- Canada

- /

- Metals and Mining

- /

- TSX:NDM

Northern Dynasty Minerals (TSE:NDM) Has Debt But No Earnings; Should You Worry?

Some say volatility, rather than debt, is the best way to think about risk as an investor, but Warren Buffett famously said that 'Volatility is far from synonymous with risk.' When we think about how risky a company is, we always like to look at its use of debt, since debt overload can lead to ruin. Importantly, Northern Dynasty Minerals Ltd. (TSE:NDM) does carry debt. But is this debt a concern to shareholders?

Why Does Debt Bring Risk?

Debt and other liabilities become risky for a business when it cannot easily fulfill those obligations, either with free cash flow or by raising capital at an attractive price. If things get really bad, the lenders can take control of the business. However, a more frequent (but still costly) occurrence is where a company must issue shares at bargain-basement prices, permanently diluting shareholders, just to shore up its balance sheet. Having said that, the most common situation is where a company manages its debt reasonably well - and to its own advantage. The first thing to do when considering how much debt a business uses is to look at its cash and debt together.

What Is Northern Dynasty Minerals's Debt?

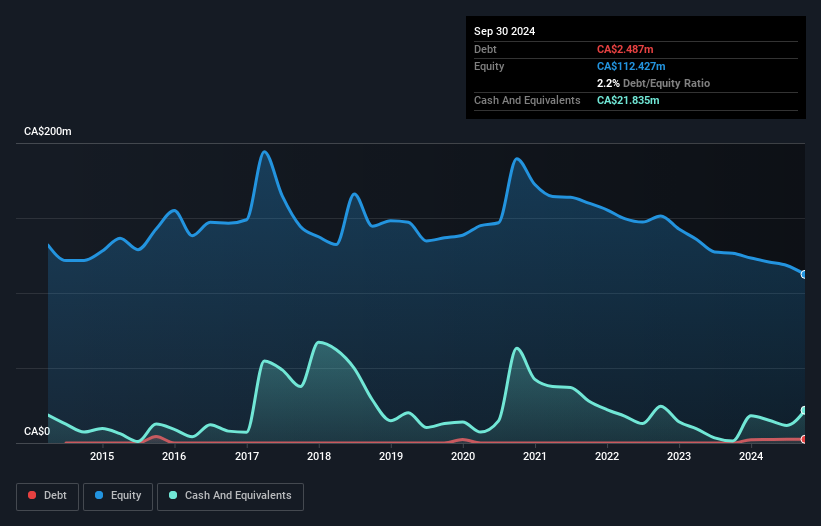

As you can see below, at the end of September 2024, Northern Dynasty Minerals had CA$2.49m of debt, up from none a year ago. Click the image for more detail. However, it does have CA$21.8m in cash offsetting this, leading to net cash of CA$19.3m.

How Strong Is Northern Dynasty Minerals' Balance Sheet?

The latest balance sheet data shows that Northern Dynasty Minerals had liabilities of CA$21.4m due within a year, and liabilities of CA$522.0k falling due after that. Offsetting these obligations, it had cash of CA$21.8m as well as receivables valued at CA$182.0k due within 12 months. So its total liabilities are just about perfectly matched by its shorter-term, liquid assets.

This state of affairs indicates that Northern Dynasty Minerals' balance sheet looks quite solid, as its total liabilities are just about equal to its liquid assets. So while it's hard to imagine that the CA$704.5m company is struggling for cash, we still think it's worth monitoring its balance sheet. Simply put, the fact that Northern Dynasty Minerals has more cash than debt is arguably a good indication that it can manage its debt safely. The balance sheet is clearly the area to focus on when you are analysing debt. But ultimately the future profitability of the business will decide if Northern Dynasty Minerals can strengthen its balance sheet over time. So if you're focused on the future you can check out this free report showing analyst profit forecasts.

View our latest analysis for Northern Dynasty Minerals

Since Northern Dynasty Minerals has no significant operating revenue, shareholders probably hope it will develop a valuable new mine before too long.

So How Risky Is Northern Dynasty Minerals?

By their very nature companies that are losing money are more risky than those with a long history of profitability. And in the last year Northern Dynasty Minerals had an earnings before interest and tax (EBIT) loss, truth be told. Indeed, in that time it burnt through CA$20m of cash and made a loss of CA$17m. However, it has net cash of CA$19.3m, so it has a bit of time before it will need more capital. Even though its balance sheet seems sufficiently liquid, debt always makes us a little nervous if a company doesn't produce free cash flow regularly. There's no doubt that we learn most about debt from the balance sheet. But ultimately, every company can contain risks that exist outside of the balance sheet. For instance, we've identified 3 warning signs for Northern Dynasty Minerals (2 are a bit concerning) you should be aware of.

At the end of the day, it's often better to focus on companies that are free from net debt. You can access our special list of such companies (all with a track record of profit growth). It's free.

Valuation is complex, but we're here to simplify it.

Discover if Northern Dynasty Minerals might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSX:NDM

Northern Dynasty Minerals

Engages in the exploration of mineral properties in the United States.

Adequate balance sheet with very low risk.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

China Starch Holdings eyes a revenue growth of 4.66% with a 5-year strategic plan

PSIX The timing of insider sales is a serious question mark

The Great Strategy Swap – Selling "Old Auto" to Buy "Future Light"

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026