- Canada

- /

- Metals and Mining

- /

- TSX:LAC

Lithium Americas (TSX:LAC) Is Up 45.3% After Historic DOE Backing and $2.26B Project Financing – Has The Bull Case Changed?

Reviewed by Sasha Jovanovic

- Lithium Americas Corp. recently completed a significant follow-on equity offering and secured a US$2.26 billion low-interest loan from the U.S. Department of Energy, which also acquired a 5% equity stake in both the company and its Thacker Pass project.

- This marks the first direct U.S. government equity investment in a domestic lithium project and underscores the national priority to secure critical mineral supply chains for electric vehicles and energy storage.

- We'll examine how this unprecedented federal backing and completion of project financing could reshape Lithium Americas' investment narrative.

We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

What Is Lithium Americas' Investment Narrative?

To be a shareholder in Lithium Americas right now, you need to have confidence in the long-term need for domestic lithium supply and the company's ability to move from pre-revenue development to full-scale production, particularly at its Thacker Pass asset. The recent US$2.26 billion low-interest loan and the unprecedented 5 percent Department of Energy equity stake fundamentally shift the story for this stock, as they provide critical financing and strong government endorsement for the Thacker Pass mine and, by extension, the wider US battery supply chain. In the short term, this federal support likely addresses the previous concern about funding risk and mitigates a key overhang regarding long-term project viability. However, the surge in share price and the sharp pullback following a downgrade highlight that valuation risk and execution delays remain in the spotlight, while the business is still loss-making and not expected to become profitable in the near future. With the pace of construction, shifting lithium prices, and continued market volatility, these catalysts and risks will keep investors focused on execution rather than just long-term potential.

However, execution risk, especially around moving from pre-revenue to production, remains crucial for investors to understand.

Exploring Other Perspectives

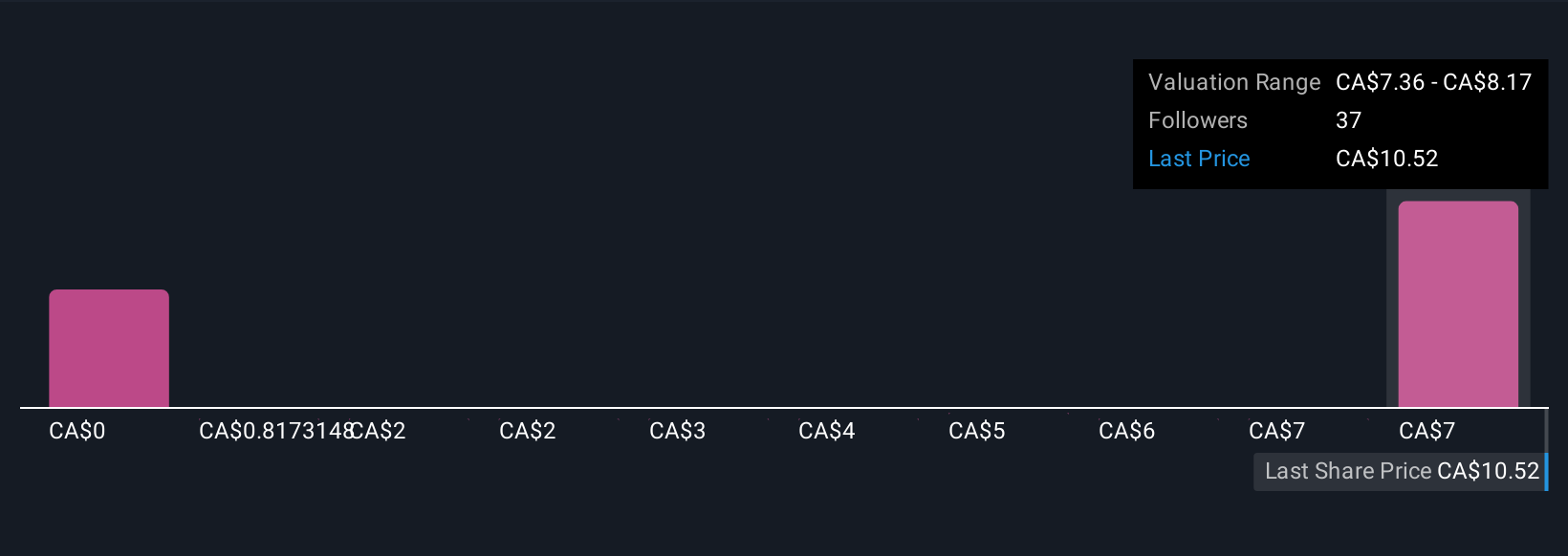

Explore 12 other fair value estimates on Lithium Americas - why the stock might be worth less than half the current price!

Build Your Own Lithium Americas Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Lithium Americas research is our analysis highlighting 4 important warning signs that could impact your investment decision.

- Our free Lithium Americas research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Lithium Americas' overall financial health at a glance.

Interested In Other Possibilities?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- AI is about to change healthcare. These 32 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 25 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:LAC

Lithium Americas

Focuses on developing, building, and operating of lithium deposits and chemical processing facilities in the United States and Canada.

Slight risk with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives