- Canada

- /

- Metals and Mining

- /

- TSX:NDM

Is the EPA Veto Challenge Changing the Investment Case for Northern Dynasty Minerals (TSX:NDM)?

Reviewed by Sasha Jovanovic

- Northern Dynasty Minerals and its wholly-owned Pebble Limited Partnership, alongside regional Alaska organizations, recently filed a Summary Judgement Brief in Alaska Federal Court challenging the EPA's longstanding veto of the Pebble Mine project, arguing the decision was based on speculative environmental concerns and weak economic analysis.

- This legal move also spotlights ongoing debate over federal versus state control of land use and regulatory thresholds in Alaska’s resource sector.

- We'll look at how the challenge to the EPA's rationale for the Pebble Mine veto shapes Northern Dynasty Minerals' investment narrative.

The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

What Is Northern Dynasty Minerals' Investment Narrative?

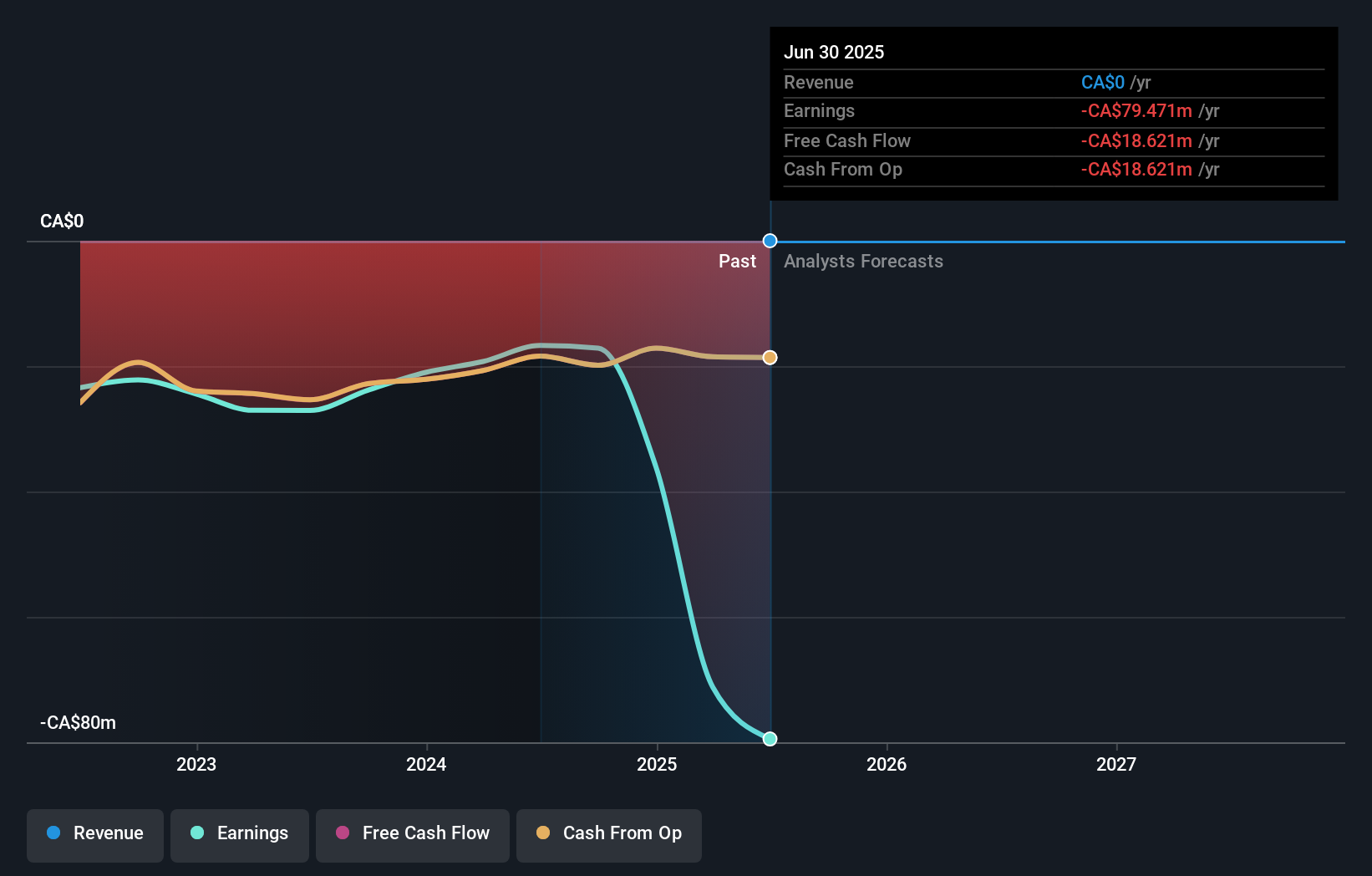

Shareholders in Northern Dynasty Minerals are betting on a successful reversal of the EPA’s Pebble Mine veto, which remains the core catalyst for the stock. The latest Summary Judgement Brief intensifies the focus on legal outcomes, which could be a near-term driver of sentiment and price action. This recent filing signals a potential shift in the risk profile, suggesting court decisions may have more immediate influence over the investment case than ongoing financial losses or market volatility. While the company’s ongoing losses, lack of revenue and significant auditor concerns have always been pressing risks, the legal process is now more central than ever as both a risk and possible path to unlocking value. The outcome of this legal challenge will likely set the tone for the company’s medium-term prospects and investor interest.

But don’t overlook the implications of continued doubts about Northern Dynasty’s ability to operate as a going concern. Our valuation report here indicates Northern Dynasty Minerals may be overvalued.Exploring Other Perspectives

Explore 3 other fair value estimates on Northern Dynasty Minerals - why the stock might be worth as much as CA$2.40!

Build Your Own Northern Dynasty Minerals Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Northern Dynasty Minerals research is our analysis highlighting 2 important warning signs that could impact your investment decision.

- Our free Northern Dynasty Minerals research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Northern Dynasty Minerals' overall financial health at a glance.

Curious About Other Options?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- These 10 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 24 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechValuation is complex, but we're here to simplify it.

Discover if Northern Dynasty Minerals might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:NDM

Northern Dynasty Minerals

Engages in the exploration of mineral properties in the United States.

Adequate balance sheet with very low risk.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Deep Value Multi Bagger Opportunity

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Unicycive Therapeutics (Nasdaq: UNCY) – Preparing for a Second Shot at Bringing a New Kidney Treatment to Market (TEST)

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026