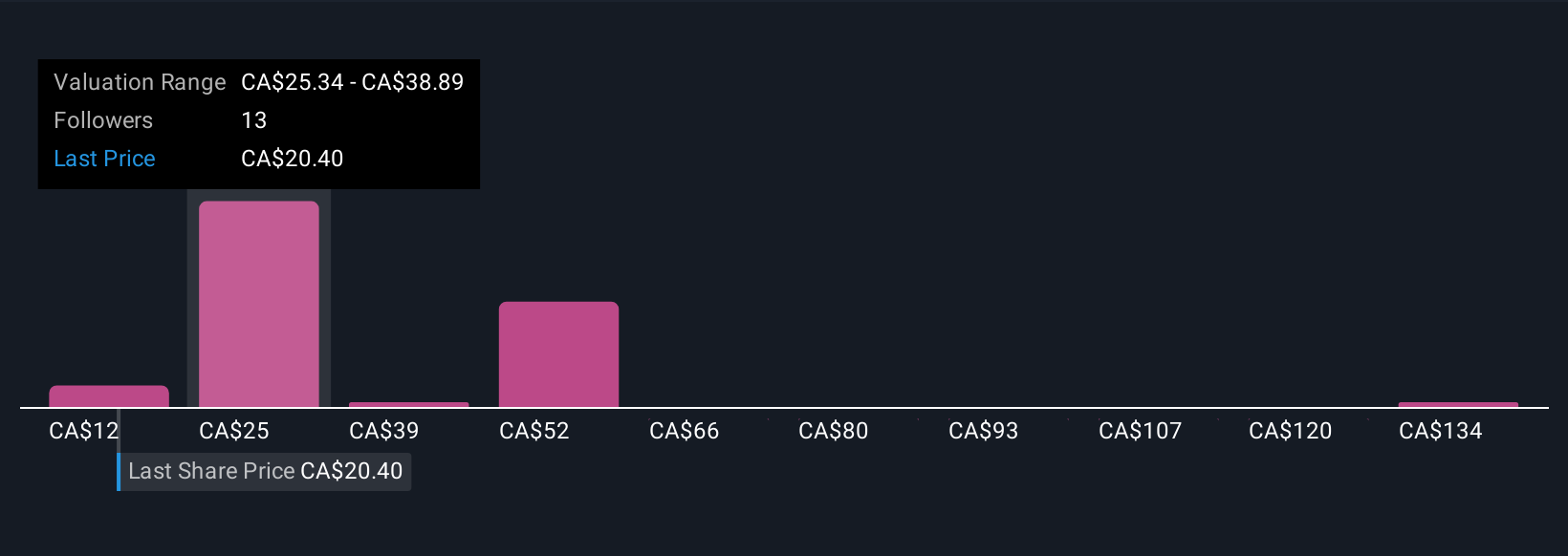

Uncover how Neo Performance Materials' forecasts yield a CA$25.54 fair value, a 25% upside to its current price.

Exploring Other Perspectives

Six diverse fair value estimates from the Simply Wall St Community range from C$11.80 to C$147.24, revealing sharply different opinions on Neo’s potential. While contract momentum supports upside, expectations for new supply chain wins may face turbulence if customer order patterns revert more quickly than anticipated.

Explore 6 other fair value estimates on Neo Performance Materials - why the stock might be worth 42% less than the current price!

Build Your Own Neo Performance Materials Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Neo Performance Materials research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Neo Performance Materials research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Neo Performance Materials' overall financial health at a glance.

Interested In Other Possibilities?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 35 best rare earth metal stocks of the very few that mine this essential strategic resource.

- These 10 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- AI is about to change healthcare. These 33 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Neo Performance Materials might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:NEO

Neo Performance Materials

Engages in the manufacture and sale of rare earth, magnetic powders, magnets, and rare metal-based functional materials in China, Japan, Thailand, South Korea, North America, Europe, and internationally.

Very undervalued with reasonable growth potential.

Similar Companies

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

The "Landlord of Orbit" – A Deep Value Play Ahead of the Starlab Era

The "AI-Immunology" Asymmetric Opportunity – Validated by Merck (MSD)

The Hidden Gem of AI Hardware – Solving the Data Center Bottleneck

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026