- Canada

- /

- Metals and Mining

- /

- TSX:LUG

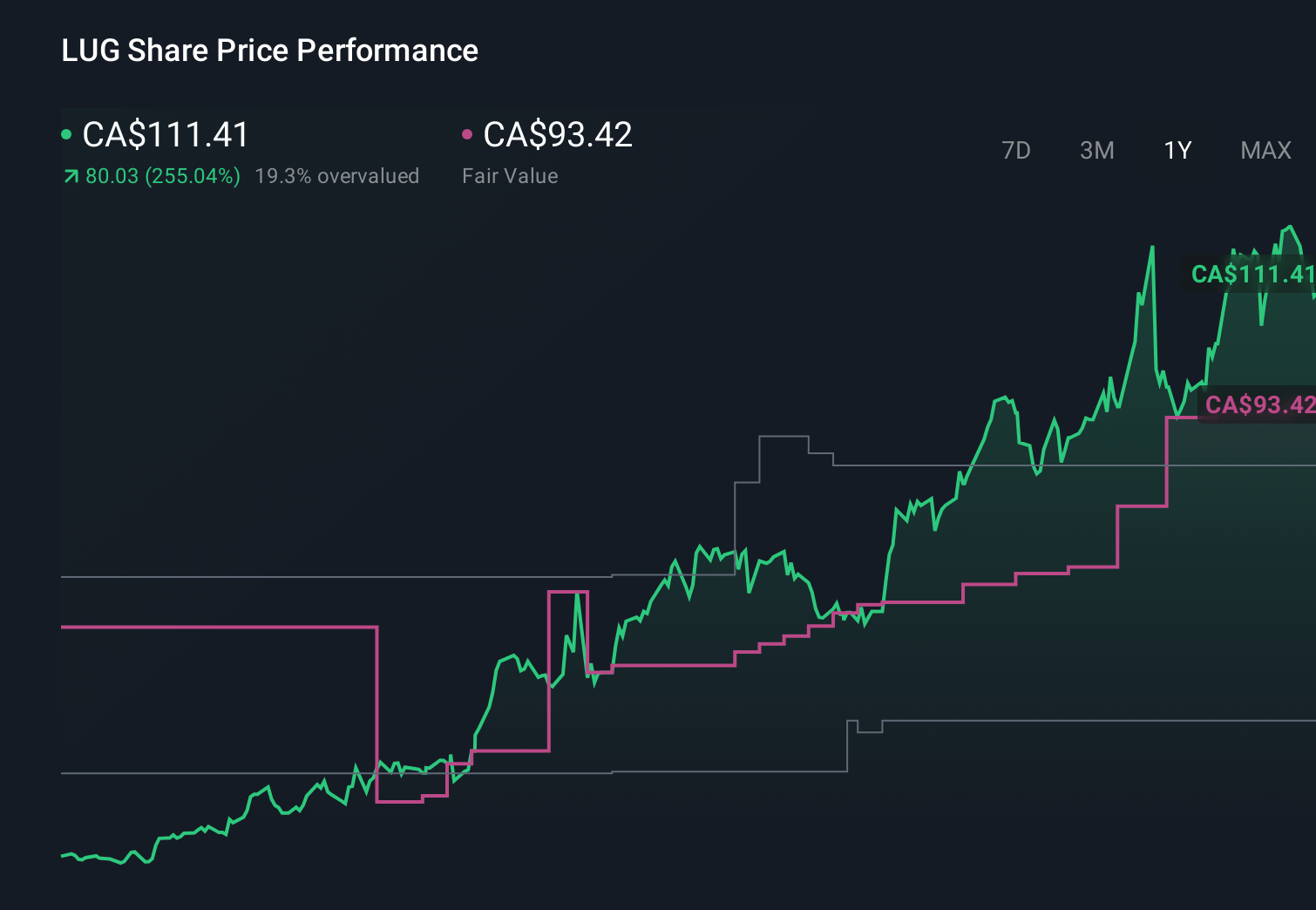

Lundin Gold (TSX:LUG) Is Up 5.2% After Reaffirming Dividend Policy And Long-Term Production Guidance

Reviewed by Sasha Jovanovic

- Earlier this month, Lundin Gold Inc. confirmed it will continue its fixed quarterly dividend of US$0.30 per share plus a variable dividend tied to at least 50% of normalized free cash flow, and issued gold production guidance for its Fruta del Norte mine through 2028.

- The combination of a consistent dividend framework and multi-year production outlook gives investors clearer visibility on how operating performance may translate into ongoing cash returns.

- We’ll now examine how this reaffirmed dividend policy, backed by multi-year production guidance, may reshape Lundin Gold’s existing investment narrative.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

Lundin Gold Investment Narrative Recap

To own Lundin Gold today, you need to believe its Fruta del Norte mine can keep converting strong production into durable free cash flow, while Ecuador remains a reliable operating base. The reaffirmed dividend framework and multi year production guidance mainly bolster visibility on near term cash returns; they do not materially change the biggest near term swing factor, which is how well the mine continues to deliver on cost and grade expectations.

The most relevant part of the recent news is the confirmation of production guidance for 2026 through 2028 at 475,000 to 525,000 ounces per year. For investors focused on catalysts, this ties the variable dividend directly to a clearer production and cost outlook, sharpening the link between mine performance, free cash flow, and potential cash returns, but it also raises the stakes if production or unit costs were to move off plan.

However, investors should be aware that even with strong current margins, Fruta del Norte’s reliance on a single jurisdiction means...

Read the full narrative on Lundin Gold (it's free!)

Lundin Gold's narrative projects $1.4 billion revenue and $758.8 million earnings by 2028.

Uncover how Lundin Gold's forecasts yield a CA$93.42 fair value, a 17% downside to its current price.

Exploring Other Perspectives

Nine members of the Simply Wall St Community currently see fair value for Lundin Gold between CA$34.66 and CA$125 per share, reflecting very different expectations. Set against multi year guidance and a dividend policy tied to normalized free cash flow, this spread underlines how differently people weigh production and cost risks when thinking about the company’s future performance.

Explore 9 other fair value estimates on Lundin Gold - why the stock might be worth as much as 10% more than the current price!

Build Your Own Lundin Gold Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Lundin Gold research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Lundin Gold research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Lundin Gold's overall financial health at a glance.

Searching For A Fresh Perspective?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 33 best rare earth metal stocks of the very few that mine this essential strategic resource.

- These 10 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:LUG

Outstanding track record with flawless balance sheet.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Sunrun Stock: When the Energy Transition Collides With the Cost of Capital

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion