- Canada

- /

- Metals and Mining

- /

- TSX:LUG

Why Lundin Gold (TSX:LUG) Is Down 5.2% After Reporting Higher Gold Sales and Output – And What's Next

Reviewed by Simply Wall St

- In the past week, Lundin Gold reported its second quarter and first half 2025 results, showing increased gold sales (136,737 ounces in Q2; 254,378 ounces for H1) and higher ore processed compared to the previous year.

- The company further improved recovery rates and boosted gold production, with total output reaching 139,433 ounces for the quarter, demonstrating higher operational throughput and consistency.

- We'll see how this trend of higher gold output contributes to Lundin Gold's longer-term investment outlook and operational strengths.

Lundin Gold Investment Narrative Recap

To be a shareholder in Lundin Gold, you need to believe in the company's ability to convert increased production and operational efficiency into strong financial performance, especially as it continues to process more ore and improve recovery rates. The recent announcement of higher gold sales and production for the second quarter supports these operational catalysts, but the company's exposure to gold prices remains the most important short-term driver, and risk, that could outweigh operational positives. At this stage, the news does not appear to change that balance in a material way.

Among the recent news, Lundin Gold's latest production updates are particularly relevant as they illustrate continued improvements in recovery rates and throughput, key drivers behind its operational momentum. These results align with the company’s previously confirmed guidance, reinforcing the theme of consistency in production capacity. For shareholders, this operational consistency can provide confidence as the company executes on its expansion and efficiency initiatives.

However, against these positive developments, investors should pay close attention to the company’s reliance on gold prices for revenue and profitability, especially if...

Read the full narrative on Lundin Gold (it's free!)

Lundin Gold's outlook forecasts $1.4 billion in revenue and $595.4 million in earnings by 2028. This scenario assumes annual revenue growth of 5.8% and a $169.4 million increase in earnings from the current $426.0 million level.

Exploring Other Perspectives

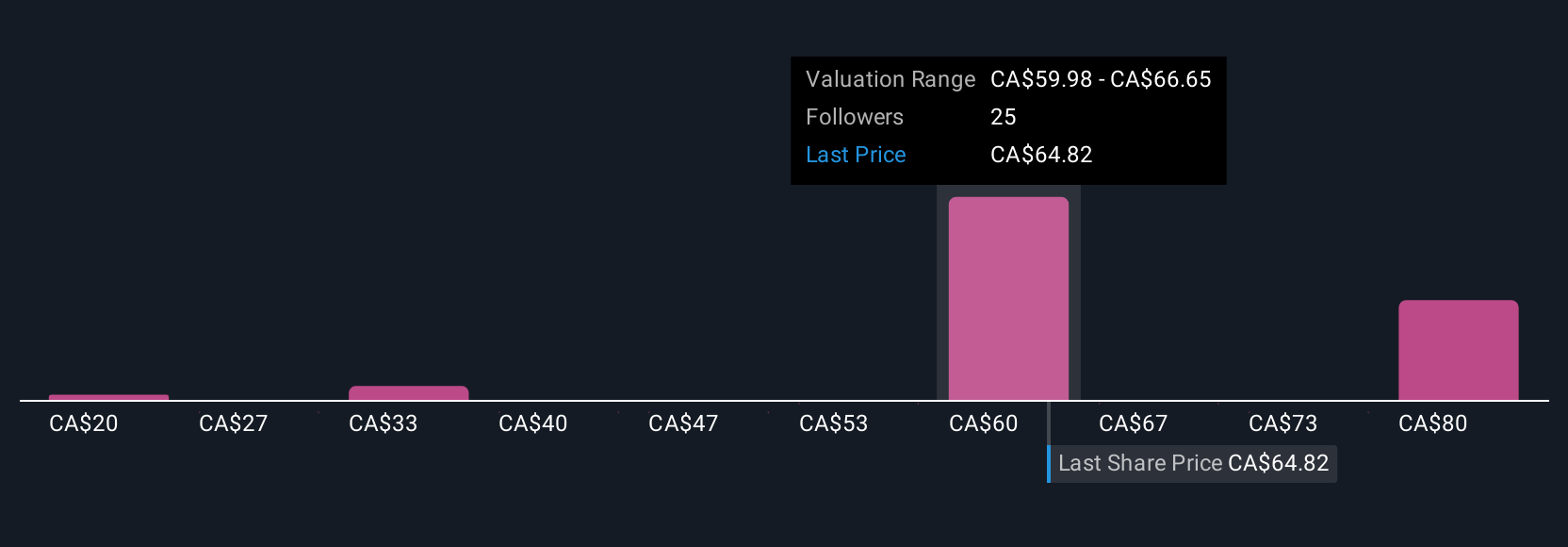

Ten members of the Simply Wall St Community provided fair value estimates for Lundin Gold, spanning from CA$19.97 to CA$85.91 per share. While outlooks are broad, many see room for growth, but the company’s dependency on high gold prices raises important considerations if market conditions turn.

Build Your Own Lundin Gold Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Lundin Gold research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Lundin Gold research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Lundin Gold's overall financial health at a glance.

Want Some Alternatives?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:LUG

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Community Narratives